— ADVERTISEMENT —

Investors

see continued

market muddle

Not much will happen until

after the election, say experts in

the Star-Bulletin's annual contest

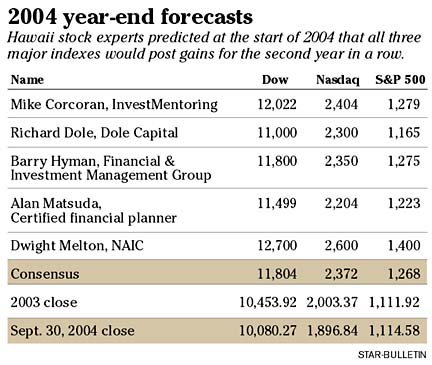

If presidential election years are supposed to bring prosperity to the stock market, then time is running out in 2004.

Since 1928, the Standard & Poor's 500 index has finished positive 16 of the 19 years there was an election for the White House, according to Chicago-based financial research firm Ibbotson Associates.

But the market has ranged from flat to down most of this year and local stock experts don't see much of a change in the fourth quarter.

"I think it will be more of the same," said Barry Hyman, vice president-management team of Financial & Investment Management Group Ltd. in Wailuku, Maui. "Interest rates are going to stay benign and probably rise a little bit from where they are now, but not significantly. Economic growth is going to remain tepid and there will be volatility related to the election. But, by the end of the year, I think the markets will be within 10 percent of where they are now."

Hyman's hypothetical $20,000 portfolio was up 2.9 percent at the end of the third quarter in the Star-Bulletin's annual survey of best investment ideas. He was second among five local experts.

The top performer as of Sept. 30 was Certified Financial Planner Alan Matsuda, a newcomer to the contest who was up 7.4 percent over the first nine months of the year.

InvestMentoring financial consultant Mike Corcoran was in third place with a loss of 1.2 percent despite having the best individual performer in eBay Inc.'s 42.3 percent gain.

Dwight Melton, a director with the nonprofit National Association of Investors Corp. in Hawaii, was in fourth place with a decline of 1.3 percent after leading the survey at midyear with a 7.3 percent return.

Richard Dole, chief executive of investment banker Dole Capital LLC, trailed the field with a loss of 14.5 percent.

By comparison, the Russell 2000 index of small companies gained 2.9 percent, the S&P was up 0.2 percent, the Dow Jones industrial average was off 3.6 percent and the Nasdaq composite index was down 5.3 percent.

Historically, the S&P 500, a broad measure of the market, is up 70 percent of the time, Ibottson said.

Matsuda sees volatility ahead because of the Federal Reserve's three consecutive interest rate increases and the November presidential election.

"We've had this before where the Fed has had three consecutive rate increases, back in 1994 (as well as 2000), and what happened is that bond prices crashed down to earth," Matsuda said. "So anticipating that to repeat, for many of my clients who need bonds in their portfolio, I have cash built up in anticipation of that although there's no guarantee that will happen."

Matsuda expects the election, as well as terrorism, to continue affecting the market with a George Bush victory likely to give stocks a boost.

"But if Kerry wins, it might even go down," Matsuda said.

Matsuda's five mutual fund picks continued to remain in positive territory for the year with Alpine Realty Income & Growth Fund, which invests in real estate investment trusts, leading the way with a 13.5 percent gain.

Hyman had two international picks with gains over 23 percent. Prospect Japan Fund, which invests in small Japan companies, rose 24.1 percent while Singapore Post Ltd., which provides postal services, jumped 23.7 percent.

However, one of his picks, Blu Inc. Group, is in limbo after changing its name to Vantage Corp. and selling its only operating subsidiary, a publishing business, to Singapore Press Holdings on Sept. 1.

The Singapore Stock Exchange has suspended trading in the shares because the existing company has cash from the deal but no operating subsidiaries.

"Due to the fact that Blu Inc. is in limbo, its price doesn't reflect the value of the company whatsoever," he said. "But I'm pretty happy with my overall performance. It's been excellent."

Melton has reduced his exposure to stocks and bonds to 50-50 from 60-40 following the Fed's last rate hike. He said the three consecutive rate increases, high oil prices, the uncertainty of the election and all three major indexes trading below their 200-day moving averages are good reasons to back off of stocks.

"You can still make money in any environment," he said. "It's all based on asset allocation. I'm at 50-50 right now because of the downward trend of the market and the consecutive rate hikes."

Melton, whose picks all showed gains at midyear, stumbled in the third quarter. His best performer now is the Pro Funds Ultra Mid Cap Fund, which was up 3.5 percent this year after the third quarter.

Corcoran's best performer, eBay, was down just a penny from where it was at the end of June. Corcoran refers to eBay as a "safe" stock.

He's not nearly as sold on the market, which he said will get its direction from the election.

"It think we're either at the start of an upward swing or we're going to stay in the quagmire," Corcoran said. "A lot of that depends on the election and the economic data coming out. But I really think we have an upward bias."

Dole, whose three technology selections fell 27 percent or greater, saw his penchant for defense pay off as Lockheed Martin Corp. rose 10 percent to be his best performer. Dole also picked Lockheed Martin in last year's survey.

"I'm happy with all my picks fundamentally," he said. "It's just the wrong market for them."

— ADVERTISEMENTS —

— ADVERTISEMENTS —