5 Hawaii hotels face

uncertain future

An investment fund is taking over

the high-value properties from

their Japan-based owner

For decades, five of Hawaii's most strategically located hotels have been part of the same family.

But those days may be numbered.

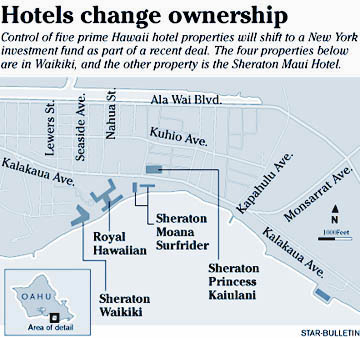

As part of a deal announced this week, control of the five Sheraton-branded properties -- including such landmarks as the Royal Hawaiian Hotel and the Sheraton Moana Surfrider -- will soon shift to New York investment fund Cerberus Partners LP, which has a history of buying assets, polishing them and then selling to the highest bidders.

"That's the most likely outcome. They'll want to drive value by separating the various properties, which will drive the price of each one higher," said Kevin Aucello, vice president and director of CB Richard Ellis Hawaii Inc.

Cerberus Partners, a $9 billion fund with a diverse portfolio, has agreed to take a controlling stake in struggling Tokyo-based company Kokusai Kogyo, which has owned the hotels for more than 30 years through local subsidiary Kyo-ya Co.

The other hotels are the Sheraton Waikiki, the Sheraton Princess Kaiulani and the Sheraton Maui. The Oahu hotels dominate the central beachfront area of Waikiki. Aucello estimated the value of all five properties around $1 billion and said the deal constitutes the largest-ever transfer of ownership control involving Hawaii hotels.

Neither Cerberus Partners nor Kyo-ya has offered comment on what may lie ahead. But observers say Cerberus' involvement could set off a round of jockeying for precious beachfront Waikiki positions.

"Other brands are going to want to step up and get on the beach. It's going to be interesting to watch," said David Carey, president and CEO of Outrigger Hotels & Resorts.

Carey said hotel companies are going to be under pressure to find financial partners for such a move, adding that Starwood Hotels and Resorts Worldwide Inc., which manages all five of the properties, is likely to be one of those.

"They're going to want to find some capital friends to maintain their positioning there," he said.

Keith Vieira, Starwood's senior vice president, said Kyo-ya has told him that no imminent changes are expected at the hotels.

"These hotels operate well compared to others in the islands and we're confident they'll keep things as they are," he said.

However, Cerberus' ultimate objective is likely to sell the properties, said Doug Pothul, who heads the local offices of Marcus & Millichap Real Estate Investment Brokerage Co.

Pothul, who has been involved in several asset deals involving Japanese investors, said financially troubled Kokusai is under pressure from creditor banks in Japan to sell assets. Kokusai operates bus and taxi services in Tokyo and Osaka and also owns three hotels and two golf courses in Japan. But the crown jewels in its portfolio are the Hawaii hotel properties and Cerberus could be in for big profits if it decides to sell.

"There are only a handful of on-beach properties and we're talking about three of them here. Those assets will definitely be attractive to a lot of people," Pothul said. "Usually when these things happen, a new buyer brings in new capital that they'll put into the hotels. That's good for Hawaii. It creates jobs and new construction work."

He said new owners also are usually more willing to strongly market their properties, which benefits Hawaii tourism as a whole.

Aucello said improved properties also can charge higher room rates, which adds to tax revenues as well.

The outlook might be less rosy for hotel employees, said Jason Ward, spokesman for Unite Here, Local 5, the union representing Hawaii hotel and restaurant workers.

Ward said the union's contract obliges potential new hotel owners to respect all existing provisions. But with the contract up for renegotiation in 2006, he said anything can happen.

"We're definitely worried. Kyo-ya was a really good owner but other hotel companies these days are focused purely on the bottom line," he said.

Ward is particularly concerned over the potential for one or more of the properties being converted to time-shares, which typically require far fewer employees to staff them.

Though the hotels in question are considered strong performers, partly because of their locations and the high rates they can charge, Carey said time-share or condominium conversion is a distinct possibility in today's market.

"If you had a chance to sell ocean-view condos for a premium price in this strong market versus the headache of running a hotel, what would you do?" he asked.

[News] [Business] [Features] [Sports] [Editorial] [Do It Electric!]

[Classified Ads] [Search] [Subscribe] [Info] [Letter to Editor]

[Feedback]