PHOTO ILLUSTRATION BY DAVID SWANN / DSWANN@STARBULLETIN.COM

Leasehold condominiums are

shedding the stigma they acquired

after sales tumbled in the early '90s

Dick Palmquist said he felt like he was running out of options.

Three months into his search for a new home, the retired engineer did what many would have considered unthinkable five years ago: He bought a leasehold property.

In January, Palmquist paid $358,000 for a two-bedroom apartment in Waikiki. He figures the same fee-simple unit would have cost him $500,000.

"I didn't have many alternatives," said Palmquist. "All of the fee-simple properties were priced out of my reach."

Palmquist is part of the growing group of homebuyers and investors who have turned to leasehold in the wake of today's heated real estate market. Written off for dead during most of the 1990s, leasehold condominiums are experiencing a rebirth of sorts due to surging demand brought on by low interest rates and the low inventory of fee-simple homes on the market.

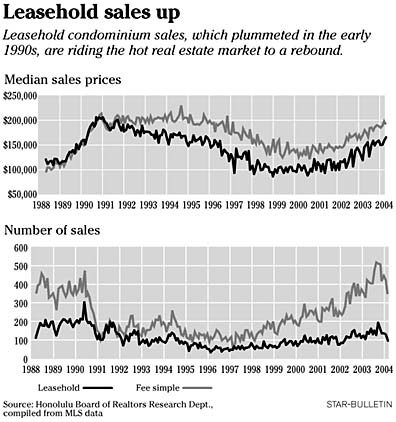

According to statistics compiled by the Honolulu Board of Realtors, the median sales price for a condominium on Oahu has risen 22 percent to about $162,300 from $133,000 in 2003. Since mid-2001, when the leasehold market began to rebound, prices are up about 80 percent.

Sales volume also has experienced steady growth, with more than 230 closings during the first two months this year. That's up from the year before's 227 and more than double the sales volume during the 1996-97 market bottom.

More than half of today's leasehold units are being sold in Makiki, Waikiki and other central Honolulu neighborhoods, according to Board of Realtor statistics.

"There's a whole 180-degree turn in the market that it's not surprising that people aren't as gun-shy of leasehold as they once were," said Mike Sklarz, chief valuation officer for Fidelity National Financial, a nationwide real estate services company.

"It took a while for the psychological stigma to wear off."

Michael Pang, principal broker at Monarch Properties Inc., believes the recovery began about two ago with the upswing in the overall real estate market.

As prices for fee-simple homes soared and inventory began to decline, buyers began to view leasehold as an affordable alternative, said Pang.

"The perceived risks have been minimized by the desperation of buyers who don't have a lot of product to buy," said Pang.

"When there's not a lot of choice, some people will take risks."

Pang believes that the leasehold rebound could effect Hawaii's rental market since many of today's buyers are first-time buyers and owner-occupants. Increased purchases of leasehold apartments by occupants will reduce the rental inventory, leading to even higher average rents, he said.

For longtime lessees, the market's recovery represents an opportunity to exit an investment that has languished for years.

When the leasehold market tanked in the early 1990s, many owners lost the equity in their homes and couldn't afford to buy their fee interest.

According to several Realtors, today's leasehold buyers are on better footing than buyers of the previous decades.

Carol Taylor, a Realtor associate at Coldwell Banker Pacific Properties, cited the city's mandatory leasehold condemnation law, which has given lessees leverage when negotiating their lease.

The state's leasehold disclosure law also gives buyers additional protections, said Jo Frasier, a Realtor at Prudential Locations Inc. Prospective homebuyers have the right to cancel their purchase up until the time they receive an independent summary of the terms and details of a lease.

Allen Kamemoto is one of those buyers whose attitude has changed toward leasehold. The Aiea financial planner said he bought and sold properties over the years, but never in leasehold.

But in September 2002, Kamemoto said he purchased a one-bedroom apartment in the Village Maluhia complex in Makiki for $70,000. Not only was the price attractive, but the lease terms were reasonable and the landowner was giving lessors the option to buy the fee.

"I always was afraid of leasehold," Kamemoto said. "But the price was right and there was enough cash flow as a rental unit."

Kamemoto's apartment complex is a case study in the leasehold rebound. Between 1995 and 1999, a total of 42 leasehold condos at Village Maluhia changed hands. Since 2000, more than double the amount -- or 87 leasehold units -- have been sold. And several of the apartments sold after Kamemoto's 2002 purchase have gone for $100,000 or more.

"Two years ago, I was ready to completely write off my investment," said local attorney Bruce Voss, who is in the process of selling his six-floor unit in Village Maluhia for about $150,000. He acquired the property in 1989 for $100,000. "Like everyone else, I assumed this market was dead and gone."

BACK TO TOP |

Tips for buying leasehold

Here are some simple tips from local Realtors on shopping for a leasehold property:>> Know the terms of the lease. In some leases, rent negotiations are conducted every 10 years while some have rents fixed at low amounts for 30 years.

>> Make sure the lease extends beyond the length of your mortgage. Most lenders require leases to extend five years beyond the length of the home loan.

>> Know your plan. Owning a leasehold home tends to be a temporary situation. If you plan to resell your home, the lease needs to be long enough so that a buyer can obtain financing.

>> Know the leasehold laws. Consumers have a bevy of laws and regulations that can help them when buying leasehold properties. For instance, every buyer is entitled to receive a leasehold disclosure report, which is compiled by an independent third-party. Consumers also need to know about the city's mandatory leasehold conversion law.

>> Check if the fee is available. Find out if the landowner already has offered the fee interest. If so, what was the price and what is his or her current attitude toward selling?