Tony Yoshida bought a Waikele condominium with an adjustable rate mortgage. While his payments are lower initially, they rise in later years.

More options open

As the market drives home prices

to record highs, consumers look

for new ways to buy

Tony Yoshida needed to buy a condo. But as a junior Aloha Airlines pilot who worked -- and got paid -- infrequently, he didn't feel comfortable locking himself into a conventional 30-year mortgage.

So like many buyers looking for a leg up in Hawaii's housing market, he rolled the dice, taking out an adjustable-rate mortgage on a $210,000 Waikele condo. He got a rock-bottom rate and has to pay back only the interest for the first five years, dramatically lowering his monthly payment.

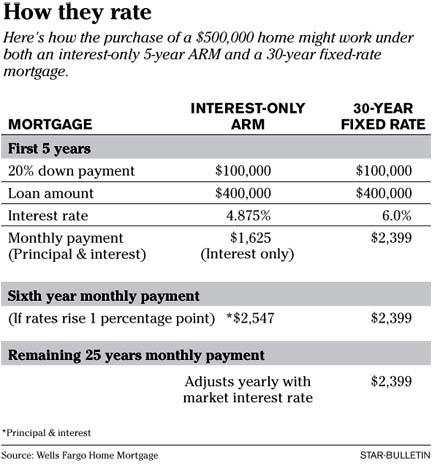

How they rate

Local lenders say interest-only adjustable-rate mortgages are one of their fastest-growing products. These feature:Low initial monthly payments

>>The loans come with a below-market interest rate for a set period, often the first five years.

>>Borrowers pay back only the loan interest in that time.Higher payments later

>>Interest rates adjust to prevailing rates after the set period

>>Buyers begin paying back principal plus interest

The catch? Much higher payments kick in after that, but he's hopeful his future earnings will cover it.

"There are definitely risks involved, but the positives outweigh the risks. Five years is a long time," Yoshida said.

Adjustable-rate mortgages, once a fringe product, are now finding favor with a growing number of people like Yoshida seeking to leverage their way into a home while putting off the financial day of reckoning.

There is a proliferating array of increasingly complicated arrangements, but most ARMs basically guarantee a below-market rate for a period of one to 10 years. After that, the rate is brought in line with that of standard 30-year fixed-rate loans, though there is usually a cap on how high the rate can rise.

Interest-only and other structures have been around for decades but are fast gaining in popularity due to rising rates and the high cost of Hawaii housing.

"People will say 'Oh I really want this home' but they can't swing it with a 30-year fixed," said Anders Hostelley, Oahu branch manager for Wells Fargo Home Mortgage. "So we say 'if you really want it, this is how to do it.'"

This has allowed financial institutions to eke out more business amid slowing mortgage turnover. Bank of Hawaii, for one, reports that variable-rate structures now account for about 45 percent of its mortgage business. A year ago, it was only about 20 percent. Local lenders say interest-only plans like Yoshida's are becoming particularly popular.

This trend is causing concern in some financial circles that unqualified buyers are over-leveraging themselves without fully weighing the consequences of such mortgages. But with prices rising, getting a foot in the door now is paramount for people like Yoshida.

Though he is based in San Diego, Yoshida wanted an Oahu condo for those nights away from home and as an investment. After making a down payment of $50,000, he mortgaged the remaining $160,000 with the interest-only loan at an initial rate of 3.875 percent for the first five years.

His monthly payment today is only $569. But after year five, he begins paying the principal. And if rates rise just one full percentage point by then, his monthly payment will nearly double to $923 by year six.

Yoshida expects rates to climb but he feels that he could refinance, rent out the property or pay the mortgage with what he expects to be a higher salary.

"It might not be too much of a hardship to keep it," he said.

But homeowners like him are "gambling" that one of two questionable scenarios will occur, said Keith Gumbinger, vice president of HSH Associates, a New Jersey-based mortgage research firm.

Namely, that rates won't rise significantly from their recent 40-year lows, or that home values will continue to expand, allowing owners to sell for a profit down the road.

"This could end very badly for a lot of people," Gumbinger said.

"People are trying to stretch it down to the last dollar. But when you stretch and stretch, especially when rates will rise and home values will level off, you're too exposed," he said.

The Federal Deposit Insurance Corp., which guarantees bank deposits, warned recently that variable-rate mortgages were opening the door to a new class of buyers that fail to meet traditional requirements for obtaining a loan.Victoria Taylor might be one. An administrative employee with a financial services company, Taylor could not afford to make a down payment on the $155,000 Salt Lake condominium she bought in June.

So her lender arranged a seven-year ARM that came with a relatively high interest rate but waived the down payment requirement. She's counting on greater earnings in the future to pull her through.

"No one stays in a job in which their pay doesn't grow," she said.

Mortgagees might have time on their side. Americans live in their homes an average of only five to six years -- a year or two longer in Hawaii -- and many owners likely will sell before the higher payments kick in.

"It's not really all that risky," said John Gray, head of mortgage banking at Bank of Hawaii. "With a five-year ARM, you're out somewhere into year eight before you start to feel the maximum adjustments and even that will probably just bring you back to break-even. And a lot of people think, "Well, I'll probably be doing something different by then'."

Gary Kai, HomeStreet Bank's Hawaii manager, says a variable-rate product is often a better option for some people.

"It's a question of your perspective. What is your plan? Are you thinking you might trade up in the next three to five years. If so, getting an ARM is not a bad option," he said.

But homeowners could be left stranded if home prices -- already at record highs in Hawaii -- start to fall. Most mortgages, and particularly interest-only ARMs, pay down little or no principal in the early years.

And if values fall below a home's purchase price, homeowners could find themselves "underwater," meaning they can't sell without somehow coming up with thousands of dollars to make up the difference.

Taylor's solution is that she plans to keep her condo as a permanent residence and never sell it, and will face her payment challenges as they come up.

"I'm not too worried about it," she said.