Oahu office vacancy

falls, report saysJob growth has fueled demand

for Honolulu office space

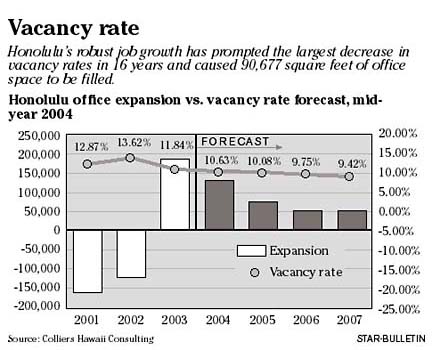

Honolulu's robust job growth rate has translated into healthy expansion for the commercial office market, prompting the largest drop in vacancy rates in 16 years, according to a new research report.

The overall Oahu office vacancy rate improved 20.15 percent, falling to 10.98 percent at mid-year 2004 from a decade high 13.75 percent vacancy rate a year earlier, according to a new report by Mike Hamasu, director of consulting research at Colliers Monroe Friedlander.

"Job growth has been directly correlated to the level of demand for office space," Hamasu said, adding that office employment counts for Honolulu averaged an annual growth rate of 2.3 percent during the past three years.

As a result, a number of metropolitan markets, which had suffered downturns in office demand from the Internet implosion, are finally forecasting improvement and growth in their markets due to rising employment figures, he said.Since January, Honolulu's office market recorded 90,677 square feet of expansion. At mid-year, the Central Business District recorded an additional 51,821 square feet of new expansion, which dropped vacancy rates nearly 19.3 percent to 11.3 percent from 14 percent a year ago.

While leasing activity slowed during the first half of 2004, activity should increase when military housing contracts begin in earnest, the Stryker Brigade arrives and the Keeaumoku Street Wal-Mart opens, Hamasu said.

The outlook for the Kapiolani corridor, which posted a decade-high vacancy rate of 14.5 percent in 2002, has improved dramatically. The corridor posted a 10.6 percent mid-year vacancy rate as several new tenants boosted occupancy at Ala Moana Pacific Center, 770 Kapiolani and Pacific Park Plaza.

Recent improvements in visitor arrivals, the hotel occupancy rate and visitor spending have spurred the Waikiki market to improve. Waikiki's office buildings posted more than 33,000 square feet of new tenancy as vacancy rates fell to 13.3 percent.

Overall, rental rates are forecast to remain flat for the near term, but are expected to increase within the next year. The recent sale of Waikiki Galleria, Davies Pacific Center, Pan Am Building, 677 Ala Moana and the expected sale of Waterfront Plaza, Pacific Business News Building and Harbor Court will likely result in rent increases as new owners seek to meet their target yields on new acquisitions, Hamasu said.

Asking rates for Davies Pacific Center, Pan Am Building and Waikiki Galleria have all recently gone up, he said.

While Hamasu's report had a positive outlook, a recent mid-year office report by Jeff Nasrallah, research services manager at Grubb & Ellis/CBI Inc., was more conservative.

According to that report, while Oahu's overall office market improved 5.7 percent over a year earlier, posting a 13.2-percent vacancy rate, it noted that tenancy fell by 11,000 square feet.

— ADVERTISEMENTS —

— ADVERTISEMENTS —