MAKING CENTSHow your money management plans

reflect your goals and personality

are key to their successThe Match Game

ILLUSTRATION BY KIP AOKI / KAOKI@STARBULLETIN.COM

Put your money where your

mouth is by making your investment

decisions match your valuesLAST OF THREE PARTS

Jack Belsom, pastor of Iao Congregational Church in Wailuku, said he's concerned about his financial future, but not to the point that he's willing to invest in companies that he can't support.

"I couldn't talk about peace and then be investing in companies that are developing weapons," Belsom said. "When I look at myself in the mirror, I have to be able to say I'm content with who I am and what I'm doing."

Seminar

Learn more about socially responsible investment>> What: Michael Kramer, an accredited investment fiduciary, will discuss how to make money and make a difference.

>> Where: The Church of the Crossroads, 1212 University Ave.

>> When: Jan. 21, 5:30 to 7:30 p.m.

>> Cost: Free

>> Information: 845-4800

ABOUT THIS SERIES

Part One: Palatable financial planning starts with knowing your own fiscal personality.

Part Two: Making small changes in spending habits can pay big dividends toward retirement or other goals.

Belsom's decision to engage in socially responsible investing is consistent with trends in financial allocations in Hawaii as well as on the mainland as more investors are demanding that their finances be consistent with their values, said Nancy Aleck, executive director of the Hawaii People's Fund, a philanthropic group that uses grants to invest in the community.

Some investors are seeking a balance between their financial and personal lives by screening investment buys to make sure they align with their personal values. Others are engaging in social activism by using their investments to illicit change in companies. And, it's becoming more trendy to invest in community development programs and reap value-based returns on investments. These investors want to see their investments yield a positive change in the universe, as well as on their financial statements, Aleck said.

"We are starting to see the children of the 60s and 70s wanting to express their values more," said Paul Sutherland, author of "Zenvesting, the Art of Abundance & Managing Money." Sutherland also is president and chief investment officer of Financial & Investment Management Group Ltd., a socially responsible investment company with an office on Maui.

"Investors in Hawaii overall seem more concerned about where their dollars are going," Sutherland said. "The people there are much more environmentally and family oriented and that's reflected in their investment choices."

According to a report released last month by the Social Investment Forum, socially responsible investing is a concept that's also catching on nationally. SRI screened portfolios grew 7 percent last year, while managed portfolios fell by 4 percent overall, said Todd Larsen, media director for the Washington, D.C. based group.

"More and more individual and institutional investors are seeing that you can combine values and ethics with investing," Larsen said. "And you can get good results."

Nearly one out of every nine dollars under management in the U.S. today is part of a responsibly invested portfolio and a wide array of socially responsible investment products are available in more than 21 countries, Larsen said.

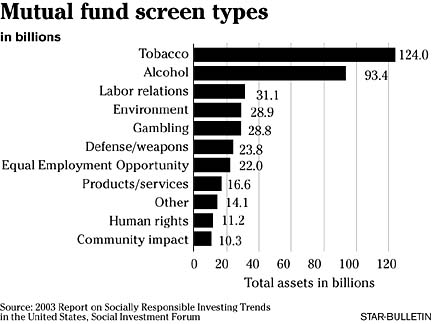

Total dollars involved in social investing are growing rapidly -- from about $65 billion in 1985 to $2.16 trillion in 2003. The number of mutual funds grew from about four in 1985 to more than 200 in 2003.

In terms of attracting investor assets, screened mutual funds grew on a net basis in 2002 while the rest of the mutual fund industry contracted. According to Lipper, socially responsible mutual funds saw net inflows of $1.5 billion during 2002. Over the same time, U.S. diversified equity funds posted outflows of nearly $10.5 billion.

Investing with values doesn't have to compromise financial gains, said Valerie Lewis of Maui.

"People have a choice and their wallet will still inflate," Lewis said.

Lewis has her money invested with Financial & Investment Management Group because the fund managers don't invest in companies whose primary business is tobacco, or weapons, or who partake in pornography or abusive labor practices or encourage irresponsible behavior.

"Companies that are doing the right thing and have the wind at their back have a low exposure to litigation risk," Sutherland said, adding his company pulled its money out of Adolph Coors Corp. when it launched an advertising campaign that promised guys chicks would dig them if they drank beer.

"I sold it instantly. I don't want to own a company that is basically telling people that if you drink beer your life will be wonderful," Sutherland said. "How can you believe a company's financial statements if they aren't honest in their advertising?"

In the days of corporate governance scandals, it's just good business to screen investments for social responsibility, said Paul Loo, senior vice president at Morgan Stanley brokerage in Honolulu.

"The real question is the moral fiber of companies and how they treat people," Loo said. " I don't really care for a company that pays its president $400 million, gives him a private jet and than fires people to reduce overhead. I'm from an average family and I don't want to join a company that treats their minimum wage people poorly."

Although Morgan Stanley has not taken a position on SRI, Loo estimates up to 10 percent of his clients engage in it when building their portfolios.

"My personal opinion is that companies that are socially responsible and treat their employees well are companies with a heart and that these companies will survive because they treat people with dignity and fairness," Loo said.

A company that produces products that serve society is worth analyzing as a potential investment, but it's not an automatic buy, said Barry Hyman of Financial & Investment Management Group.

"The overlying guiding doctrine that we follow in our investments is that price matters," Hyman said. "After doing all of our research and analysis, we will only invest in companies we like when their securities are selling at bargain prices, and we will sell those securities, no matter how much we love the company, when they become expensive."

It's entirely possible for people who are interested in SRI to get good fund performances if they exercise caution, said Shannon Zimmerman, mutual fund analyst at Morningstar in Chicago.

"Investors need to remember that just because they are investing in a way that is consistent with their values, doesn't mean that they don't need to ask critical questions," Zimmerman said.

While it is possible for SRI to yield good performance in the large cap arena, it's harder to find competitive performances in SRI small and mid cap funds because the management fees for these funds are traditionally higher and because the universe of available funds is smaller.

"It's definitely possible to go into the universe of SRI funds and find a core fund," Zimmerman said. "But as you look further down the capitalization scale, it becomes more difficult. The universe you have is so small that you wouldn't be doing your due diligence if you didn't at least look at other options."

Before engaging in SRI, investors need to determine who manages the fund, examine its track record and weigh the expense ratio against its performance, he said.

Then and only then, can they truly feel good about a "feel good" investment, he said.