— ADVERTISEMENT —

Summerlin’s entry

shakes up staid

insurance market

Hawaii's fifth and newest full-service health insurer has yet to announce its first client after getting its state license barely more than a month ago.

But Las Vegas-based Summerlin Life & Health Insurance Co. isn't shy about where it expects to get its future members. It has its stethoscope pointed at Hawaii's top health insurer, Hawaii Medical Service Association.

"Summerlin's competition, make no mistake about it, is HMSA," Summerlin Chairman Jim Dyer said in a recent telephone interview. "HMSA has a current monopolistic position in the state and has the majority of business in the state."

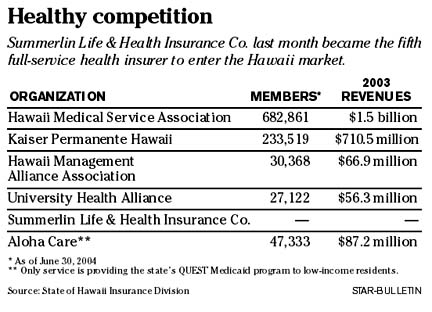

HMSA, predominantly a preferred provider organization, had 682,861 members at the end of June and $1.5 billion in revenues from health plan dues last year.

Kaiser Permanente Hawaii, the state's largest health maintenance organization, had 233,519 members at midyear and $710.5 million in revenues in 2003.

Summerlin, a for-profit firm whose parent company i/mx has more than 1 million members, is close to signing up its first Hawaii customers.

"We have a large number of pending contracts and commitments but we're not in position to discuss those for a few weeks," Dyer said yesterday.

State Insurance Commissioner J.P. Schmidt said Summerlin's presence should benefit the state's health insurance market.

|

"We have a very restricted market with a couple of dominant players and a couple of smaller companies and, in any line of insurance, there are problems when you only have a handful of companies doing business," said Schmidt.

"When you have a good healthy marketplace with a number of competitors, it ends up being much better for the consumers. The reason for that is that the competition makes the different companies sharpen their pencils and take a closer look at how they're treating their customers and the prices they're providing."

Dyer said the three plans Summerlin is offering are either equal to or better than what is available in the marketplace. He singled out two features of the plans -- routine physical exams for a $10 co-pay, and a 24-hour-a-day, seven-day-a week customer service line. Dyer said there are no plans for Summerlin to offer HMO coverage in Hawaii.

"All prior carriers, including those that currently exist, have duplicated what HMSA developed, and all that has been sold in the state of Hawaii has been prices," Dyer said. "There has historically been no creativity whatsoever in offering plan designs or concepts."

HMSA Chief Financial Officer Steve Van Ribbink said he's not concerned with having another insurer in the field. He said he looks at Summerlin as another competitor among rival insurers Kaiser, Hawaii Management Alliance Association and University Health Alliance, as well as Aloha Care, which provides the state's QUEST Medicaid program to low-income residents. HMSA and Kaiser also offer QUEST programs.

"We're fine with having competition and hopefully the members of the community will choose the best health plan that will provide them with the best value and quality," Van Ribbink said. "We are confident that will continue to be us, HMSA."

Kaiser, likewise, believes its HMO model offers consumers the best choice.

"Plans like ours are very rich in benefits because they include as part of your prepaid premium all the preventive things, such as nutritionists and dietitians," Kaiser spokeswoman Alison Russell said. "We believe this is really the best way to deliver health care because you're dealing with illness and prevention."

Dyer, who founded Summerlin in 2003, said Hawaii is familiar territory because i/mx, whose companies focus on health care and information technology, has been conducting business in the state since the end of 2001. That was when one of its subsidiaries, HMA Inc., won contracts to administer benefits for several large self-insured trust funds representing both organized labor and management.

"We had been looking at the Hawaii market for years and were so happy to be able to put on display our capabilities in managing health plans," Dyer said. "Our initial bidding process involved 32,000 client members, so we entered the state in a big way."

In conjunction with HMA's arrival, i/mx also put two of its other subsidiaries to work in Hawaii. They were Health Management Network, a preferred provider organization that provides health care to the members of those trusts; and R/xx, a pharmacy benefits management company that provides prescription drugs to the trust members.

Summerlin's emphasis, Dyer said, will be on companies with between two and 500 employees. But Summerlin also faces an uphill battle because of HMSA's dominance and the state's 1974 Prepaid Health Care Act that made Hawaii the only state where most employees are guaranteed health insurance. Thus, Summerlin must compete for employees who already have coverage, many of them through their union-negotiated plans. There also is an uninsured population of about 10 percent that Summerlin could pursue.

Dyer said Summerlin is offering two comprehensive medical plans and a preferred provider plan. One of the comprehensive plans is an 80-20 where the member pays monthly premiums and 20 percent of the expenses up to an out-of-pocket maximum of $2,500. The other comprehensive plan features a $15 co-pay for office visits, along with monthly premiums, with an out-of-pocket maximum of $2,000. In both plans, there is one set of benefits whether or not a patient uses one of the 3,800 providers in the network.

Summerlin's preferred provider plan offers different costs depending upon whether a network provider is used.

HMAA and UHA, the state's two smaller insurers, said they're waiting to see if Summerlin has staying power.

"There's always a lot of hype when a new health plan comes into the market, whether it's PGMA, Queen's or Kapiolani," HMAA President Arnie Baptiste said. "Everyone has very high hopes they'll have an impact on the market."

PGMA was liquidated in the late 1990s due to fraud while the Queen's and Kapiolani plans failed because they were unable to compete in the marketplace.

"If you look at Summerlin's main plan, it's 80-20 whereas our plan offers 90 percent coverage," said Baptiste, whose company has 30,368 members. "The pricing of those plans is in line with our current plan so whether that's going to be competitive or not is questionable. Our plan includes chiropractic, acupuncture, life insurance, natural path (a blend of Eastern and Western medicines) and an employee assistance program."

Baptiste added that any price break customers may realize now will be eliminated in a year when the price of health insurance goes up.

UHA Chief Operating Officer Howard Lee said his organization, which has 27,122 members, mostly works with smaller companies and focuses on its customer service.

"Competition to us is part of everyday life in business and we're just going to focus on what we do well and continue to be a strong company," Lee said. "If we do a good job, customers will stay with us. If we don't, they'll leave."

— ADVERTISEMENTS —

— ADVERTISEMENTS —