Final Damon

Estate heir dies

Estate beneficiaries are arguing

over how to distribute the assets

![]()

Joan Damon Haig, 84, died at her home in New Jersey, setting in motion a termination process that could take years and is complicated by a pending Hawaii Supreme Court appeal that could dramatically affect the amounts each of the roughly 20 beneficiaries will get.

Estimates of the estate's assets range from about $750 million to nearly $900 million, according to people familiar with its operations.

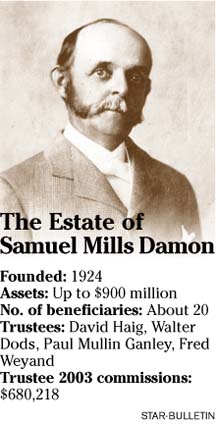

Created in 1924 by the will of First Hawaiian Bank pioneer Damon, the estate used to be one of Hawaii's largest private landowners, at one time laying claim to more than 121,000 acres in Hawaii.

But it has sold off its major property holdings in recent years, preparing for the termination triggered by the death of Damon's last grandchild.

With tens of millions of dollars for each beneficiary at stake, the much-anticipated ruling by the Supreme Court will determine how the estate's assets -- now mostly in stocks and other liquid investments -- will be distributed.

Because of ambiguity in Samuel Damon's will, the beneficiaries have been fighting for years over the way the pie should be split, and that fight ultimately will be settled when the Supreme Court rules on the appeal of a lower-court decision in an April 1998 lawsuit.

Based on the current scheduled split, some beneficiaries would stand to get roughly $25 million on the low end and as much as about $100 million on the high end, according to one attorney familiar with the case. Depending on how the high court rules, those shares could change by tens of millions of dollars.

The fight over how to split the Damon pie was not uncharacteristic for the estate.

The organization has been known for its squabbling among beneficiaries, fueled by the ambiguity in the will. Even the timing on the estate's termination was the subject of a major legal battle.

A Supreme Court ruling in 1994 determined that the estate would terminate upon the death of the last grandchild. Four were living at the time, but all were elderly. Some beneficiaries had argued that the estate was supposed to end 21 years after the last death.

Since that 1994 ruling, the estate has been operating with an eye toward its eventual termination.

In 2001, the estate sold its stake in BancWest Corp., First Hawaiian Bank's parent company, to BNP Paribas for more than $500 million.

Michael Haig, one of the beneficiaries, said the stock sale represented half the value of the trust.

Last year, the estate sold its other major asset, 220 acres of light industrial and commercial properties in Mapunapuna and Sand Island, for $466.1 million to Massachussetts-based HRPT Properties Trust.

It also sold mainland properties and Big Island ranch land.

One of its few remaining land holdings is Moanalua Gardens, but it is not known what will become of that.

An estate administrator could not be reached for comment.

"A great deal of the process of termination of the trust has been accomplished," said Haig, noting that 99 percent of the estate already has been liquidated. "There are a few matters that need to be resolved."

The trustees "are given a reasonable amount of time to wind up the affairs of the trust," Haig said. "I expect they will now begin to do that. I can't speculate on the time frame."

Damon heiress gave

millions to various

local institutions

Joan Damon Haig, 84, the benefactor of dozens of Hawaii institutions and hundreds of First Hawaiian Bank employees, died yesterday in Metedeconk, N.J.

As the last surviving grandchild of Samuel Mills Damon, co-founder of First Hawaiian Bank, her death sets in motion the dissolution of the multimillion-dollar Damon Estate trust that he established.

In the mid-1980s, Haig gave her shares in First Hawaiian Bank to the employees, about 10 shares for each, said her friend and former daughter-in-law, Myrna Murdoch.

"She originally wanted it to go to single women employees because she recognized it was difficult to work and raise a family," Murdoch said.

"She was truly a Renaissance woman," Murdoch said. Among Haig's endowments were a wing of the Waikiki Aquarium, named for her late brother Henry Damon, and millions of dollars in gifts to the YMCA of Honolulu, Iolani Palace and Hawaii Pacific University, she said.

Haig was born in Moanalua Valley and attended Hanahauoli and Punahou schools. She was studying art in New York City when World War II began, said son Michael Haig. She met Alexander Haig, a British army captain, while living with friends in New York state and they married in 1946. The Haigs eventually settled in New Jersey.

She is survived by Alexander; sons Michael, Christopher and David; daughter Wendy Sadler; and seven grandchildren. Services will be held in New Jersey.