Hawaii investors saving for their children's college education through the new state-sponsored 529 investment program may not want to look at their statements for awhile. Investors in 529 plans

getting a real educationBy Dave Segal

dsegal@starbulletin.comIn most cases, there's less money in their accounts than when they started.

But that's a consequence of the stock market, not the 529 program. And even though nine of the TuitionEDGE plan's 11 options have posted negative returns since the plan began in early May, the 529's predetermined asset allocation has helped soften the blow from a 3-year-old bear market that also has claimed among its victims other savings vehicles like 401(k)s and individual retirement accounts.

"Just like any investment program, you have to go into the 529 investment program with a long-term view," said Dan Carlson, vice president in charge of 529 plans for Delaware Investments, the administrator of Hawaii's program. "If you got in on the Hawaii program on day one, even five months later it's a very short time frame from an investment point of view."

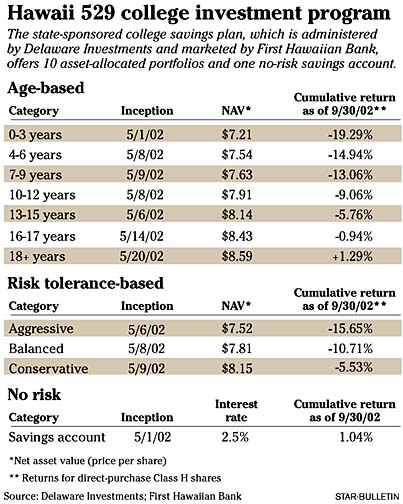

The 529 program, named after a section of the Internal Revenue Service code, is marketed in Hawaii by First Hawaiian Bank. Participants can choose a Delaware Investments portfolio from seven different age-group options or select a plan based on desired risk level, such as aggressive, balanced or conservative. Contributions also can be divided between the age-based and risk-based portfolios.In addition, there is a savings account option, which currently pays an annualized rate of 2.5 percent, that is risk free and offered by First Hawaiian Bank.

Seven investment strategies, covering fixed income, domestic equity and international equity, are incorporated in each of the age- and risk-based portfolios. They are short-term bonds, intermediate-term bonds, U.S. diversified value stocks, U.S. diversified growth stocks, U.S. small-cap value stocks, U.S. small-cap growth stocks and international stocks.

For portfolios based on a child's age, more risk is taken with investments when a child is younger. As a child gets closer to college age, the portfolio automatically adjusts and becomes more conservative.

The numbers bear that out, too. Since inception in early May through the end of the third quarter, the cumulative return for 0 to 3 years of age was minus 19.29 percent, compared with a positive 1.29 percent return for the 18-plus age portfolio.

The risk tolerance-based portfolios, which are not based upon the beneficiary's age, all had negative returns from inception through Sept. 30. The aggressive plan was down 15.65 percent, the balanced plan fell 10.71 percent and the conservative plan was off 5.53 percent.

"In mutual fund land, past performance is no guarantee of future results," said Carlson, repeating the often-used investment mantra. "You always have to say we're investing in the market. But I think we've created some good asset-based allocation risk that's appropriate. Still, there's no guarantee with any of this."

Hawaii's 529 plan, which is open to all U.S. residents, generated just under $4.7 million in assets through Sept. 30 by attracting 555 account owners representing 799 beneficiaries. The disparity between the account and beneficiary numbers is because some account owners have contributed money for more than one child.

"We feel good about the response," First Hawaiian Bank spokesman Gerry Keir said. "It's a new procedure and requires a lot of explaining to people. It's something they haven't seen before. Even with that, in the first five months we've exceeded the goals we set for the first 12 months."

The age-based category, spread between seven groups, has been the most popular with nearly $2.3 million in assets. Of the risk-based alternatives, the balanced option attracted $724,436, the aggressive option $651,174 and the conservative option $444,954. The savings account brought in $585,792.

Carlson said the majority of Hawaii investors have signed up for the plan's H class, which can be done online or through First Hawaiian Bank and doesn't involve the higher fees required by an A, B or C class purchased through a financial adviser. Those signing up for the H class and selecting the age-based or risk-based portfolios pay a program management fee at an annualized rate of 0.95 percent. Thus, if an investment return before fees was 8 percent for the year, the investor would be credited with a 7.05 percent return. There is no maintenance fee for the savings account option.

One of the big advantages of Hawaii's 529 program is that the earnings are free of both federal and state taxes if the funds are used for higher education. The 529 program also offers a low investment minimum of $15 to open an account and $15 for subsequent accounts, a lifetime contribution limit of $253,000 per account, and the ability to change beneficiaries to another member of a beneficiary's family without penalty.

There also is a 529 gift provision that allows a person to contribute up to $55,000 ($110,000 for a married couple) per beneficiary in a single year and be free from federal gift taxes provided no additional contributions are made to that same beneficiary for five years. For those opting not to contribute a lump sum up to $55,000, the federal law allows annual tax-free gift contributions per beneficiary of up to $11,000 per year.

Prospective college students seeking financial aid also shouldn't be affected significantly by the 529 plan since the funds in the plan are considered assets of the parent and not the child. The U.S. Department of Education's "expected family contribution formula," which is used to help determine a student's eligibility for federal and nonfederal financial aid, only considers 5.5 percent of a parent's assets as being reasonably expected to be used for college. On the other hand, the same formula calculates that a child can be reasonably expected to use up to 35 percent of one's assets for college.

If withdrawals are taken from the 529 plan and the funds aren't used for college, the account owner faces income tax consequences as well as a refund penalty of 10 percent on earnings.

Sponsor: State of Hawaii Learning the 529

Administrator: Delaware Investments

Marketer: First Hawaiian Bank

Web site: www.tuitionedge.com

Additional 529 info: www.collegesavings.org; www.savingforcollege.com

Information: 643-4529, 24 hours; 2 a.m. to 2 p.m. HST to speak with Delaware Investments; 3 a.m. to 3 p.m. after Oct. 26.