Kaiser is granted full

11% rate increase

The state's No. 2 insurer justified

its request for 2005, the state

insurance commissioner says

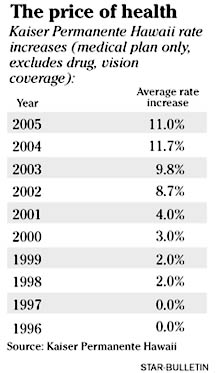

Kaiser Permanente Hawaii received everything it wanted for Christmas as state regulators approved the health maintenance organization's full 11 percent rate-increase request this week, to go into effect at the start of 2005.

Smaller insurers University Health Alliance and Hawaii Management Alliance Association were not as fortunate, since their rate increase requests for 7 percent and 6 percent, respectively, were rejected entirely.

"We're pleased that the (state) found that our rates were not excessive or discriminatory in any way," said Scott Nariyoshi, Kaiser's community relations and communications director.

Kaiser, which has about 233,000 members, is the second-largest insurer in the state behind the Hawaii Medical Service Association. Kaiser had its rate increase request for 2004 partially reduced by the state Insurance Division.

Nariyoshi said the increase will pay for the rising cost of delivering medical care and for upgrading facilities, including Kaiser's planned $68.45 million expansion and renovation of its Moanalua Medical Center, which will begin in May.

The 11 percent average increase will cover basic medical care. In addition, the Insurance Division approved a 3.1 percent increase for Kaiser's drug costs and a 5 percent gain for optical and other coverage. Overall, the combined rate will rise 10.4 percent.

"The supporting documentation for the rate increase this year was very solid," state Insurance Commissioner J.P. Schmidt said. "The rate they requested this year was fully justified."

Earlier this year, the Insurance Division reduced Kaiser's 13.8 percent rate increase request for basic medical care in 2004 to 11.7 percent. The rate, approved in March, was applied retroactively and created a paperwork headache for the state's largest HMO. Kaiser submitted its request for 2005 in July -- more than a month earlier than last year -- to avoid a similar situation.

Earlier this year, the Insurance Division reduced Kaiser's 13.8 percent rate increase request for basic medical care in 2004 to 11.7 percent. The rate, approved in March, was applied retroactively and created a paperwork headache for the state's largest HMO. Kaiser submitted its request for 2005 in July -- more than a month earlier than last year -- to avoid a similar situation.

"What we submit is really what we believe we need, not any more or less," Nariyoshi said. "That's how we go into every year."

Nariyoshi said the rates approved by the Insurance Division affect businesses and individual plan members. Rates for federal workers and federal programs, such as Medicare and QUEST, are negotiated separately, as are rates for state workers.

The state rejected increases for HMAA and UHA because their proposals lacked sufficient support, Schmidt said.

HMAA would have had too much discretion to change the rate, Schmidt said. "So it really wasn't a request to have a rate approval, if you can change it," he said.

Schmidt said UHA's request was incomplete and that his staff already had been in contact with the insurer.

"We recognize the administrative expenses and impact on the plans of not having a rate going into the new year, so rather than just denying the rate and sitting back and waiting for them to do it right, we are trying to work with them to get it right so they can get an improved rate," Schmidt said.

HMSA, which has more than 679,000 members, previously had a 7.7 percent small-business rate increase approved. It took effect July 1. Businesses with 100 or more employees will see HMSA premiums rise an average of 5 percent beginning in January.

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]