STAR-BULLETIN SURVEY

OF BEST INVESTMENT IDEASTop local stock picker

turns cautious on Asia

after market run-up

Japan's stock market is no longer the bottomless pit it once seemed.

An improving economy and increased business confidence ended a 13-year spiral in 2003 and has the Nikkei index poised for its second straight year of gains.

But local stock expert Barry Hyman is becoming more cautious about Asia after Prospect Japan Fund, his top performer in the Star-Bulletin's annual survey of best investment ideas, jumped 39.7 percent during the first quarter.

"I think the time to invest in markets is when they're out of favor and stocks are cheap," said Hyman, vice president of Financial & Investment Management Group Ltd. in Wailuku, Maui. "Asia, in general, has been reflating, so the risk-return profile doesn't look nearly as good now as when I first chose Prospect Japan Fund."

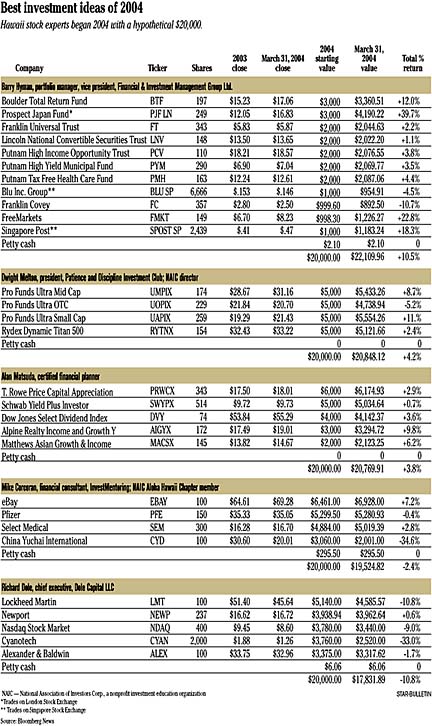

Hyman, who continues to hold that fund, had the best overall performance in the first quarter as he outpaced four other survey participants with a 10.5 percent gain in his hypothetical $20,000 portfolio.

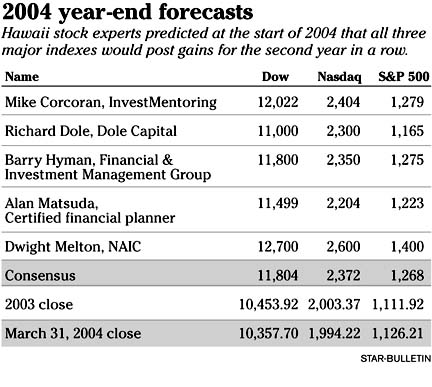

Dwight Melton, a director with the National Association of Investors Corp. in Hawaii, was second with a gain of 4.2 percent. He was followed by Certified Financial Planner Alan Matsuda, up 3.8 percent; InvestMentoring financial consultant Mike Corcoran, off 2.4 percent; and Richard Dole, chief executive of Dole Capital LLC, down 10.8 percent.

By comparison, the Russell 2000 index of small-company stocks had a gain, including dividends, of 6.3 percent; the Standard & Poor's 500 index rose 1.7 percent; and the Dow Jones industrial average and the Nasdaq composite index both declined 0.4 percent.

"I think when the market, especially the U.S. stock market, is at valuation levels where it is now, the market's going to look for excuses to revalue itself," Hyman said. "So whether it's the Fed raising rates, or the jobs number coming back down in the next quarter or the next month, it's not that relevant. What's important is that assets are still generally overpriced in the U.S. And, as a result, we think you've got to be very cautious in this environment."

The Star-Bulletin investment survey underwent a format change this year with local stock experts being given a hypothetical $20,000 to invest in either stocks, mutual funds or fixed income. Last year, the experts were allowed to pick three investments each, with the individual returns being averaged to calculate their percentage gain. Experts are required to hold on to their selections for the entire year.

Hyman made three international picks among his 11 selections with Prospect Japan Fund -- up 59 percent in 2003 and 5.3 percent in 2002 -- continuing to outperform its benchmark. The Hawaii Kai-based fund invests in Japan small-cap companies and is managed by Curtis Freeze, who splits his time between Tokyo and Hawaii.

Among Hyman's other international picks, Singapore Post Ltd. -- which provides postal services and offers a 10 percent dividend yield -- gained 18.3 percent while Blu Inc. Group -- a Singapore publishing company -- slipped 4.5 percent.

