Oahu’s inflation

highest in 10 yearsLed by housing costs, consumer

prices top the national average

for the last half of '03

Oahu's housing market, reaching heights reminiscent of the Japanese bubble in the mid-1980s and early 1990s, catapulted the Honolulu consumer price index in the second half of 2003 to its highest level in 10 years.

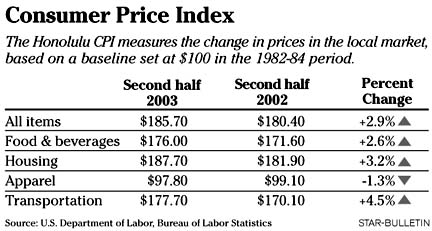

Honolulu inflation exceeded the national rate and rose 2.9 percent from a year ago to its loftiest mark since reaching 3.3 percent in the last six months of 1993, according to a report from the federal Bureau of Labor Statistics. The U.S. inflation rate was 2.0 percent in the second half of 2003 while the West Region index hit 1.8 percent. For the year, Honolulu consumer prices grew an average of 2.3 percent to match the national average.

Bank of Hawaii Chief Economist Paul Brewbaker said Honolulu's CPI, up 1.7 percent in the first half of 2003, has picked up steam after trailing the national average for much of the last decade. He pointed to the CPI's shelter component, which represents 32.9 percent of the overall index, as having the most telling number because it reflects the boom in housing prices. Both the shelter index and the broader housing index, which includes such items as rent, fuel, utilities and household furnishings, rose 3.2 percent from a year ago.

A number of private and government payments and service contracts are indexed to the CPI because it is the most common measure of inflation.

"The really significant thing is we spent about 10 years above the national average in the 1980s, then 10 years below the national average," Brewbaker said. "Now we're back above for all the reasons that were there in the late '80s -- housing inflation. What we know about it is that it historically stays there for awhile until the average household can't afford to buy a house. So we've just gone over to the dark side."

At the end of 2003, the median price on Oahu was $399,999 for single-family homes and $180,000 for condominiums, according to the Honolulu Board of Realtors. Those prices continued to climb last month to a record $400,000 for single-family homes and $187,000 for condos. The all-time high for condos was $208,000 in October 1990.

Honolulu's housing index, which including the shelter index represents 42.1 percent of the CPI, rose 1.6 percent in the first half of 2003. The shelter index gained 2.2 percent.

Gasoline prices, which hovered around $2 on Oahu during the second half of 2003, were 19.4 percent higher than the second half of 2002 and 5.8 percent higher than the first half of 2003. The high gas prices pushed the broader transportation index, which represents 16.9 percent of the overall CPI index, up 4.5 percent from a year ago and 1.4 percent from the first half of 2003.

Among other CPI components:

>> Food and beverage prices climbed 2.6 percent from a year ago and rose 1.3 percent from the first half of 2003;Brewbaker, who had forecast 1.8 percent growth in Honolulu's consumer prices for all of 2003, said Hawaii's booming housing market will prompt him to raise the 1.7 percent rate he has forecast for 2004 to somewhere in the neighborhood of 3 percent.>> Recreation prices gained 2.3 percent from the second half of 2003 and increased 2.2 percent from the previous six months;

>> Education and communication prices increased 4.7 percent from a year ago and gained 2.4 percent from the first half of 2003;

>> Apparel prices fell 1.3 percent from a year ago and dropped 1.4 percent from the preceding six months;

>> Other goods and services prices rose 0.9 percent from a year ago and gained 0.4 percent from the first half of 2003.

"Our problem in the near term and the next several years is that housing prices are rising so rapidly, there's no chance we'll have a low inflation rate in Hawaii," Brewbaker said. "We'll just have to grin and bear it.

"If the Fed (Federal Reserve Chairman Alan Greenspan and fellow policy makers) are going to conduct monetary policy based on low inflation across the nation, we're going to be one of those oddball markets (because of Honolulu's higher CPI). I expect the housing prices in Hawaii to rise until the last Californian no longer finds its profitable to move here."