FL MORRIS / FMORRIS@STARBULLETIN.COM

Matson Navigation company benefited from increased shipments of autos in the second quarter, parent Alexander & Baldwin said.

A&B earnings jump

Alexander & Baldwin showed

second-quarter improvement

among all of its subsidiary businesses

Alexander & Baldwin Inc., benefiting from an improving Hawaii economy and free of the labor strife that plagued previous periods, said yesterday that net income jumped 75.8 percent in the second quarter.

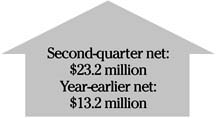

The parent of Matson Navigation Co. posted earnings of $23.2 million, or 56 cents a share, compared with $13.2 million, or 32 cents a share, a year ago. Revenue increased 13 percent to $314.7 million from $278.6 million.

"The second quarter reflected solid, improved performance by all of our businesses," said Allen Doane, president and chief executive officer of A&B. "That is significant, as it follows results over the past two years that were uneven and driven largely by external events."

A&B was hurt during the past two years by the fallout from 9/11, and then later by the dockworkers lockout that disrupted the flow of goods from the West Coast to Hawaii.

Doane also noted that the company was able to grow its earnings despite pension costs that were 6 cents a share above the second quarter of a year ago and will represent a 25 cents-a-share drag on earnings in 2003.

The earnings results, announced yesterday after the market closed, easily beat the estimates of analyst Jamelah Leddy, who covers the company for Seattle-based McAdams Wright Ragen Inc. Leddy, who has a "buy" rating on the stock with a $29 target price, had forecast earnings of 45 cents a share and revenue of $312 million.

The stock closed yesterday at $27.44.

"It is our sense that the real estate market in Hawaii is picking up with strong demand in resort/residential properties on Maui, Kauai, and the Kona side of the Big Island," Leddy wrote in a note to clients yesterday. "A strong real estate market is good for (A&B) both in terms of its land development, but also increasing demand for Matson's shipping services."

A&B already has been active on the real estate front this quarter, signing a $135 million contract with Shinwa Golf Group earlier this week to acquire three golf courses and 270 acres of fully zoned undeveloped land at Wailea Resort on Maui, and two golf courses and an undeveloped hotel site at the Kauai Lagoons Resort. The deal is expected to close in October.

The company also will deploy a new diesel-powered cargo vessel, MV Manukai, later this year for service between the West Coast and Hawaii.

Despite the developments, Doane cautioned that the second half of the year may be more challenging when compared with last year.

"With tougher quarterly comparisons coming up in the second half, it will be a challenge to sustain favorable year-to-year comparisons and to get us back to earnings levels that the company attained previously," he said.

Ocean

Matson's ocean transportation division posted a 67 percent jump in operating profit to $23.2 million from $13.9 million a year ago while revenue rose 13 percent to $199.3 million from $175.7 million.The A&B subsidiary attributed the rise to a 17 percent boost in Hawaii auto carriage, an improved mix of freight, a terminal handling charge implemented in January, improved results from joint ventures and improved productivity at the Sand Island container terminal. Container volume was virtually flat from a year ago.

Matson's intermodal services had a 56 percent gain in operating profit to $1.4 million from $900,000 while revenue grew 18 percent to $57.4 million from $48.6 million.

Leasing

A&B's property leasing activity achieved record numbers, with operating profit rising 23 percent to $9.5 million from $7.7 million and revenue increasing 18 percent to $20.6 million from $17.4 million. Occupancy rates on the mainland grew 5 percent to 96 percent from 91 percent and were up 3 percent in Hawaii to 90 percent from 87 percent.

Sales

Property sales posted a 138 percent rise in operating profit to $6.9 million from $2.9 million and revenue jumped 59 percent to $26.4 million from $16.6 million.Sales in the quarter included Airport Square, a Reno, Nev., shopping center; one industrial lot on Oahu; and three residential properties.

A&B's food products unit improved from higher production and sales of raw sugar and higher raw sugar prices. Operating profit more than doubled to $2.3 million from $1 million while revenue increased 27 percent to $35.1 million from $27.6 million.