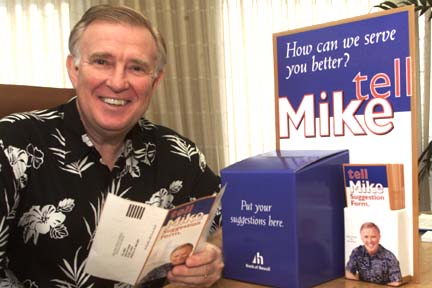

STAR-BULLETIN FILE

Bankoh CEO Mike O'Neill says his 3-year plan is winding down.

Bankoh’s quarter

is best in 4 yearsEarnings increase 21.5% to

$36.7 million and the dividend

is boosted 58%

Bank of Hawaii Corp. yesterday reported its best earnings for any quarter since 1999 and raised its dividend by nearly two-thirds, giving the company's share price an immediate boost. The fourth-quarter dividend was raised to 30 cents, up 58 percent from its 19 cents level of the last four quarters.

The company's net profit for the third quarter was $36.7 million, up 21.5 percent from $30.2 million in the 2002 third quarter. Per-share income surpassed analysts' estimates at 61 cents a share in the latest quarter compared with 43 cents a year ago. That was a rise of 41.9 percent, as the higher profits were shared among fewer shares, as a result of an ongoing share buy-back.

The consensus of third-quarter income estimates by analysts, as reported by First Call, was 56 cents for the third quarter.

"The principal thing is that we're doing very well and therefore feel confident that we can raise the dividend," said Mike O'Neill, chairman, CEO and president. "The dividend is good news but everything about this report is good news," he said.

Investors apparently agreed. Bank of Hawaii's stock closed up 1.65, or 4.7 percent, to $36.79 on the New York Stock Exchange. The financial report was released before the markets opened.

O'Neill joined the bank in November 2000 and has since disposed of businesses that weren't performing well, particularly operations outside Hawaii, and brought the bank home to its local-market routes. He said his initial three-year plan is winding down.

"We've put away the power tools here and we've taken out the scalpel and the chisel," he said in an interview. O'Neill there are still another 10 to 15 projects to be done but none will have the impact of the divestitures or the more recent shift to new systems technology.

"Our single biggest objective is to get completely focused on our customers," with none of the distractions of the big changes of the last three years, he said.

Third-quarter net interest income was $91.1 million, down $1.1 million, or 1.2 percent, from $92.2 million in the 2002 quarter, and the bank said that was largely due to reductions in interest rates. Lower rates make it harder for banks to increase the difference between what they pay to attract deposits and what they earn in interest from borrowers.

Bank of Hawaii said the quality of its credit continued to improve and nonperforming assets dropped 36.7 percent to $40.1 million on Sept. 30 from $63.3 million a year earlier.

Total assets at the end of the quarter were $9.37 billion, down 3.4 percent from $9.7 billion at the end of the 2002 quarter. The decline was largely because of net loan growth being offset by reductions in short-term investments as excess liquidity was used to buy Bank of Hawaii shares in the marketplace.

Bank of Hawaii ended the latest quarter with 56 million shares outstanding, down 15.2 percent from 66 million a year earlier.

Deposits of $7.1 billion were up 7.1 percent from $6.63 billion on Sept. 30 2002 and loans of $5.44 billion were up 6.7 percent from a year-earlier $5.1 billion.

"The Hawaii economy remained strong during the third quarter of 2003," the bank said. Construction and real estate surged through the summer and August was a record month for Hawaii tourism, the bank said.

"The fourth quarter, I am hoping, will be even better. We will certainly have achieved our three-year plan," O'Neill said in the interview.

In its formal report, Bank of Hawaii said it expects full-year earnings to exceed the previously published earnings guideline of $131 million. That would mean earnings of at least $34.5 million in the fourth-quarter, which would compare with $28.9 million in the final quarter of last year.