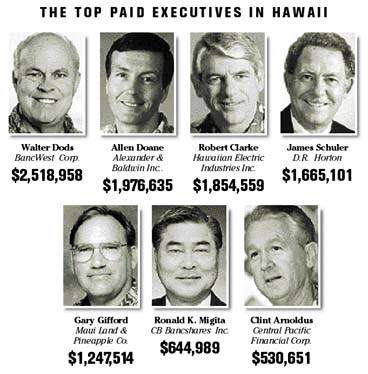

BRYANT FUKUTOMI / BFUKUTOMI@STARBULLETIN.COM The $2.5 million man

Walter Dods leads the pack of

Hawaii's best paid corporate leaders

The head of the state's largest bank received a 50 percent pay reduction in last year but still earned more than any other public company executive in Hawaii.

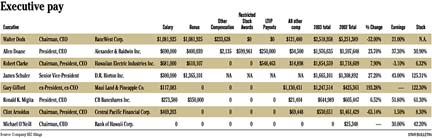

For the second year in a row, BancWest Chief Executive Officer Walter Dods topped the list of Hawaii's highest paid executives with a 2003 compensation package of $2.52 million.

That was $540,000 more than that of the next highest paid executive, Alexander & Baldwin Inc. Chief Executive Allen Doane, who received $1.97 million in base salary, bonuses and other compensation last year.

By contrast, Michael O'Neill, the chief executive officer of the state's second-largest financial institution, received no compensation last year.

In a year in which many of Hawaii's largest publicly traded companies posted record earnings and increased growth, seven-figure pay checks like Dods' were hardly the exception.

According to figures compiled by the Star-Bulletin from company filings with the Securities and Exchange Commission, top executives with Hawaii's public companies took home an average of $1.3 million last year.

That works out to about $3,577 a day and is nearly 47 times the per capita income in Hawaii.

Of the eight executives surveyed for this report, five earned more than $1 million last year while two received a bonus of more than $1 million.

Only two top executives -- Dods and Clint Arnoldus, Central Pacific Financial Corp.'s chief executive officer -- saw a drop in their pay for 2003.

Here's a snapshot of what the CEOs were being paid last year:

>> Dods' 2003 compensation package -- which reflects the company's record earnings and continued growth -- is all the more attention-grabbing when you consider it's less than half the $5.25 million that he received in 2002.

The $5.25 million income -- an all-time high for CEO pay in Hawaii -- was largely the result of BNP Paribas' acquisition of BancWest, which triggered a $2.99 million long-term incentive payout that otherwise would have been paid over three years.

>> Dods was followed by Alexander & Baldwin's Doane, who received a $378,987 pay increase last year. The company, whose earnings and stock price were up about 40 percent last year, granted Doane $599,961 in restricted stock awards, pushing up his overall compensation package to $1.97 million.

>> Robert Clarke, Hawaiian Electric Industries Inc.'s CEO, received a $135,859 raise to $1.86 million last year from 2002's $1.72 million. Although HEI's earnings were down 3.1 percent, Clarke received a $610,000 bonus and $548,463 in long-term incentive pay because the company hit its targets for earnings and return on equity for the year.

>> James Schuler, the founder of Schuler Homes Hawaii Inc., received a $1.37 million bonus last year, boosting his overall package to $1.67 million. Schuler -- now a senior vice president for D.R. Horton Inc., which acquired Schuler Homes in 2001 -- earned $1.31 million in 2002.

>> Gary Gifford, who stepped down as Maui Land and Pineapple Co. chief executive officer last May, received a $1.13 million severance package, which nearly tripled his 2003 pay to $1.25 million from the previous year's $425,361.

>> In the midst of a hostile takeover attempt by rival Central Pacific, City Bank gave its Chief Executive Officer Ronald Migita a $350,000 bonus, lifting his overall pay to $644,989. The bonus is largely reflective of the company's performance last year, which included a 51.8 percent increase in earnings and a takeover-fueled, 61.8 percent rise in its stock price.

>> Central Pacific CEO Clint Arnoldus and his senior management team opted not to take a bonus last year as costs increased more than $10 million with its attempted purchase of City Bank. As a result, Arnoldus' pay dropped 63.1 percent to $530,651 from $1.46 million.

>> For the second straight year, Bank of Hawaii Corp. CEO Michael O'Neill opted to take no pay or bonuses. O'Neill -- who owns 714,069 Bank of Hawaii shares or about 5.87 percent of its outstanding stock -- believes that he benefits only when shareholders benefit.

Last year, Bank of Hawaii's earnings rose 30 percent while its stock price has soared 42 percent. The higher stock price increased the value of O'Neill's Bank of Hawaii holdings by $8.1 million to $30.1 million.

BACK TO TOP |

Click for larger version