Hefty nets for CB execs

If a merger goes through,

the company's officers

walk away with millions

Ronald Migita, president and chief executive officer of CB Bancshares Inc., stands to make more than $8.1 million if Central Pacific Financial Corp. is successful in its $291 million hostile takeover attempt.

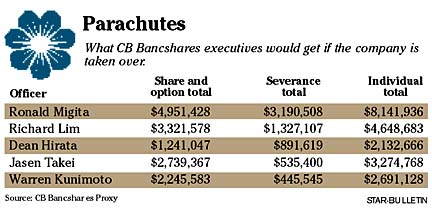

Migita, who has not yet publicly indicated whether he supports the merger of the state's fourth- and fifth-largest banks, would earn nearly $5 million through his ownership of stock and options and then about $3.2 million from severance-related payments if the merger goes through, according to data available in the company's latest proxy.

Altogether, CB Bancshares' top five executives collectively would pocket nearly $20.9 million if the deal succeeds.

Migita would gain nearly $3.6 million through his personal stock ownership and $1.4 million in options based on Central Pacific's original offer price of $70 a share. In addition, he would get $1.5 million under the bank's change of control agreement, $900,000 in retirement and $786,500 in deferred compensation as part of his severance. Migita earned a salary of $257,520 and a bonus of $250,000 last year.

Among other officers, Richard Lim, president and chief operating officer of City Bank, would receive $4.6 million; Dean Hirata, senior vice president and chief financial officer of CB Bancshares, $2.1 million; Jasen Takei, executive vice president of City Bank, $3.3 million; and Warren Kunimoto, executive vice president of City Bank, $2.7 million.

The proposed transaction heated up yesterday when Central Pacific Bank parent CPF delivered a letter and information sheet to the parent company of City Bank requesting a shareholders meeting be called to discuss the merger. Migita, who repeatedly has said CB Bancshares is thoroughly reviewing the proposal, said "he was disappointed that CPB has taken these steps."

"CPB's actions are obviously designed to put pressure on the CB Bancshare board while we are continuing to consider CPB's proposal," Migita said. "The CB Bancshares board takes its fiduciary responsibilities very seriously and will make its decision in due course with the interests of our shareholders, customers, employees and the communities we serve in mind."

Shareholders last week voted to change the company's name to Central Pacific Financial from CPB Inc.

Clint Arnoldus, chairman, president and CEO of Central Pacific, said he is willing to negotiate but is running out of patience.

"Unfortunately, CB has been unwilling to discuss this offer with us in a meaningful way," he said. "The shareholders of our two companies cannot be asked to wait indefinitely for the CB board of directors to make a decision."

A veteran Hawaii financial executive offered a new twist to the takeover battle.

"It would be a brilliant move for American Savings Bank to be a white knight (and buy CB Bancshares) because it would be a rare opportunity," said the executive, who is not involved in the merger. "American Savings could go from ($6.4 billion to $8.1 billion in assets) and get very close in size to Bank of Hawaii and First Hawaiian."

Robert Clarke, chairman, president and CEO of American Savings parent Hawaiian Electric Industries Inc., said it is policy not to comment on hypothetical issues. He acknowledged that he has not conducted an in-depth study to see how antitrust concerns might play a factor.

"My sense is that if you were to do an acquisition, there might have to be a large amount of branches divested," Clarke said. "I can't say under no circumstances American won't do it, but I know there would be antitrust issues."

Analyst David Schanzer, who covers HEI for investment firm Janney Montgomery Scott LLC in Philadelphia, suggested that if Central Pacific saw enough value in CB Bancshares to do a hostile takeover that American Savings might also be a takeover target.

"American Savings might be more valuable than some people imagined," Schanzer said. "I'm not sure if HEI has an exit strategy for owning a bank, but this hostile takeover of a Hawaiian bank certainly adds value to American Savings, particularly given the sound performance in recent years."

Schanzer also said American Savings, the state's third-largest bank, possibly could take the initiative as a white knight to come in and buy CB Bancshares or, in a scenario with a similar result, CB Bancshares could go to American Savings and ask to be acquired.

"Whether HEI can act that quickly remains to be seen," Schanzer said. "Historically, utilities have not reacted as quickly as the situation calls for to do that kind of input."

Schanzer said one thing HEI wouldn't have to worry about in making an acquisition is obtaining the necessary financing.

"The company has a tremendous reputation as a utility and as a bank and has never had difficulty securing financing," he said.

Schanzer dismisses antitrust concerns, saying that there are plenty of regional oligopolies in the banking industry.

"I'm not sure if having three large banks at the end of the day instead of four would cause the federal government to take an antitrust issue," Schanzer said. "I do know in large markets there are three banks that dominate."

Central Pacific Bank

City Bank