Damon heirs

to get $500M

Beneficiaries will receive

payments representing

70% of the cash assets

The Estate of Samuel Mills Damon will pay its beneficiaries nearly $500 million over the next two months, with a large chunk going to two California heiresses.

The Estate

Founded: 1924

Assets: Up to $900 million No. of beneficiaries: About 20 Trustees: David Haig, Walter Dods, Paul Mullin Ganley, Fred Weyand Trustee 2003 commissions: $68,218

|

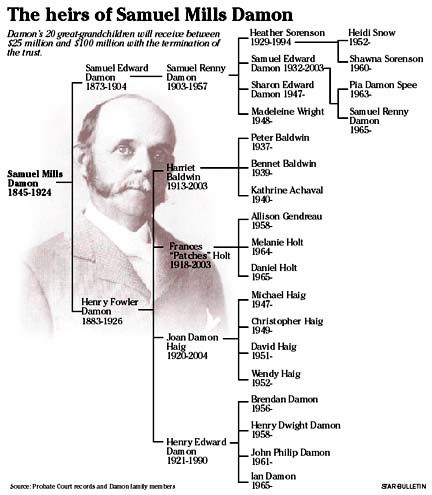

The remaining $389 million in trust assets will be given to Damon's 20 heirs over the next several years pending the outcome of a ruling by the state Supreme Court over how to divvy up the proceeds of the $860 million estate.

The payments come after Samuel Mills Damon's last remaining grandchild, 84-year-old Joan Damon Haig of New Jersey, died earlier this month, triggering the dissolution of one of the nation's wealthiest family fortunes.

It also comes after the trust sold 220 acres of light industrial lands in Mapunapuna last year for $466.1 million and its $500 million sale in 2001 of its one-quarter stake in First Hawaiian Bank's parent, BancWest Corp.

People familiar with the trust operations said a quarter of the upcoming distribution, or about $118 million, will go directly to Damon's two great-granddaughters, Sharon Damon and Madeleine Wright.

The sisters eventually could each receive as much as $100 million if the Supreme Court upholds the trust's current distribution structure, which gives them a one-eighth share of the Damon family fortune.

Even if the high court rules against them, the sisters will get more than $40 million from the trust.

Madeleine Wright did not return a call, and Warren Price, Sharon Damon's attorney, had no comment.

People familiar with the estate said the sisters have had little contact with the estate and the Damon family during the past 20 years. In fact, Sharon Damon's mainland lawyer, William Soskin of Monterey, Calif., once demanded the Damon Estate's board of trustees not contact his client, they said.

Both sisters live in Northern California -- Sharon in Carmel and Madeleine in Pebble Beach -- and rarely visit Hawaii, although Sharon Damon's 36-year-old son, Siddhartha Damon, is a Maui resident.

"I haven't seen them or spoken to them in over 15 years," said relative Michael Haig, a Damon Estate beneficiary.

The Damon Estate was founded in 1924 by the will of Samuel Mills Damon, who headed what is now known as First Hawaiian Bank. Much of the lands that made up his trust were given to him by Princess Bernice Pauahi Bishop in her will.

The sisters are just two members of the storied Damon clan, who have played a prominent, if not colorful, role in Hawaii's business and civic life during the past several decades.

Frances "Patches" Holt, who died at the age of 84 in January 2003, was a well-known patron of the local arts and advocate for liberal causes.

During the late 1940s and 1950s, she gained notoriety as an outspoken leader of a communist youth group on the East Coast. Holt, who later married to noted Hawaiian historian and poet John Dominis Holt, returned to Hawaii, where she fought against the construction of the H-3 freeway and development in Kahala.

Upon the trust's termination, Holt's children, Allison Gendreau, Melanie Holt and Daniel Holt, will receive about $35 million each.

Holt's brother, Henry E. Damon, who died in 1991, also figured prominently in local business and charitable causes. Damon, who was a fighter pilot in the Burmese theater during World War II, gave up a successful banking career in New York and returned to Hawaii after the abrupt 1957 death of his half-brother, Samuel Renny Damon.

In addition to looking after the Damon family's vast interests, Henry Damon founded the Big Brothers Big Sisters of Honolulu charity in the early 1960s. His son J.P. Damon remains a board member.

Joan Damon Haig, the sister whose death this year triggered the trust's liquidation, was also a big backer of local charities, leaving millions to the YMCA of Honolulu, Iolani Palace and Hawaii Pacific University.

Haig and her children -- Damon Estate Trustee David Haig, local businessman Michael Haig, artist Christopher Haig and mainland attorney Wendy Haig -- also are at the center of the termination dispute that's now before the state Supreme Court.

Attorneys for Michael Haig and other beneficiaries have argued the trust's assets should be equally divided among Samuel Mills Damon's 20 great-grandchildren, giving each about $40 million. They believe that Damon's will was ambiguous on the matter.

Circuit Judge Virginia Crandall struck down that idea in 1998 when she ruled that the trust's assets should be split equally between the two lines created by Samuel Mills Damon's two sons.

That means that great-granddaughters Sharon Damon and Madeleine Wright, offspring of Samuel Mills' son Samuel Edward Damon, will receive about 1Ú8 of the trust, or roughly $100 million each.

Under Crandall's ruling, the 16 remaining great-grandchildren, descendants of Samuel Mills' other son Henry Fowler Damon, are to receive between 1/24 and 1/32 of the trust, or $35 million to $27 million.

The Damon Estate declined comment on the distribution plan and the appeal. But people familiar with the trust's operations said that the estate has placed about $200 million in reserve in anticipation that the court rules in favor of either plan.

|