ASSOCIATED PRESS

Jaimie Naeole of Waimanalo watches the pump ring up $10 at a gas station in Kaneohe as he fills up his brother's car. A law imposing gas-price caps is set to take effect July 1.

Making gas is

cheaper in isles,

report showsTesoro's low per-barrel

costs bring into question

Hawaii's high prices

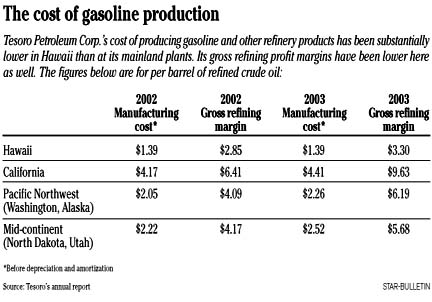

The per-barrel cost of manufacturing petroleum products, including gasoline at Tesoro Petroleum Corp.'s Oahu refinery last year was about one-third to one-half the comparable tab at its five mainland refineries, according to Tesoro data.

The fact that it cost Tesoro substantially less to make petroleum products here than on the mainland tends to dilute one of the main arguments the industry has used to justify high pump prices in Hawaii.

For years, the industry has maintained that motorists pay more here than on the mainland partly because of the high cost of doing business in the islands.

But data from Tesoro's annual report recently filed with the Securities and Exchange Commission show that per-barrel manufacturing costs, before depreciation and amortization, at the company's California refinery in 2003 were more than three times the comparable amount at its Oahu refinery.

Manufacturing costs at Tesoro's two refinery regions that include Washington, Alaska, North Dakota and Utah were nearly twice the level of the Oahu tab, according to the annual report.

The Oahu plant also easily had the lowest costs in 2002 and 2001, though by lesser percentages, the report shows.

Tesoro's local refinery is the largest of two refineries at Campbell Industrial Park. The other is owned by ChevronTexaco Corp., which does not break out manufacturing costs by refinery.

Critics of the oil companies say the Tesoro numbers further undermine the industry's long-held argument that Hawaii's higher costs are a significant factor in explaining high pump prices.

"The bottom line is, their arguments don't hold water," said Tim Hamilton, a petroleum analyst in Washington state.

"It's more smoke and mirrors," agreed Frank Young, a former Oahu Chevron dealer and president of the Hawaii Automotive Repair and Gasoline Dealers Association.

But Eric Lee, regional retail manager for Tesoro in Hawaii, said the lower relative manufacturing costs don't reflect the higher expenses, such as land for gas stations, high gas taxes and medical benefits for employees that Tesoro incurs in distributing and marketing its products.

While those costs generally are much higher here than on the mainland, the Hawaii stations tend to be much smaller and sell less gas, meaning the fixed costs per gallon are pushed even higher compared with the company's mainland operations, Lee said.

"It's light-years difference," he said.

But Barry Pulliam, a Southern California economist who specializes in petroleum issues, said Hawaii's higher distribution costs historically have not been enough to account for the major differences between mainland and local gas prices.

Hawaii's distribution costs represented only several cents a gallon over mainland costs, said Pulliam, whose Econ One firm assisted with the state's $2 billion 1998 antitrust lawsuit against Hawaii's oil companies.

The main reason accounting for the big difference in pump prices was the companies' substantially greater levels of profitability here, the state claimed in the lawsuit, which accused the defendants of conspiring to overcharge Hawaii consumers in the 1990s while earning excessive profits.

The companies denied the allegations. They eventually paid the state $35 million to settle the lawsuit, without admitting any wrongdoing.

The lower manufacturing costs for Tesoro in Hawaii stem largely from the makeup of its plant.

Lee said the refinery isn't as complex and sophisticated as the ones on the mainland and therefore isn't as costly to operate on a per-barrel basis.

One offshoot: The Oahu refinery last year produced far less gasoline, a highly refined product, as a percentage of its overall production mix than the mainland refineries. Gasoline typically has among the highest profit margins.

About 24 percent of the production mix at the Oahu plant was gasoline, compared with 60 percent at the company's California refinery, 52 percent at its Utah/North Dakota plants and 43 percent at its Pacific Northwest operations, according to the annual report.

While the Hawaii plant produced a relatively low percentage of gasoline, its production of heavier oils and residual products, which typically have the lowest profit margins, was greater last year than at the mainland refineries.

That explains why the gross refining margin -- a gauge of gross profitability -- was lower at the Hawaii plant than at the company's other refining regions, Lee said.

The annual report didn't break out Hawaii profitability by product category, such as gasoline.

But in court proceedings related to the antitrust lawsuit, industry representatives several years ago acknowledged that Hawaii was among the most profitable gasoline markets in the country because of its oligopolistic characteristics: Only a few suppliers control the market, demand is stable and companies have little incentive to lower prices.

"To quote our recent ex-president, if you are looking for an explanation, 'It's the oligopoly, stupid,'" one oil industry lawyer told the court.

High gas prices are commanding attention at the Legislature this session as lawmakers debate whether to amend or repeal a law that, beginning July 1, will impose price caps in Hawaii.

BACK TO TOP |

House panel touts

gas-cap delay

Any changes that would be made to Hawaii's unique gasoline price cap law before it takes effect July 1 are being left to a joint House-Senate conference committee.

The House Finance Committee late Thursday advanced a proposal to amend the law that allows the state to set a maximum price at which regular unleaded gasoline can be sold.

As passed two years ago, the law would mandate a maximum pretax price for gasoline sold at wholesale and retail levels, tying the ceiling to a weekly average of prices in West Coast markets.

Proposed changes include a delayed start date to allow further study of the formula and tie the maximum price to an average of prices nationwide. Other proposed changes include extending the cap to cover all grades of gasoline and applying it only to the wholesale price.

The bill advanced Thursday by the Finance Committee was an amended version of a proposal already approved by the Senate.

Finance Chairman Dwight Takamine, D-Hawi-Hilo, noted that the bill was being advanced in a form that ensures it goes to conference for further discussion and crafting.