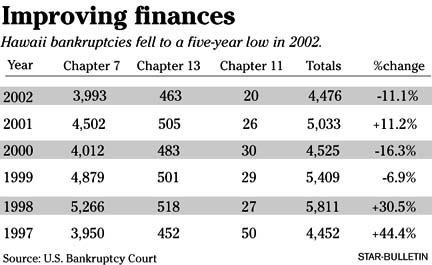

Isle bankruptcies drop State bankruptcies fell 11.1 percent in 2002 to their lowest level since 1997 as refinancing mortgages helped put money in consumers' pockets and the lingering effects of Sept. 11, 2001, continued to unwind.

Bankoh's economist says

the number remains surprisingly

high given refinancing opportunitiesBy Dave Segal

dsegal@starbulletin.comDespite the decline to 4,476 filings from 5,033 a year ago, Bank of Hawaii economist Paul Brewbaker expressed surprise yesterday that the number did not drop further.

"There's room for further improvement, the way the economy in Hawaii has improved and given the forecast, which has a fairly broad consensus, for continued moderate growth," Brewbaker said. "I would have imagined these filing numbers would have dropped off even more than we've seen in the last five years if you look at indicators like the unemployment rate."

|

In November the state's jobless rate was 3.9 percent on a seasonally adjusted basis. Any number 4.0 or lower is considered "full employment," Brewbaker said.Oahu's unemployment rate for November was a not-seasonally-adjusted 3.6 percent.

Brewbaker expects the state's real, or inflation-adjusted, total personal income to increase 3.1 percent in 2003. He is the most optimistic of the state's economists, whose growth estimates range down to 2.4 percent. Hawaii's growth rate for the past five years has been about 2.3 percent.

Bankruptcy filings, which fell year-over-year in December for the ninth time in the past 10 months, have shown a clear trend since the 2002 high of 460 filings in March. In December, historically a low month for cases, there were 271 bankruptcy filings.

"This is clearly a 9/11 story," Brewbaker said. "By January the fallout would have still been there in terms of business failures because of the spillover from 2001. In the second quarter, we started making progress again in lowering bankruptcy filings that we previously had been making prior to Sept. 11."

Still, Brewbaker said the refinancing opportunities available in 2002 should have helped lower the numbers.

"It may have been that the retailers after Sept. 11 saw the handwriting on the wall but stayed open through the Christmas season a year ago but didn't file until early in 2002," he said.

In the just-concluded year, filings for Chapter 7, which involve the liquidation of business or personal assets, were down 11.3 percent, to 3,993 from 4,502 a year ago.

Chapter 13 filings, which allow an individual to work out a repayment plan to creditors and generally pay a certain percentage on the dollar, declined 8.3 percent, to 463 from 505 in 2001.

Filings for Chapter 11, which is for business reorganizations, decreased 23.1 percent, to 20 from 26 a year ago.

"There's no question 2002 gave households an opportunity to restructure their finances," Brewbaker said. "It certainly helped many families that might, in a normal year for interest rates, have difficulty taking advantage of the opportunity to refinance. The low interest rates also gave a tremendous amount of access to the housing market for families looking to make the transition for the first time to home buyers, which also offers the chance to consolidate debt."

Hawaii bankruptcies peaked in 1998 at 5,811 just as the state economy was beginning its recovery. They fell to 5,409 in 1999 and 4,525 in 2000 before jumping 11.2 percent to 5,033 in 2001.

With Hawaii's unemployment rate once again near historically low levels, he said it is startling that the bankruptcy filings are more than double what they were in the mid-1990s, when the annual filings numbered 2,000 or fewer and unemployment hovered around a seasonally adjusted 6 percent. He cites several likely reasons filings have not fallen further:

>> The near-term legacy effects of Sept. 11, 2001, may have prompted some businesses to hold off filings until after the prime retail season in December.Brewbaker said the wave of bankruptcy filings that occurred after the Gulf War and Sept. 11, 2001, may repeat itself if the United States goes to war with Iraq.>> Japanese tourism is roughly two-thirds of what it was six years ago, and many businesses that were focused on that market segment may have been unable to make the adjustment to capitalize on tourism growth from the domestic market.

>> The persistence of high levels of bankruptcy filings in Hawaii may reflect a broader national phenomenon of increased personal bankruptcy filings.

>> The stigma once associated with bankruptcy has diminished.

>> A proliferation of credit card issuers and credit card users in the 1990s is having a backlash effect as the issuers are starting to tighten credit standards and users find themselves over their heads in debt.

"What we have here are two good examples of how much economic damage can be done to Hawaii: first immediately through tourism, and subsequently over time to the business or personal financial failures that are a result of lost business or employment loss," he said.

"Without a conflict in Iraq, 2003 would presumably extend the steady (economic) improvement that was briefly interrupted by Sept. 11. But the sequence of dates following Sept. 11 shows how much disruption Sept. 11 caused. It's a reminder that events on the other side of the planet can have a profound impact on the economy here."