It was easy to poke fun at them during the bull market.

Hawaii's largest public companies

The categoriesBy Dave Segal

dsegal@starbulletin.com

Those high-flying dot-coms with no earnings and unrealistic market capitalizations captured the investing public's imagination, if not their wallets.

But today, when more acquisitions are being consummated with cash rather than stock, market caps don't carry as much impact as they once did.

Yet, they still provide a snapshot in time of what investors think -- rightly or wrongly -- a company is worth.

"The market cap just reflects the share price, and that can be driven much more by market trends than other factors," said Peter Di Teresa, senior mutual fund manager at Chicago-based investment research firm Morningstar Inc. "It may not actually reflect much about the underlying business. It may not really tell you much of anything about what the business is really worth."

Such was the case in December 1999 when Internet poster child Amazon.com Inc. soared to a market cap of $36.4 billion, roughly the size of Boeing Co. and greater than the market caps of General Mills Inc. and Nike Inc.

Today, Microsoft Corp. has the largest market value in the world at $249.2 billion. Amazon, which last month reported just its second profitable quarter ever since going public in 1997, has persevered despite its skeptics and has a market cap of $8.3 billion. Large caps, as defined by Morningstar, have a value of more than $7.7 billion.

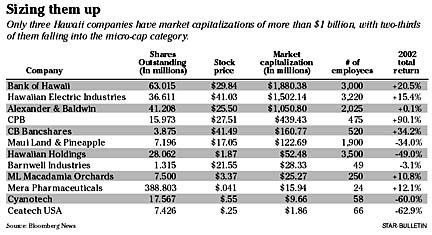

Given Hawaii's small population base of 1.2 million and the absence of major industrial industries, it's not surprising that the state has no large-cap stocks. Rather, Hawaii ranks at the other end of the spectrum with eight of the 12 stocks in the Bloomberg Honolulu Star-Bulletin index falling into the micro-cap category. Micro-cap stocks are companies that are valued under $250 million.

The state's three largest publicly traded companies, Bank of Hawaii Corp. ($1.9 billion), Hawaiian Electric Industries Inc. ($1.5 billion) and Alexander & Baldwin Inc. ($1.1 billion), are classified as mid caps. In addition, First Hawaiian Bank parent BancWest Corp., which no longer is publicly traded, had a market cap of about $4.4 when it was acquired by French banking giant BNP Paribas SA in December 2001. If BancWest had remained public, its market cap would be much higher today since its assets have grown 60 percent following its acquisition last year of Los Angeles-based United California Bank and its more than 100 branches.

Mid caps, according to Morningstar, are valued at between $1.4 billion and $7.7 billion.

Central Pacific Bank parent CPB Inc., the fourth-largest Hawaii company in terms of market cap, is considered a small cap at $439.4 million. Morningstar refers to small caps as companies between $250 million and $1.4 billion.

Hawaii's micro caps are City Bank parent CB Bancshares Inc., $160.8 million; Maui Land & Pineapple Co., $122.7 million; Hawaiian Airlines parent Hawaiian Holdings Inc., $52.5 million; Barnwell Industries Inc., $28.3 million; ML Macadamia Orchards LP, $25.3 million; Mera Pharmaceuticals Inc., $15.9 million; Cyanotech Corp., $9.7 million; and Ceatech USA Inc., $1.9 million.

High market caps can give a company more leverage to make acquisitions or may mean a company is firing on all cylinders. Contrarily, it could mean that the value of the company is inflated.

Low market caps can mean that a company is either small or has flown below investors' radar screens. It also could mean there is something fundamentally wrong with the company.

Top executives at both Bank of Hawaii and Hawaiian Electric, while acknowledging they pay attention to the market cap, prefer to focus instead on the total return to shareholders from increased stock prices and dividends. Bank of Hawaii had a total return from its stock and dividends last year of 20.5 percent while Hawaiian Electric's total return was 15.4 percent.

In Bank of Hawaii's case, its stock had fallen to $11.25, nearly a 10-year low, and its market cap was about $900 million on Oct. 28, 2000, just days before Michael O'Neill took over the helm. Today, the stock price is $29.84 with a market cap of $1.9 billion. In addition, Bank of Hawaii has returned $570 million to its shareholders since that time through a buyback program.

"What is interesting in our case is that our market cap has increased despite the fact that we have repurchased nearly 20 million shares of our stock," said O'Neill, Bank of Hawaii's chairman and chief executive officer. "The steady increase in our share price has offset the reduction in shares outstanding resulting from the buyback. Definitely a good deal for our shareholders."

Robert Clarke, Hawaiian Electric chairman, president and chief executive, said that while he may look at Hawaiian Electric's market cap, it's not particularly important to him.

"To me, total return is more important than market cap," Clarke said. "What's more important to an investor is what kind of stock price appreciation and dividend did I get."

|

Last year, Hawaiian Electric's 15.4 percent total return easily surpassed the 15.1 percent total decline of its peer group, the Standard & Poor's 500 Electric Utilities index, and the 22.1 percent drop of the S&P 500 index.Hawaiian Electric, which has paid dividends continuously since 1901, has kept its quarterly payout at 62 cents a share for the past 21 quarters. But Clarke said the company would like to increase its dividend when the situation becomes right.

"We're trying to grow our earnings level that would support an increase in the dividend," Clarke said. "What we want to do is get our payout ratio of dividends to earnings to 65 percent. Once we do that, we would consider an increase in the dividend."

The $2.48 a share annual dividend that Hawaiian Electric paid out last year represented 76 percent of the company's $3.26 per-share earnings in 2002. The company's dividend yield is 6 percent.

Market caps, though, are no indication of how a company is performing.

"You can have a company with a big market cap performing well and a company with a big market cap performing poorly," Clarke said. "You also can have a company with a small market cap performing well and a company with a small market cap performing poorly."

Al Landon, vice chairman and chief financial officer at Bank of Hawaii, said such things as revenue growth, expense control, risk and capital levels, and management abilities are important elements for increasing share value and hence market cap.

"Different environments call for different strategies," Landon said. "Given the difficult environment of the last two years, most companies have encountered decreased market capitalization and share value. Hawaii is fortunate that its financial institutions have generally increased their share values and market capitalizations. But each used different strategies."

Di Teresa, the Morningstar analyst, said investors are better off valuing a company not by market cap but by looking at future earnings projections for the company and discounting such things as new competitors, changes in the market and interest rates.

"You want to find out what the company is really worth as opposed to what the market cap is," Di Teresa said.

Di Teresa said investors who buy the biggest market-cap companies, such as Microsoft, may be arriving at the party too late.

"It's exciting that this is the biggest company in the world but, as an investor, you would have been better off buying it before it became the biggest company in the world," he said. "Then, you would be able to participate in its growth. If you're buying into something that's already the biggest company in the world, then you have to hope it will get even bigger. Otherwise, it's not even a worthwhile investment."

|

BACK TO TOP |

Market capitalizations, which are calculated by multiplying the shares outstanding by the stock price, can be divided into four groups -- large cap, mid cap, small cap and micro cap. While definitions vary, investment research firm Morningstar's classifications are: The categories

>> Large cap -- More than $7.7 billion.

>> Mid cap -- Between $1.4 billion and $7.7 billion.

>> Small cap -- Between $250 million and $1.4 billion.

>> Micro cap -- Under $250 million.