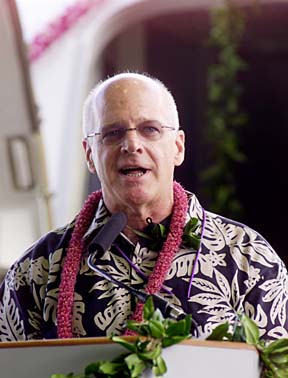

STAR-BULLETIN FILE

Hawaiian Airlines Chairman and Chief Executive John Adams is likely to be replaced, but the airline and its creditors cannot agree on who would fill the post.

Hawaiian Air remains

at odds with creditorsThe sides cannot agree on

who would replace CEO Adams

The three main parties in the Hawaiian Airlines trustee saga exchanged proposals yesterday but remained far apart on two key issues.

Hawaiian wants Mark Dunkerley, hired in December as president and chief operating officer, to become the new chief executive officer, according to a source close to the situation. Boeing Capital Corp. and the unsecured creditors committee are seeking a CEO from outside the company and want assurances that the board isn't controlled by AIP LLC, the partnership controlled by current Chairman and CEO John Adams.

The airline's 11-member board, which met Monday, made a proposal yesterday to the creditors committee and the committee is planning to respond with a counterproposal, another source said.

Time, though, may be running out on the parties.

Bankruptcy Court Judge Robert Faris said at the end of a two-day hearing Friday he would make a decision "promptly" regarding the appointment of an airline trustee but urged the parties to work out a deal. Although the sides resumed talking yesterday, there was no indication whether they would be able to reach an agreement before Faris rules.

"We don't have any control over that," Hawaiian spokesman Keoni Wagner said. "The intention is simply to take the judge's words to heart and to resume these discussions."

Hawaiian, which filed for Chapter 11 reorganization March 21, repeatedly has said it filed for bankruptcy because it was unable to restructure aircraft leases with its three lessors.

Boeing Capital, the main provider of aircraft to Hawaiian, filed a motion 10 days later requesting a trustee be appointed to oversee the airline through bankruptcy. Boeing Capital said it had no confidence in Adams, who the lessor accused of self-dealing, conflict of interest and insider transactions.

Russ Young, spokesman for Boeing Capital, said the company has been talking with the airline and the creditors committee about a possible alternative to a trustee since May 5.

"The key elements we're looking for is sufficient protection against future insider transactions and something that allows outside investors to offer reorganization plans," Young said. "We continue to feel a trustee is the best way to bring about a successful reorganization, but we remain open to the idea of meaningful alternatives."

In another development, Wagner said Hawaiian was going to file a five-day extension with the Securities and Exchange Commission for releasing the airline's first-quarter earnings.

The company, scheduled to file earnings May 15, now has until May 20.