Home price spike

steeper in some areasSome parts of West Oahu have

seen home and condominium

prices double in three years

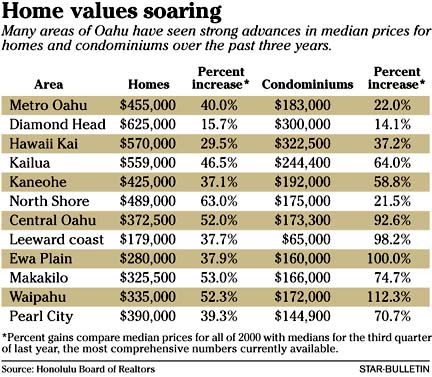

Oahu real estate continued to set new records in 2003, with increases in both sales volume and prices.

Only as far back as 2000, median prices in some neighborhoods were half what they are today. For example, out on the Ewa plain, the median price for a condominium during 2000 was $80,000. By the third quarter of 2003, the median for the area had moved up to $160,000.

In neighborhoods like Kailua, the median price for a single-family home in 2000 was $381,500. By the third quarter of 2003, with inventory dwindling, the median stood at $559,000.

The median price for a single-family home on Oahu was just shy of $400,000 by December 2003, up 14 percent from the year prior. Median prices of condominiums, which had lagged behind single-family homes, also accelerated in 2003, reaching $180,000 in December, an increase of 12.5 percent over the previous December.

For those who remember being stuck in homes and condos they couldn't sell through much of the 1990s -- a hangover from the 1980s Japanese bubble -- the uptick in values on Oahu during the last couple of years was a relief.

But some prospective buyers, looking at rising prices, have begun to wonder whether they're too late.

"What I think you'll see is that people who were around during the last peak and who remember will get nervous we're heading in that direction again. I think as the year goes by, you'll see a slowing down," said Mike Pang, principal broker of Monarch Properties.

Oahu real estate observers say some neighborhoods appear to be getting close to their peak. In neighborhoods like Kailua and Hawaii Kai, prices will continue to move up, but the pace of those increases is likely to slow, they say.

"Kailua is pretty well maxed out -- there is still appreciation there but not the jump they experienced a couple of years ago," said John Riggins, of John Riggins Realty.

Still, Realtors say there are good prices left in some neighborhoods.

One neighborhood many agree has been undervalued during the current upswing is Waikiki.

"(Waikiki) boomed so hard in the 1980s that when the bubble burst, it fell off tremendously. And as we started to climb out, it didn't pick up as fast as a lot of other markets, it just kind of lagged back," said Jim Wright, president of Century 21 All Islands.

Another reason for the Waikiki lag was the interest by off-shore buyers in neighbor island properties, said Pang.

"If there was a lag in Waikiki, it makes sense because it was so heavily driven by off-island investment. A lot of that money went to the neighbor islands first," he said.

Riggins believes Ewa is a still a good investment -- especially for the first-time buyer -- with new inventory being added by developers every month.

"You can still get a new home at a reasonable price, and it's a developing community," he said.

For Bill Chee, principal broker of Prudential Locations, neighborhoods close to Honolulu represent the best values overall, especially for the long-term owner-occupant.

"Most of my choices are primarily around central and east Oahu because there is nothing more going to be built there. Wherever you have a shortage, it has a tendency to hold its price," he said.

Other areas that have appeal are so-called crossover neighborhoods, Chee said.

"There's not only local appeal but out-of-state appeal as well. Obviously it's places with a view or on the water."

While most in the industry predict a strong 2004 in Oahu real estate, some slowing is likely -- if only because inventory levels continue to shrink, pent-up demand is gradually lessening and it would be difficult to maintain such a pace.

"Some of the urgency is off," said Pang.

People also have got more used to a couple of years of low interest rates, he said.

"I don't think the hysteria of the last couple of years is there. It's still busy, there are multiple offers, but I think the hysteria and emotion isn't quite as strong given the steady interest rates," he said.

BACK TO TOP |

CRAIG T. KOJIMA / CKOJIMA@STARBULLETIN.COM

Residential real estate expert Mike Sklarz sees property as a good bet for the patient investor.

Market watcher Sklarz

sounds off on real estate

Question: How high do mortgage rates have to go before home sales activity is affected and what is your prediction in terms of both rates and activity in the next few years?

Mike Sklarz

>> Title: Chief valuation officer

>> Company: Fidelity National Financial Inc.

Answer: The top end would be 8 percent or so before you'd see a noticeable effect. We'll probably see something more in the 6.5 percent to 7 percent range later this year.

Q: We've seen a move toward more condominium sales in recent months. Is it inventory or affordability causing this?

A: It's both. Generally, single-family homes are the property of choice, but as people get priced out of single-family homes -- which has happened in some areas -- they move toward condominiums.

Q: Where are developers on Oahu likely to go next?

