Isle warehouse space

is getting scarceThere is less space available

to rent or buy now than

in the past 10 years

Oahu industrial real estate space is tightening up as businesses look for more places to store and make goods.

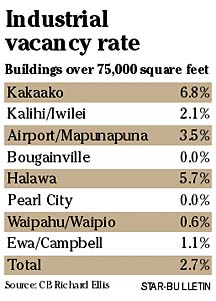

The industrial real estate market stands at a 2.7 percent vacancy rate, lower than it has been since a 3.5 percent rate in 1992, according to a new report by Jeffery Hall, senior director of research at the real estate firm CB Richard Ellis Hawaii.

Demand persists, but land prices and low industrial rents are holding developers back from building new warehouse-industrial properties, Hall said.

There are spaces available, but many of them are "junk" in the eyes of prospective tenants, he said.

Hall's numbers are close to those of Mike Hamasu, director of consulting research for the commercial real estate firm Colliers Monroe Friedlander. Two months ago, Hamasu estimated the industrial vacancy rate on Oahu at 2.6 percent.

"The market is extremely tight. We're forecasting that the vacancy rate will fall below 2 percent by year-end," Hamasu said.

He said the demand is driven by an increase in construction of new homes plus the high pace of resale of existing homes, creating a demand for furniture and other goods that need to be warehoused.

Hall and Hamasu both said the industrial properties that are available are not really desirable. One reason, Hamasu said, is a lack of modern loading docks.

Jeff Nasrallah, research services manager at Grubb & Ellis/CBI Inc. in Honolulu, has a somewhat higher industrial vacancy rate, but he said the various commercial real estate firms survey different property sizes.

His most recent report had the industrial vacancy rate at 4.5 percent at midyear, but he said the rate was falling fast. Nasrallah said one reason his rate is higher than that of other researchers is that he counts the 100,000 square feet of former Costco space in the Bougainville industrial area as industrial space.

His report shows Bougainville with a 45 percent vacancy rate.

CBRE's Hall counts the Costco property as retail and does not include it in its industrial-warehouse category, despite the fact that it is zoned warehouse and Costco technically is a wholesaler, Hall said.

"I think it will be retail" and should not be included as industrial, he said. "I've taken it out of my index. It's always been retail," he said.

Hall said warehouse-industrial clients are beginning to find purchasing more attractive than leasing. CBRE recently listed four lots in the Milltown Industrial Park for sale at $30 a square foot, and four offers were received in the first two days, he said.

The CBRE report shows asking rents ranging from 55 cents in the Ewa-Campbell Industrial Park area to $1.18 a square foot in the Ala Moana-Kakaako area.

Asking rates were up in the Kalihi-Iwilei, airport-Mapunapuna and Ewa-Campbell areas, flat in Kakaako-Ala Moana and down in Bougainville, Pearl City and Waipahu-Waipio, Hall said.

All of the forecasters have predicted rising rental rates for industrial properties.