Local stock experts

spread their money across

variety of funds for 2004

Portfolio manager Barry Hyman is concerned.

As a value investor, he's not accustomed to chasing after stocks. But he acknowledges that investors, who are enjoying success after three straight miserable years in the market, may attempt to squeeze too much out of their stocks and repeat the same mistakes of three years ago.

"I believe we are in what many in the financial media are calling a cyclical bull market within a secular (longer term) bear market," said Hyman, who is vice president of Financial & Investment Management Group Ltd. in Wailuku, Maui.

"Investors are pouring money into stocks, not because they are prudently researching them and determining which ones they can buy at prices below their real values, but rather because they think the market is going up."

And, in 2003, the market did just that as the Nasdaq composite index soared 50 percent, the Standard & Poor's 500 index jumped 26.4 percent and the Dow Jones industrial average rose 25.3 percent.

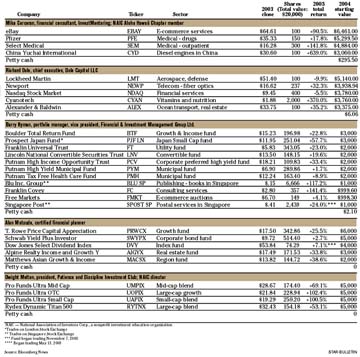

Best investment ideas for 2004

Hawaii stock experts are starting out

the year with a hypothetical $20,000.But Hyman, who calls the current rally a self-fulfilling prophecy, wonders if the current bull run will end just as badly as the last one. In the crash of 2000, investors took a round trip as they rode their investments up and then back down -- often far below their original purchase price.

Click image for larger version.

"The test for investors will be to know when to take their money off the table," Hyman said. "Hopefully, people learned their lessons this last time around."

The Star-Bulletin's annual survey of best investment ideas is changing format this year, with local stock experts being given a hypothetical $20,000 to invest in either stocks, mutual funds or fixed income. Last year, the experts were allowed to pick three investments each, with the individual returns being averaged to calculate their percentage gain.

Surprisingly, after most of the experts eschewed mutual funds last year, they are embracing them this time with more funds being selected than individual stocks. In several cases, the experts chose to divvy up their play-money across a broad array of asset classes.

Certified Financial Planner Alan Matsuda, a newcomer to this year's survey, spread his wealth across five different types of funds -- growth, corporate bond, dividend index, real estate and international growth and income.

Matsuda said that since the contest rules do not allow any selling during the year, stocks were too risky and funds were more appropriate.

"Mr. Investor wants his money back after one year, so not losing money is more important than big gains," Matsuda said. "My selections would be entirely different if the rules were different."

He allocated his largest amount -- $6,000 -- to T. Rowe Price Capital Appreciation, which he said is the only stock mutual fund that hasn't lost money in any of the last 13 years.

Hyman was the most diverse of the group as he selected seven funds, including the Prospect Japan Fund run by Hawaii Kai's Curtis Freeze, as well as four low-priced stocks. In fact, Hyman looked to Singapore to tap two of the companies -- Blu Inc. Group, a publishing company; and Singapore Post, which provides postal services and offers an 11 percent dividend.

"There are still bargains to be had throughout the world by investing in securities that have not been discovered, understood or duly appreciated by the masses, Hyman said. "I have constructed a balanced portfolio with roughly 50 percent bonds and 50 percent stocks."

InvestMentoring financial consultant Mike Corcoran, whose eBay pick rewarded him with a 90.5 percent return in 2003, put more than $6,400 in the same stock for 2004 in the hope of enjoying similar success. He also bought 100 shares of China Yuchai International, which makes diesel engines in China.

Last year, Morgan Stanley Executive Director Paul Loo, who's not in this year's survey, rode Chinese Internet stock Sina to a whopping 419 percent gain.

Dwight Melton, a director with the National Association of Investors Corp. in Hawaii and the only stock picker to lose money last year, is hoping to rebound with $5,000 each in four funds that encompass small, midsize and large stocks. Two of the funds -- the Pro Funds Ultra OTC and the Pro Funds Ultra Small Cap -- doubled last year.

