Richard Behnke always said that investors need to look under rocks to find stocks that offer the best value. Obscure choices

win stock picksTwo insurance firms

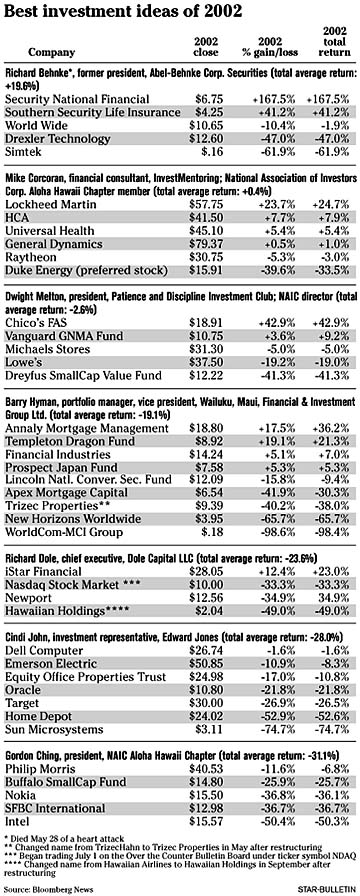

The tallies

off the beaten path come up

with impressive gainsBy Dave Segal

dsegal@starbulletin.comThat led him to two obscure life insurance companies last year among his picks in the Star-Bulletin's 2002 survey of best investment ideas.

Although he didn't live long enough to see his selections through to the end, it was ironically those two life insurance picks that propelled the former president of broker-dealer Abel-Behnke Corp. Securities to an overall 19.6 percent return and made him a runaway winner over six other local stock experts.

Behnke, who died of a heart attack in May, had the first- and third-best performing investments of a total of 41 chosen by the experts.

Security National Financial Corp., which is involved in life, accident and health insurance; the funeral industry; and residential and commercial loans, had an astounding 167.5 percent total return. The Salt Lake City-based company, which has a market capitalization of just $65 million, closed the year at $6.75.

Behnke's other key selection was Southern Security Life Insurance Co., which jumped 41.2 percent. Florida-based Southern Security, with a market cap of only $9 million, closed 2002 at $4.25.

"To find opportunity (looking under rocks) is where you're going to have to go," Behnke said when making his selections. "You're not going to find it on the S&P, where institutions have to buy and push up the price. You find it in obscure places."

The only other local expert to finish in the black was financial consultant Mike Corcoran, who eked out a 0.4 percent gain largely on defense and health care stocks.

However, four of the seven experts managed to beat the 23.4 percent fall of the broad-based Standard & Poor's 500 index. All of the experts' performances and the stock returns include reinvested dividends.

Dwight Melton, president of the Patience and Discipline Investment Club and a director of the National Association of Investors Corp. Aloha Hawaii Chapter, a nonprofit investment education organization, lost just 2.6 percent.

Barry Hyman, portfolio manager and vice president of Financial & Investment Group Ltd. in Wailuku, Maui, fell 19.1 percent.

Richard Dole, chief executive officer of Dole Capital LLC, came within a whisker of matching the index as his picks fell 23.6 percent.

Cindi John, investment representative of financial services firm Edward Jones, dropped 28 percent.

And Gordon Ching, president of the NAIC Aloha Hawaii Chapter, tumbled 31.1 percent.

"While four of the seven beat the S&P 500, given the overvalued levels of the index at the beginning of the year, beating it was no great feat," Hyman said. "Getting positive returns on the other hand was, so I applaud the late Mr. Behnke."

Corcoran, who led Benhke by nearly 17 percentage points at the end of the third quarter, lost his lead as investors began to cash in their profits in the defense and health care sectors. Corcoran's best pick turned out to be defense contractor Lockheed Martin Corp., which gained 24.7 percent.

"The market looks ahead at least six months and those stocks were defensive in nature and the market feels those won't be the ones that will grow in the next year or so," Corcoran said. "So they're looking at tech stocks now and financials. Those are the ones that usually lead coming out of a recession."

While Corcoran is letting down his guard a little bit, he still recommends caution in making stock picks.

"It just depends how risk averse you are, whether you want to get in now or wait," he said. "I'd be inclined to wait.

"There's a big risk with the possibility of war with Iraq. If you're a long-term investor, there's no problem. But if you're someone who needs the money in three to five years, it could be disastrous if we have a war and it doesn't go well. The market hates uncertainty. On the other side, if the war is resolved quickly, everyone indicates the market should be up 15 to 20 percent this year. But I'd be inclined to be more conservative."

Melton, meanwhile, said he's more concerned with fundamental and technical analysis than the market environment.

"Also, I won't buy stocks for my portfolio unless I can write covered calls on those to be able to generate the premiums," Melton said.

Writing covered calls is a conservative strategy that enables an investor to generate income by selling call options on stocks that he already owns.

Melton, whose personal asset allocation is currently 70 percent fixed income and 30 percent equities, said he's still partial to the Vanguard Ginnie Mae Fund, which had a total return of 9.2 percent last year and was his second-best-performing pick. His top selection was Chico's FAS Inc., a women's casual clothing retailer that split its stock twice during the year and soared 42.9 percent. That was the second-best return among stock pickers behind Behnke's selection of Security National Financial.

Hyman's best selection was Annaly Mortgage Management Inc., a real estate investment trust that gained 36.2 percent. However, Hyman's portfolio also had the worst performer in WorldCom-MCI Group, a unit of WorldCom Inc. MCI Group, which tracks the consumer long-distance phone business, tumbled 98.4 percent after WorldCom filed for bankruptcy and eliminated MCI's hefty dividend.

Dole had one gainer among his four picks as iStar Financial Inc., a finance company that's taxed like a REIT, rose 23 percent. Another one of his selections, the Nasdaq Stock Market, finally went public July 1 on the Over the Counter Bulletin Board (ticker symbol: NADQ) after plans for its initial public offering on the Nasdaq National Market fell through due to market conditions. Dole also was the only stock picker to put his faith in a Hawaii stock, selecting Hawaiian Airlines parent Hawaiian Holdings Inc. However, Hawaiian ended off 49 percent after its planned merger with Aloha Airlines fell through in March.

John and Ching both saw all their picks finish in the red. John's best performer was Dell Computer Corp., which slipped just 1.6 percent. Ching, counting on Philip Morris Cos.' sizable dividend, saw that pick go up in smoke as the stock fell 6.8 percent.

BACK TO TOP |

|