Mid-year top stock

picker says short-term

gains worth a lookA quartet of mutual funds

hand Melton the best

return so far for 2004

It's the summer doldrums. The Federal Reserve has just raised interest rates for the first time in four years. The presidential election is up for grabs. And the Iraq situation is still as volatile as ever.

What's an investor to do?

For local stock expert Dwight Melton, a devout follower of stock market trend lines, it's time to become more of a short-term trader and stay poised for another possible rate hike in August.

"The way market cycles work, you get the biggest bang for the buck from the 1 November time frame to 30 April, and then from 1 May through the remainder of the summer you have what is known as the summer doldrums," he said. "So, during that period I look for quick hits. It's more of a trading strategy for me in that period."

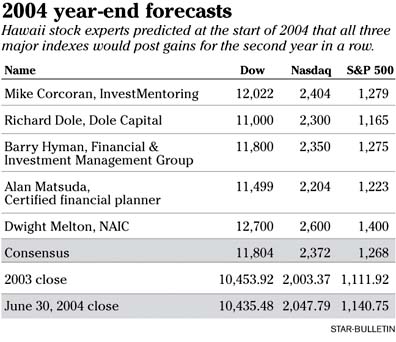

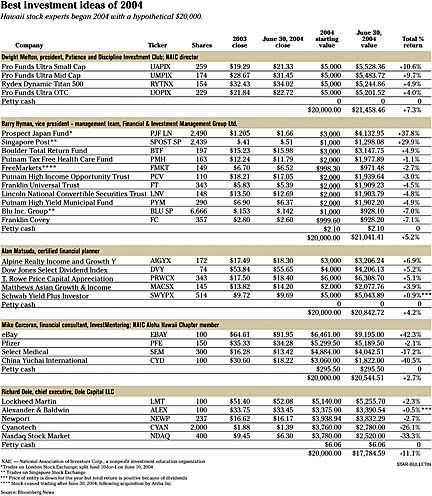

Melton, a director with the nonprofit National Association of Investors Corp. in Hawaii, was up 7.3 percent at the midpoint of this year to lead four other local stock experts in the Star-Bulletin's annual survey of best investment ideas. Each expert was given a hypothetical $20,000 portfolio at the beginning of 2004 and isn't allowed to make any changes during the year.

Barry Hyman, vice president of the management team of Financial & Investment Management Group Ltd. in Wailuku, Maui, was second with a 5.2 percent gain. He was followed by Certified Financial Planner Alan Matsuda, up 4.2 percent; InvestMentoring financial consultant Mike Corcoran, up 2.7 percent; and Richard Dole, chief executive of investment banker of Dole Capital LLC, down 11.1 percent.Melton diversified his selections among four mutual funds and received the best returns from Pro Funds Ultra Small Cap with a 10.6 percent gain and Pro Funds Ultra Mid Cap with a 9.7 percent increase.

For his own personal portfolio, he closely follows the 200-day moving averages for the Dow Jones industrial average and the Standard & Poor's 500 index to help gauge what direction those two indexes will take. He uses a 70-30 asset allocation of stocks to fixed income and currently is trading sectors within the S&P 500 to reduce risk.

"The three things that I use to gauge the overall market condition is interest rates, inflation and company profits," Melton said. "The interest rates have started to make their move on the upside. Inflation is still in check. And the company profits are coming in pretty strong. So what I'm doing right now is tracking the Fed rate hikes moving forward, and if the rates rise again at the 10 August meeting, I'm changing my asset allocation from 70-30 to 60-40.

Hyman, whose year-to-date return dropped in half from a survey-leading 10.5 percent in the first quarter, saw eight of his 11 picks decline in the second quarter. However, he was rescued by two of his Asia picks -- Hawaii Kai-based Prospect Japan Fund, up 37.8 percent; and Singapore Post Ltd., up nearly 30 percent. Prospect Japan Fund invests in small Japan companies while Singapore Post provides postal services and offers a 12 percent dividend yield.

Given the rise in those investments, Hyman said he wouldn't buy them at current levels even though the actual portfolios of his company continue to own full positions in them. He's reluctant to forecast how the international market will look the remainder of this year.

"I think trying to predict short-term performance is like playing on the freeway," Hyman said. "I think Asia, in general, is going to have a difficult time as the air gets let out of the China bubble.

"Having said that, Asia, or any region for that matter, will have good individual companies. And it takes hard work to separate the wheat from the chaff to fund the undervalued gems that are out there."

Matsuda, who laments not being able to make any changes in his hypothetical portfolio, said it was important for him to stay diversified since he had to stay with the same selections all year."I take my function very seriously," he said. "I don't want to lose people's money. This may be a game or a contest, but it's still serious."

To that vein, Matsuda is hoping that two of his specialized picks can ride out the year unscathed. His best performer, the real estate-focused Alpine Realty Income and Growth Y fund, was up 6.9 percent at midyear while his international play, the Matthews Asian Growth & Income fund, rose 3.9 percent.

"People are predicting that China will collapse the same way Japan collapsed," Matsuda said in reference to his Asian fund selection. "China is grabbing raw materials from all over the world and making prices go sky high because they need to keep their factories running. It's scary."

Matsuda said he expects both the Asian fund and the real estate fund "to grow nicely" for the rest of the year before fizzling out.

Corcoran had the distinction of having both the best and worst performers at midyear as eBay Inc. zoomed 42.3 percent and China Yuchai International Ltd., which makes diesel engines, stumbled 40.5 percent.

EBay has been a longtime favorite of Corcoran, who calls it "the perfect company."

"It's got no warehouses. It has no inventory. It's got all these buyers and its going international and into China," Corcoran said.

"It's reinvesting all its cash. It's just doing a wonderful job of management and it's a safe investment in case the market drops."

Dole, who made two high-risk selections in the Nasdaq Stock Market Inc. and Cyanotech Corp., paid dearly for it as the two stocks fell 33.3 percent and 26.1 percent, respectively.

"The market was worse than I thought in the first half of the year, but as a whole I think it will finish higher this year," he said. "I don't think it will be stellar, but there will be moderate to single-digit gains."

— ADVERTISEMENTS —

— ADVERTISEMENTS —