Richard Dole, chief executive of Dole Capital LLC, picked two Hawaii companies among his five picks. He went with Cyanotech, a producer of nutritional and vitamin supplements, after the stock surged 370 percent last year.

Dole also repeated his selection of Alexander and Baldwin, citing its "good dividend and earnings trend." A&B, which offers a 2.7 percent dividend yield, had a total return of more than 35 percent in 2003.

BACK TO TOP |

Some investors are forecasting

a Dow record this year

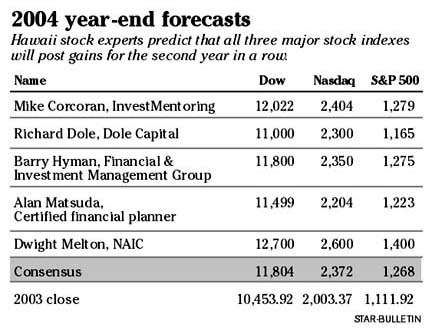

It would have been hard to believe it 15 months ago, but if most of Hawaii's stock experts are correct, the Dow Jones industrial average will hit an all-time high this year.

The blue-chip index, which reached its peak of 11,722.98 on Jan. 14, 2000, needs a gain of just more than 12 percent this year to reach that milestone. Who would have thought it when the Dow was flailing around at 7,286.27 in October 2002.

"We are in a period of strong optimism fueled not only by Wall Street and Washington cheerleaders, but also by the very liberal stance of the Fed," said Barry Hyman, vice president of Financial & Investment Management Group Ltd. in Wailuku, Maui. "I don't see either of those changing in the short term. Thus, I think, despite the excessive overvaluation of large-cap U.S. stocks as a group, their prices will trend higher in the short term."

The most optimistic of five local stock experts participating in this year's survey is Dwight Melton, a director of the National Association of Investors Corp. Hawaii chapter. Melton predicts the Dow will reach 12,700, a jump of more than 21 percent from where it started this year.

Melton also forecasts the Nasdaq composite index, which surged 50 percent in 2003, to rise nearly 30 percent. He's picking the Standard & Poor's 500 index to gain nearly 26 percent.

"My 2004 forecast assumes that the economy will continue to perform well, with the nation's gross domestic product to rise by more than 4 percent for the year as a whole," Melton said. "Given such a positive business setting, I would expect the major indexes to move higher in the year ahead."

Mike Corcoran, a financial consultant for InvestMentoring, also tapped the Dow to break 12,000 with a forecast of 12,022.

Certified Financial Planner Alan Matsuda, like Melton, expects interest rates to rise this year. However, Matsuda said that the presidential election may cause angst among investors.

"It will create much anxiety, and the stock market will probably dive if Howard Dean, the Democrats' expected nominee, becomes president," Matsuda said. "Remember that in 2000, the Democrats' Al Gore had 537,000 more popular votes than Bush."

Matsuda pointed out that Dean wants to give $10,000 to every college student and has promised to repeal Bush's tax cuts.

"Dean's rabid 'tax and spend' platform could easily scare the stock market," Matsuda warned.

Still, Matsuda is looking for 10 percent gains across the board in the major indexes.

While the Dow may indeed hit an all-time high this year, the Nasdaq could be years away from reaching its pinnacle of 5,048.62 on March 10, 2000. The midway point to that mark is 2,524.31, and only Melton -- who is looking at 2,600 -- expects the tech-heavy index to reach that level. Likewise, none of the experts thinks the S&P 500 index will eclipse its all-time high of 1,527.46. Melton is the most optimistic with a prediction of 1,400.

The most pessimistic is Richard Dole, chief executive of Dole Capital LLC. His picks of 11,000 for the Dow and 1,165 for the S&P 500 were the lowest of any of the prognasticators. Matsuda held the distinction of having the lowest Nasdaq forecast at 2,204.