Hawaiian Air

wants millions

returnedThe bankruptcy official files

suit for $28 million from former

Chairman John Adams and others

Hawaiian Airlines trustee Joshua Gotbaum, claiming that former Chairman and Chief Executive John Adams concocted a scheme to siphon money out of the now-bankrupt carrier, filed a lawsuit late yesterday seeking the return of $28 million from Adams, other shareholders and insiders.

The suit, which names Adams, his investment groups and parent company Hawaiian Holdings Inc. as defendants, accuses Adams of extracting millions of the airline's cash for Adams and his affiliates at the expense of the airline and its creditors. Hawaiian subsequently filed for Chapter 11 reorganization bankruptcy on March 21 of this year.

Gotbaum, hired July 3 after Adams was ordered removed from office by U.S. Bankruptcy Judge Robert Faris, said he was given two mandates when he was appointed as trustee. One was to lead the airline out of reorganization, which Gotbaum has said he expects to happen next summer. His other main objective was to investigate management activities leading up to the company's bankruptcy.

"The investigation led me to conclude that funds had been improperly diverted from Hawaiian Airlines, funds that could help the airline and its creditors," Gotbaum said in a statement yesterday. "As trustee, I have to preserve the resources of Hawaiian Airlines. If we can get those funds back, we will."

Adams, despite not being involved with the daily operations of the airline, still is chairman and CEO of the parent company as well as the sole managing member of AIP LLC, Hawaiian Holdings' majority stockholder with 50.9 percent of the shares. He also is president of Smith Management LLC, which performed consulting work for the airline.

The $28 million that Gotbaum and the airline seek to have returned comes from the $25 million tender offer -- which was paid at a 31 percent premium to the stock price on the day the offer was announced -- and nearly $3 million that was paid to insiders and their interests for "purported consulting agreements and compensation."

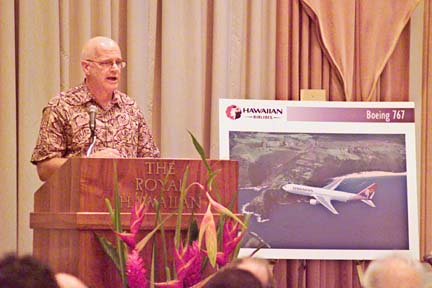

STAR-BULLETIN / 2002

At Hawaiian Airlines' annual shareholders meeting in August 2002, then-CEO John Adams addressed the crowd.

In another motion yesterday, Gotbaum also filed his much-anticipated request for compensation. He is seeking cash remuneration of $500 an hour, subject to a cap of 140 hours per month. If he maxes out his hours each month, he would earn $840,000 a year. Adams, by comparison, was making $600,000 a year as chairman and CEO in addition to other compensation he received from his other affiliations.

Gotbaum also is seeking reimbursement of reasonable expenses, including the cost of renting a single-family residence and automobile in Honolulu; relocation expenses at the beginning and end of his service as trustee; and the right to request additional compensation in the form of a success fee, payable in a combination of cash and/or stock grants based on the results obtained by him and the comparable compensation paid to executives in similar situations.

Hawaiian's trustee also is seeking compensation of $58,700 for John Monahan, the prior trustee who resigned because of personal reasons after just three weeks on the job. Gotbaum, who praised Monahan for his service to Hawaiian during the initial stages of trusteeship, based his request on a rate of $500 per hour for 117.4 hours.

Faris, who ordered Adams removed from office in a May 16 ruling, said the former executive consistently had placed the interests of the shareholders ahead of those of the creditors. Faris also criticized a $25 million tender offer that preceded the bankruptcy and rewarded Adams and his partnership more than $17 million. The timing of that offer came several months after Hawaiian received a $30.1 million federal grant because of the Sept. 11, 2001, fallout. The payout also occurred at a time when Hawaiian's financial situation was deteriorating and at the same time that Hawaiian was seeking more than $20 million in leasing concessions from its three aircraft lessors.

Hawaiian, which announced its tender offer on May 31, 2002, had lost $18.5 million in the first quarter of that year and had a working capital deficit of $76.1 million, the largest in recent history.

Adams and his attorney said in the May 2003 trustee hearing that the airline went ahead with the tender offer because it felt its financial condition would be improving since it was entering its peak travel period. Hawaiian had $93.6 million in cash at the end of the first quarter in 2002, but the airline also had an unfunded pension liability of at least $54.1 million.

Hawaiian filed for bankruptcy nine months after the tender offer was completed, and Boeing Capital Corp., the airline's primary aircraft lessor, filed a motion 10 days after the bankruptcy seeking a trustee to replace Adams.

"In bad faith and in breach of his fiduciary duties, Adams caused the board he controlled to approve these transactions despite clear and alarming indicators that the company's financial condition had dramatically deteriorated," the filing said. "Predictably, distributing one-quarter of the company's critically needed cash left Hawaiian with unreasonably small capital to sustain its operations and rendered it insolvent."

Russ Young, spokesman for Boeing Capital, said last night that he applauded Gotbaum's latest move.

"We think that's a positive and appropriate step on the trustee's part," Young said. "As we stated in our motion for a trustee, we felt that a significant amount of capital was improperly taken out from the airline, leading directly or indirectly to the Chapter 11 filing."

Messages left for Adams and three of his attorneys last night were not returned.