— ADVERTISEMENT —

HEI powers ahead

Hawaiian Electric's profit

jumps nearly 40 percent

on higher demand

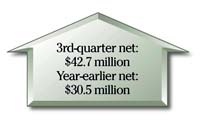

Hawaiian Electric Industries Inc.'s net income jumped nearly 40 percent to $42.7 million in the third quarter as a hot and humid summer boosted power demand.

|

HEI, which owns Hawaiian Electric Co., the state's biggest power producer, as well as American Savings Bank, credited the state's overall economic pickup with lifting the parent company's performance.

"The strengthening of our economy is showing up in our results," said Robert Clarke, HEI's chairman, president, and chief executive officer.

The solid year-on-year growth beat analysts' per-share forecasts by a full dime.

Earnings from continuing operations -- net income minus any discontinued lines of business -- came in at $40.8 million, or 51 cents a share, compared with analysts' estimates of 41 cents a share, according to Thompson Financial.

HEI's total revenue grew 11.7 percent to $506.8 million, with the lion's share of the growth contributed by HECO.

HECO's net income grew 28.5 percent to $26.2 million on a 14 percent increase in revenues, which totaled $408 million.

The results were powered by a 3.6 percent increase in kilowatt-hour sales thanks to increased power use by residential customers. Commercial sales also rose, by 2.8 percent.

HECO had to contend with higher operating expenses in the quarter, primarily a 27 percent increase in fuel oil costs stemming from the recent ascent in crude oil prices. The utility said the average fuel cost per barrel rose to $42.72 from $35.62.

But costs were offset by the higher electricity sales, a $1.9 million decrease in retirement benefits expenses and a $1.3 million reduction in interest and other expenses.

Net income for American Savings Bank, meanwhile, returned to the black after posting a net loss in the second quarter thanks to a $24 million charge.

That charge was due to an unfavorable tax ruling given to the bank's real estate investment subsidiary.

Still, the bank's third-quarter performance was largely flat at $15.4 million in net income compared to $15.3 million in the year-earlier quarter.

Results were helped by a $3.8 million reduction in loan-loss provisions.

Clarke said the amount of troublesome loans remained "well below historical norms" thanks to strength in Hawaii's real estate market, low unemployment, and job growth.

"Bank earnings continue to benefit from strong asset quality," he said.

Net interest income grew slightly to $48.5 million but HEI indicated that an uncertain interest rate environment will continue to pressure interest earnings.

— ADVERTISEMENTS —

— ADVERTISEMENTS —