Market outdoes

expert forecasts

Maybe Hawaii's stock experts should have been a little more bullish in 2003.

But after three straight down years for the major indexes, you can't blame them for tempering some of their enthusiasm.

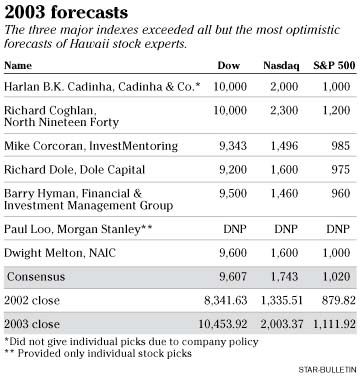

Only two of the seven experts thought the Dow Jones industrial average had enough strength to return to its glory days at 10,000. The same two experts also thought the beleaguered Nasdaq composite index could rebound to 2,000 or higher.

Both turned out to be right as the economy -- especially in the second half of the year -- began showing signs of picking up again.

When the New Year's Eve revelers were done shouting, the Dow had finished the year up 25.3 percent at 10,453.92 and the Nasdaq had jumped a whopping 50 percent to 2,003.37. Not to be forgotten, the Standard & Poor's 500 index regained the 1,000 level -- as three experts correctly forecasted -- and had risen 26.4 percent to 1,111.92.

Hilo investment adviser Richard Coghlan of North Nineteen Forty Inc., the most bullish of the group, selected 10,000 for the Dow, 2,300 for the Nasdaq and 1,200 for the S&P 500.

"I am very pleased with my investment results and market index predictions for 2003," Coghlan said. "The economy improved, corporate earnings beat expectations and the technology sector experienced a market rebound."

Harlan B.K. Cadinha, chief investment officer of Cadinha & Co., was similarly optimistic with forecasts of 10,000 for the Dow, 2,000 for the Nasdaq and 1,000 for the S&P 500. He cited company policy, though, in not providing any individual stock selections for last year.

The lowest forecasts among the experts came from Richard Dole, chief executive of Dole Capital LLC, who selected 9,200 for the Dow; and Barry Hyman, vice president of Financial & Investment Management Group Ltd. in Wailuku, Maui, who chose 1,460 for the Nasdaq and 960 for the S&P 500.

"I am long-term fearful of a painful decline in the U.S. market indexes, especially the Nasdaq and a lesser extent the S&P 500," Hyman said. "However, as a great investment philosopher once said, 'In the short term the market is a voting mechanism, in the long term it is a weighting mechanism."

In other words, Hyman said, fear and greed push the markets to levels well above and then well below their intrinsic values.

Coghlan, though, sees a brighter future for the market.

"The market outlook has not looked this attractive in four years," he said. "An improved economy, low interest rates, low inflation, an improved labor market and an election year means the coming market year holds great promise."

Coghlan acknowledged that further market success could be sidetracked by a record federal deficit, the ever-rising cost of terrorism and continued U.S. military occupation in the Middle East. He also said that, in general, an increased market sensitivity to political developments worldwide could put a damper on the market in the event of a successful terrorist attack.