A: It's hard to say. As we know, in places like Kailua and Kaneohe, there's no more room. Hawaii Kai has been going through a little boomlet in development, but that will end. Moving west, the traffic has been getting worse. My feeling for many years -- and maybe I'm being too idealistic -- is that there is a huge opportunity in renovating urban Honolulu. We've got all these great underutilized parcels with low rises like in Moiliili, Makiki, along Kapiolani Boulevard and so on. The real question is what would it cost to fix up the infrastructure in town, like the sewer system, vs. building more freeways, which we will need if we keep building houses out in the west? At some point, we'll have to deal with it.

Q: On the neighbor islands especially, there are now some serious shortages of houses and rising prices in some neighborhoods on Kauai and Maui, and in Kona. Do you think prices will ever stabilize there or will they keep being driven in large part by investment from the West Coast and retirees and people seeking second homes?

A: That's the new development. Now you have this added macro factor of baby boom demographics, which wasn't there before. It's really going to play out over the next 10 years, at least in terms of demand.

Q: Do you think people will keep investing in real estate, or will there be some return to the stock market?

A: I think a whole generation of stock market investors were traumatized. Certainly, some element will get back in. But when you see your 401(k) vaporize as quickly as it did, that stays with you for a while. And, conversely, real estate has done well. People can relate to it and use it. The thing I think we learned in the last few years is that for the average guy, the stock market was never a big deal. I think statistics now show that the average guy has twice as much money in his house in terms of his net worth and over the last couple of years, he's actually come out better. People who got hurt were people who didn't own a home and were totally relying on the stock market as a way to riches.

Q: Are we seeing as many investors or even speculators in real estate this time as we saw during the last boom in the 1980s? Do you think we'll see speculators flipping properties?

A: Actually, in terms of Hawaii real estate history, you've always had a significant component of investors, especially in condominiums. At times, they've been speculators, but not this time to any great degree. In Hawaii, investors have taken the place of apartment developers because they've been willing to buy apartments, accept negative cash flow and be the source of the rental market, which is very unusual compared to other places. That's why if you look at a typical condo, you'll see lower owner-occupant percentages. Typically, Hawaii people have always done this, they are much more inclined to do this than buy stocks.

Q: Recently, with all the development, a number of land-use issues have come up. The Hokulia case on the Big Island comes to mind. Do you think there will have to be substantial changes in the way land use policies and zoning are set?

A: You have to realize that what drives zoning is the overall economy. We have a hot market and all of a sudden, people start saying we have to slow this thing down. The '90s were interesting because things were bad for so long. There has always been this back and forth thing between construction and the economy. A lot of things were pushed through with the idea that we have to stimulate the economy, so this is very typical. Whether here or in San Francisco or Orange County -- in chronically supply-constrained areas, you'll have this "not in my back yard" thing flip-flop back and forth. We're following the script perfectly. People need to understand that none of this works in a vacuum and there will be a time again when people will say we want developers, jobs and business.

Q: What do you think the impact will be of all the new military housing scheduled for Oahu.

A: Well there aren't huge numbers, maybe 600 homes a year. I think if they were opening a thousand units a year, it might be a different story. Right now with the rental market being tight, it will help ease that situation, which will be a positive thing. The other side is that it will put a lot of construction workers to work. In terms of home sales, it's not like it used to be in the '70s when the military stationed here brought properties. If prices moved up, they were lucky and made a bunch of money. But as prices moved up in the 1980s and 1990s, it become much less of an issue.

Q: Where are we in the real estate cycle?

A: We always talk about the luxury market leading the recovery -- you can see that here in 1999 and more recently in 2000. This is a trend I've seen on the mainland, where the luxury market leads on the upside and on the downside. In 50 luxury markets, analysis we did showed that half are actually down in price. It peaked anywhere from one to three years ago.

We've had peaks every 10 years or so. In Hawaii we are a little late this time. Traditionally, Waikiki was always the lead indicator, but it didn't fulfill its normal role, the neighbor islands led this time.

But it's not like these things change on a dime, so that's why I think we'll have these conditions for the next couple of years. We are running out of inventory, so there probably won't be as much activity. But I think the economy is getting better, which is only supportive of the local buyer.

Q: Are there any good buys left?

A: You've got to go into real estate willing to be patient. I tell people unless you are planning on owning for five years, you shouldn't bother. Unless you are really lucky with timing, then you can get in and out in a couple of years and make a bunch of money. But you always need to plan that you could hit a period that can go on for a few years. I've always thought, for the average person, it's a forced savings account. You've got to pay rent anyway. Most people are totally undisciplined about saving. With real estate, you can leverage it more so than another investment and you have the government helping you with the interest payment. I think there are some good buys in the condo market, it still has a lot of catching up to do. I would think well-located condos will do best. Kailua certainly has been one of the better performers. Hawaii Kai to a lesser extent. The others -- Mililani, Pearl City and out in that area -- are just getting back to where they were in the 1990s, so there's more room in those places.