Hyman also had a double-digit gainer in FreeMarkets Inc., an e-commerce auction company that gained 22.8 percent.

Melton's runner-up performance was fueled by an 11.1 percent gain in the Pro Funds Ultra Small Cap fund and an 8.7 percent gain in the Pro Funds Ultra Mid Cap fund. However, he expects investors to shift away from small- and mid-cap stocks into dividend-paying stocks as the year progresses because of dividend tax breaks.

Melton also sees a possible bear market brewing and said investors could see another downturn in less than a year if the Federal Open Market Committee raises interest rates at three consecutive meetings.

"As long as the major indicies are trading above their 200-day moving average, the uptrend is going to continue," he said. "What may put a curve on that right now is if the Fed starts raising interest rates. That's going to start to have an impact on those major industries."

Melton said he has an asset allocation now of 70 percent stocks and 30 percent fixed income, but that he would rebalance his allocation to 60-40 after the first rate hike, 50-50 after the second increase and 30-70 after the third hike.

"That's going to be the beginning of a possible downturn in the market," Melton said. "When you get three consecutive rate hikes, the next indicator will be a flat or inverted yield curve (where yields on short-term bonds are higher than yields on long-term bonds). The next step would be major indicies moving below their 200-day moving average and, after that, you're going to see a bear market that will complete the cycle."

Melton added, though, that his market outlook would be more positive if the Fed doesn't raise rates at three consecutive meetings. The Fed, which meets every six weeks, has its next three meetings on May 4, June 30 and Aug. 10. The upcoming presidential election could prompt the Fed to hold off on rate increases for the short term, Melton said.

Matsuda, a newcomer to the survey, said he makes his selections based on what sectors are performing well rather than trying to bottom fish. That investment style led him to the Alpine Realty Income and Growth Y fund, a real estate fund that was his best performer last quarter with a 9.8 percent gain. He was the only expert to have all of his selections post gains in the quarter.

"Real estate is booming, but it probably is on its last legs," Matsuda said. "Real estate investment trusts have done well the last few years, but it's not going to continue forever. Hopefully, it will last until the end of this year."

Matsuda said he's advising some of his clients now to begin conserving cash in anticipation of bond prices going down, which would push yields up.

"That's the biggest thing right now -- what's going to happen to bonds," he said. "There are two things that drive the stock market -- corporate earnings and interest rate movements -- and right now the quarterly earnings are coming out. With the corporate earnings getting better and the economy recovering, the interest rates are going to go up."

Corcoran, who eschewed funds for stocks, saw his China play backfire as China Yuchai International Ltd., which makes diesel engines, had the worst performance of the entire survey with a decline of 34.6 percent. Corcoran's best pick was eBay Inc., which rose 7.2 percent.

"I think there's a bubble in China," Corcoran said. "Investors are looking at China possibly dropping off severely, but I don't think that's going to be the case. In the short term, it has a lot going for it with the Olympics in 2008, better relations with its neighbors, better relations with the U.S. The Asian economy is also getting better. I think (China Yuchai International) is a good play, but it's speculative."

Dole, whose year-end index projections were the most conservative of the group, nevertheless underperformed the market in the first quarter as both of his Hawaii selections fell and the three major indexes were virtually flat. Dole picked the Dow to end the year at 11,000, the S&P at 1,165 and the Nasdaq at 2,300.

Cyanotech Corp., which last year gained 370 percent, was Dole's worst performer as it tumbled 33 percent in the quarter. Ironically, the Kona nutritional supplement company announced in January that it ended 2003 with its first profitable period after 22 straight losing quarters.

"When I picked Cyanotech (for this survey) last year, it was about $1.50 and a late spurt pushed it to $1.88 (to give Dole a higher starting point)," he said. "But I'm looking for the whole year, not just one quarter. It wasn't too long ago that the stock was fighting to stay above $1 so it could stay listed on the Nasdaq SmallCap Market."

Dole's other Hawaii selection, Alexander & Baldwin Inc., slipped 1.7 percent last quarter after solid performances in 2003 from the company's ocean transportation subsidiary, Matson Navigation Co.; and A&B's real estate division.

"I expected A&B to boost its dividend (22.5 cents a share) and it didn't," Dole said. "I trust by the end of the year it had big capital projects in place and was struggling with the concrete strike. A&B is into construction, and its own property development was affected by that concrete strike. Now the strike is over, though."

— ADVERTISEMENTS —

— ADVERTISEMENTS —