HAWAII'S RETAIL MARKET IS SIZZLING, AND...

Keala Peters, marketing manager for Niketown, gave a presentation Friday to retailers taking a tour of 2100 Kalakaua Ave. and King Kalakaua Plaza.

There’s more

in storeInvestors look to take advantage

of Hawaii's changing visitor mix

Retailers eyeing Hawaii's improved market are using the isles' changing tourist patterns to help determine what's in store.

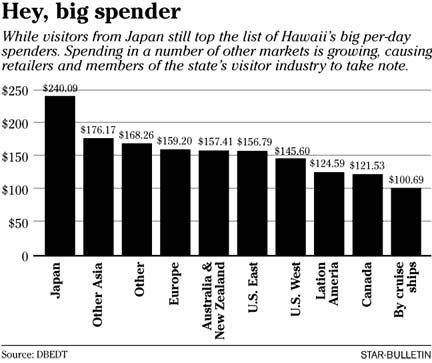

In the late 1990s, when the Japanese tourism boom to Hawaii was taking off, the state's largest industries went to great lengths to cater to the needs of these nouveau riche of Asia. Then, the bubble burst.

"We have to diversify our market," said retail analyst Stephany Sofos said. "In the 1980s, the Japanese people came fast and furious and those who didn't cater to them were left out. Now it's changing, and as visitor groups change, retailers are having to figure out what their market is from one day to the next."

Retail sales at neighborhood and community centers have historically been strong, but it's been more of a challenge for the state's resorts, said Mike Hamasu, director of consulting research at Colliers Monroe Friedlander.

"When nobody is coming to visit, nobody is spending money there," Hamasu said, adding that improved visitor numbers have renewed interest in a once tired market. Improvement in Hawaii's tourism industry has prompted retailers to be more concerned about finding ways to tap that strengthening market, which netted more than 6.4 million visitors in 2003, about 4.3 million of them from the mainland.

Projects like the Royal Hawaiian Shopping Center renovation, Outrigger's new Lewers Street project and International Market Place are designed to appeal to the new breed of tourists comprising domestic visitors, time-share buyers, cruise ship travelers, friends of the military and value-conscious Asians, said Andres Albano Jr., a vice president with CB Richard Ellis Hawaii Inc.

"What most of these new markets mean is a higher percentage of domestic visitors," Albano said. "The retail community knows that now is definitely the time to focus on different kinds of visitors coming into the state."

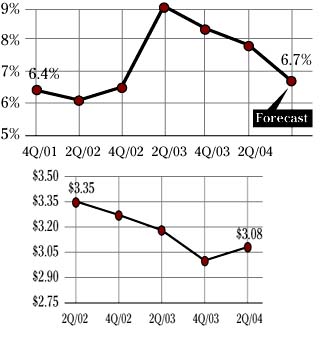

TOP: Retail vacancies

An attractive market has prompted several major retailers to move ahead with plans to enter Hawaii’s booming market. Vacancy rates, which dropped 13.3 percent year over year, are expected to drop another 14.10 percent by year’s end.

ABOVE: Retail rent prices

As Hawaii’s economy and visitor numbers improve, retail renters were willing to pay more. Asking rental rates made their first move upward in more than two years. Asking rents rose nearly 3 percent for the first half of 2004, moving up to $3.08 per square foot.Source: Grubb & Ellis

But while developers and owners of retail establishments see the shift in visitor numbers to a primarily domestic market, some have been slow to reposition due to long-term leases, Albano said.That's changing as an attractive market has prompted several major retailers to move ahead with plans to enter Hawaii, creating more competition.

New players have caused Hawaii's retail market to boom, dropping vacancy rates and lifting rents, according to a mid-year market report released Friday by Jeffrey Nasrallah, director of research at Grubb & Ellis/CBI Inc.

The overall Hawaii retail market improved 13.3 percent year over year, falling from a 9 percent vacancy rate recorded at mid-year 2003 to 7.8 percent at mid-year 2004, Nasrallah said, adding that he expects vacancy rates to drop to 6.7 percent by year end.

Asking rental rates also rose for the first time in more than two years, Nasrallah said, adding that the combination of declining rental rate space coupled with a booming tourism industry will allow rental rates to continue creeping up for the next year.

"For 2004, wax your surfboards, it's going to keep going and its going to be a good ride," Anthony Buono, managing director of CB Richard Ellis, National Retail Services, told members of the International Council of Shopping Centers Friday at an idea exchange in Waikiki.

The exchange brought more than 300 retailers and developers to Oahu to scope out opportunities and see if they could make a deal. As Oahu's visitor market improves, many of these retailers and investors are going to take advantage of more visitor-based opportunities, said Jeffrey Hall, senior director of research at CB Richard Ellis.

"There's huge amount of interest in redoing resort retail, especially in Waikiki," Hall said.

According to market reports, Waikiki has a high number of retail vacancies at this time, but in three to four years as some of Waikiki's projects come to fruition, Hall said he forecasts a much more bullish outlook for the state's resort retail sector.

"The Royal Hawaiian Shopping Center is rapidly changing. The Beach Walk and the International Market Place projects are just getting under way; expect that in a few years Waikiki will be an entirely different place," Hall said.

The shift in demographics has changed the way Hawaii tourism experts must market the destination and how businesses -- from accommodation providers to tour operators -- advertise their products, said state tourism liaison Marsha Wienert.

The Royal Hawaiian Shopping Center, which has been more than 40 percent vacant at times, is undergoing a $55 million renovation and tenant repositioning, said Susan Todani, director of investments for owner Kamehameha Schools."We're Waikiki's 50-yard line," she said. "And we're in the process of restoring our center."

Nine new stores have opened since December at Waikiki's largest shopping mall, Todani said, adding that one of the new offerings, The Cheesecake Factory, is already a top performer. Current projections estimate gross sales as high as $20 million for 2004, she said.

Other new retail offerings have included LUSH Cosmetics, local art and gift seller Elephant Walk, Italian Shoe manufacturer A. Testoni, and David & Goliath, an irreverent clothing store. Island Snow has also moved to a more prominent location and Allure and Cartier & Hermes have announced plans to double their retail space, Todani said. More leasing announcements are expected shortly, she added.

As part of the 2004 Hawaii/Pacific Rim Idea Exchange, participants toured Waikiki businesses Thursday. King Kalakaua Plaza general manager Brenda Morey led the tour.

The success has prompted Round One, a Japanese entertainment company, to begin planning a seven-story entertainment complex between Saratoga and Beach Walk, just off Kalakaua.The center, which is designed to appeal to a rebounding Japanese tourist market, will feature video games, bowling, darts and karaoke, Hall said.

It's also prompted other popular domestic retailers like Nordstrom to consider entering Ala Moana and Eno's Restaurant to look at Victoria Ward Center and Ala Moana, Albano said.

All of these projects along with Hawaii's national allure have generated increased interest in Hawaii's retail capital market, said Tom Gilmore of Los Angeles-based Madison Marquette, who was in town for the idea exchange and to find retail investment opportunities.

"The secret is out about Hawaii," Gilmore said, adding the popularity of tropical wear retailer Tommy Bahama, as well as Hawaii's network TV shows, "American Idol" success and frequent movie exposure has helped generate some of the attraction.

"There's an updraft of interest in Polynesian stuff, and Hawaii happens to be the original brand," he said. "I've talked to hundreds of clients and most of them are interested in Hawaii."