KEN IGE / KIGE@STARBULLETIN.COM

Despite flagging tourism, Hawaii's economy is holding up well, a new University of Hawaii report says.

Isle outlook brightens Hawaii's economy may be in better shape than previously thought, thanks largely to low interest rates, according to a new outlook by the University of Hawaii Economic Research Organization.

Hawaii's economy is resilient,

a new outlook saysBy Lyn Danninger

ldanninger@starbulletin.comBut, of course, world events could push any sustainable growth off the rails, said the report, which was released yesterday.

Although some sectors, such as tourism and transportation, are clearly being hurt by the impact of war with Iraq and the growing epidemic of severe acute respiratory syndrome cases, the local economy is showing resilience, said Carl Bonham, a UH professor of economics and one of the report's authors.

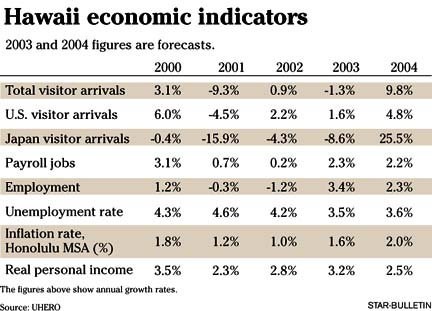

Tourism from Japan is likely to end the year down 8.6 percent, the fourth straight declining year, the report said. Domestic arrivals are expected to rise 1.6 percent.

Bonham noted that even before the outbreak of war, Hawaii's tourism sector was beginning to suffer -- particularly the Japanese tourism market, which never completely recovered after 9/11. Likewise, related economic sectors, such as retail and transportation, were also feeling the effects of war nervousness.

But when the researchers looked at the economy as a whole, a different picture emerged, Bonham said.

"There's always the case that there is a lot going on in different sectors so when you look at the aggregate economy and add everything up, it often looks very different from individual sectors," he said.

Bonham attributes much of the resilience to continued low interest rates.

"Primarily it's the low interest rate environment and how much money has been released through home refinancing," he said. "If you look at people's ability to re-finance along with the appreciation of property in the last couple of years, not only can they re-finance but some will take out second mortgages for renovations, or repairs or buy an SUV. The extra money has definitely offset a lot of the weakness in tourism."

Bonham noted that while the retail and tourism sectors usually go hand in hand, retail has staged somewhat of a mini-recovery on its own.

"We're still down about 1,000 jobs in retail and we're not quite at pre-Sept. 11 levels, still down about 3 percent, but it has recovered in the last two months," he said.

Retail Merchants of Hawaii Executive Director Carol Pregill, while acknowledging that retail is not fully recovered, attributes much of the improvement to two areas, spending from mainland visitors and residents buying items for their homes.

"We're spending on our homes," Pregill said. "What's driving a lot of the local spending is home resales. When you buy a home you need new furniture and appliances. Another strong category is home entertainment."

These items are not everyday purchases, Pregill said, but are big-ticket significant investments.

Military and residential construction, renovations to a number of Waikiki hotel and apartment properties as well as individual home renovations have all contributed to growth, Bonham said. The sector reported 8.9 percent more jobs in the first two months than a year ago.

One surprise area of growth the report found was in the area of government jobs -- both federal and state. While it's not clear where all the jobs fell, Bonham said at least one likely area of growth would be homeland security at both the federal and state levels. Education also saw an increase in jobs, he said. However, in spite of the growth, Bonham said he is still predicting that job growth in the state sector will slow.

"We had assumed it would slow down in terms of job growth because of the fiscal situation and I still think that's going to be the case so we are assuming very little state government job growth," he said.

Other strong areas of job growth were professional and business services, up 5.9 percent, and real estate, up 3.9 percent.

The report noted that the resale market for condominiums reached its highest levels since 1990. The number of units sold and the median price are up 48 percent and 23 percent respectively over last year. Single-family home activity and prices continue to rise, but at a more moderate level.

Some job declines were seen in the technology sector -- particularly in telecommunications, the report found. Information services declined 2 percent so far this year while communications continued to lag 2002 levels by nearly 5 percent.

UH Economic Research Organization

UHERO Hawaii Outlook report