Hawaiian Air

leads local stocks

despite bankruptcy

The stock of Hawaiian Airlines' parent company was flying in circles until the carrier filed for bankruptcy reorganization 15 months ago.

Now, under the auspices of Chapter 11, Hawaiian Holdings Inc. is the best-performing local stock so far this year with a double-your-money gain through the first six months.

That feat has a lot of airline insiders scratching their heads. But hedge fund managers, who have been fueling the rise, have been laughing all the way to the bank."It's a wild bet," said Richard Dole, a local stock analyst and chief executive of Honolulu-based investment banker Dole Capital LLC. "There's little supply and a lot of demand that will run the stock whether it's fundamentally sound or not."

Of course, an investor group of Ranch Capital LLC, which recently purchased 10 million shares from former majority shareholder AIP LLC, says there's value in the shares. AIP and former Hawaiian Airlines CEO John Adams, who sold off his personal stake as part of the $41.4 million deal, say the same thing. That assessment ultimately will be left up to federal Bankruptcy Court later this year.

For now, though, there's no question Hawaiian Holdings has been the place to stow money for investors betting that the shares won't get wiped out in the reorganization.

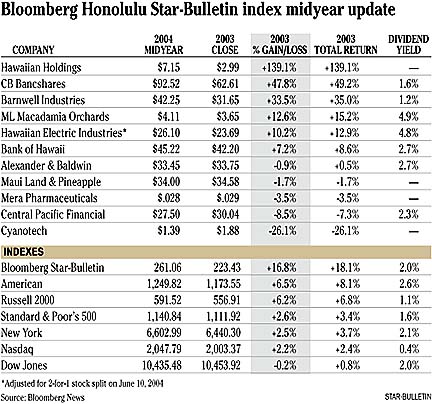

Hawaiian Holdings soared 139.1 percent in the first half of this year to lead 10 other stocks in the Bloomberg Honolulu Star-Bulletin index. More impressive, Hawaiian's midyear close of $7.15 represented its highest finish since hitting $7.88 on June 27, 1995. The shares are up 2,283 percent since its post-bankruptcy closing low of 30 cents on June 12, 2003.

Put another way, an investor who bought $10,000 worth of shares less than a year ago would have $228,333 today.

The second-best local performer in 2004 is another company whose story line also has endured for more than a year. CB Bancshares Inc., parent of City Bank, jumped 47.8 percent in the first six months as it reaped the dividends of rival Central Pacific Financial Corp.'s March 2003 merger offer.

CB Bancshares ended mid-year at $92.52, nearly $1 above Central Pacific's cash-and-stock offer of $91.83. Since the deal consists of only $20 in cash and the rest in Central Pacific stock, any rise in Central Pacific's shares will boost CB Bancshares' stock.

Barnwell Industries Inc., which hit an all-time high of $48.75 in May, was the third star performer in the first half of the year with a 33.5 percent gain.

Overall, the basket of 11 Hawaii stocks trounced all the major indexes as the Star-Bulletin index gained 16.8 percent, more than 10 percent higher than any other index. This was in spite of the fact that five of the 11 local companies saw their stocks down at midyear.

Other gainers were ML Macadamia Orchards LP, up 12.6 percent; Hawaiian Electric Industries Inc., up 10.2 percent; and Bank of Hawaii Corp., up 7.2 percent. All three stocks had even better performances when their dividends are factored in.

Dole said Hawaiian Electric could be adversely affected by yesterday's interest rate increase because investors have been using the company as a bond substitute.

Dole also said local financial stocks probably have seen their better days because of the rising rates. However, he said Hawaii banks still can benefit from the booming construction industry even though they'll have to boost what they pay out for deposits to remain competitive.

"When those things start rising, they'll have to make it up somewhere else," Dole said.

The bottom four consisted of Maui Land & Pineapple Inc., down 1.7 percent; Mera Pharmaceuticals Inc., off 3.5 percent; Central Pacific Financial, down 8.5 percent; and Cyanotech Corp., off 26.1 percent after posting an index-leading 370 percent gain in 2003.

— ADVERTISEMENTS —

— ADVERTISEMENTS —