Leeward prices When Oahu's real estate market turned upside down as the Japanese buying frenzy waned in the early 1990s, the neighborhoods of west Oahu were among the hardest hit.

lag behind

LEEWARD OAHU / TROUBLE RETURNING TO HIGH

During the 1980s, property values on Oahu and parts of the neighbor islands shot sky high as wealthy speculators from Japan bought up real estate. As the decade closed, the Japanese bubble burst and property prices started to slide. Hawaii residents who bought homes as prices soared were trapped with real estate worth less than they had paid. But many neighborhoods are beginning to make a comeback. This is part four of a seven-day look at home prices and sales volume in the state of Hawaii.

By Lyn Danninger

ldanninger@starbulletin.comAs more people were frozen out of Honolulu's metropolitan area and older established neighborhoods of central Oahu, many -- especially first-time homebuyers -- headed west. It wasn't hard to see why. The area boasted a mix of single- and multi-family homes -- many of them new -- along with affordable housing and attractive loan programs.

"When pressure on Honolulu housing became so great, this is where it was released," said Ricky Cassiday, research consultant for Prudential Locations realty firm.

But not all prospective homebuyers qualified for government affordable-housing programs that sold homes at below-market prices. Those buyers paid higher prices for housing that often was identical or similar to nearby affordable housing in such neighborhoods as Kapolei, Ewa, Waikele and Mililani.

Sales were so good in one master-planned development, Ewa By Gentry, that in one year over 800 families moved into both affordable condominiums and market-rate condominiums and single-family homes, Cassiday said. In some cases, the difference in price between affordable and market-priced homes was as much as $50,000.When overall housing demand dried up as the economy declined in the 1990s, home prices plummeted, particularly for multi-family units, making it even harder for those people who bought at or near the market's peak. People who had bought homes at the top of the market found themselves competing for buyers with those who had qualified for affordable housing.

Many people saw the value of their homes drop by more than what they owed on their mortgage. Over the next few years, falling home prices and a weak economy resulted in a jump in the number of foreclosures and bankruptcies on Oahu, Cassiday said.

But the high number of foreclosures also offered opportunities for many first-time homeowners entering the market in the past couple of years.

Patty Rubio, an independent Realtor who specializes in Veterans Administration and Department of Housing and Urban Development property resales, said much of the activity with VA/HUD foreclosed properties began to heat up in 2000.

"That was the bottom of the market and everyone was buying. But a year after that we saw a big jump in sales," she said.

Much of the interest from first-time homebuyers and investors is spurred by the fact the mortgages require either a small downpayment or none at all, as well as bargain interest rates. But in recent months, as more people found out about remaining VA/HUD properties, prices have moved up, Rubio said.

Today, many such properties in areas such as Ewa and Makakilo have multiple bidders. The VA properties, requiring no downpayment, are now routinely overbid -- recently for as much as $20,000 to $30,000 above the asking price, Rubio said.

Bank and HUD repossessions are also seeing overbids, as much as $5,000 over the asking price, as inventory is drying up.

Part of the problem is that at the bottom end of the market, values on those properties have dropped to low levels, Rubio said.For example, at the height of the market, two-bedroom fee-simple units at the Sunrise condominium complex in Ewa had risen as high as $180,000. The same type of unit sold at around $80,000 early last year. In a recent sale, a similar two-bedroom unit closed at $110,000, Rubio said.

Today, median resale prices for condominiums on the Ewa plain sit at $93,300, according to Honolulu Board of Realtors figures for the first quarter of 2002.

The median sales price for single-family homes through the April is $222,000. In 2000, those figures were $80,000 for condominiums and $203,000 for single-family homes.

So while the area shows strong improvement, there is still a ways to go for many area residents to recover the prices paid at the top of the market.

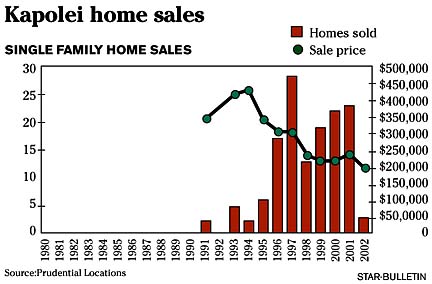

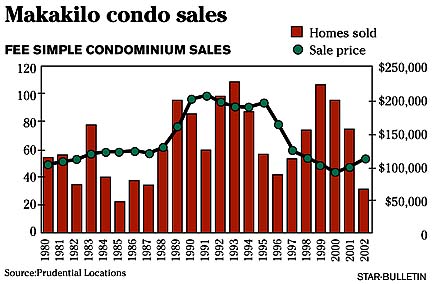

Similarly, in Makakilo, prices in both single-family homes and multi-family unit resales show big improvements, due in large part to a recovery from large drops in value during the 1990s as well as declining inventory, said Larry Arinaga, broker in charge at Coldwell Banker Pacific Properties Leeward office.

For the first four months of 2001, the median price for a Makakilo condominium or townhouse unit was $89,100, with 39 sold during that period. Over the same period this year, the median price had improved to $112,000 with 25 units sold, Arinaga said.

But like other areas of the island, appraisals in West Oahu still lag behind rising sales prices, making it harder for some prospective buyers to secure financing.

New home sales, once a big part of real estate activity in West Oahu, have been hampered by the big jump in resale activity. But increasing resale prices will likely tell developers that they can begin to increase prices for new homes, said Prudential's Cassiday.

In 1992 and 1993, about 45 percent of all homes sold on Oahu were new, and many were in West Oahu. Today only 15 percent of homes sold are new, Cassiday said. With few buyers, developers scaled back projects during the state's economic slump. While projects are once again on the move, it's unlikely they will again command nearly half of the market.

New homes' natural share of the market is more likely to be closer to 25 percent, Cassiday said. But a good mix of new and resale properties offers prospective home buyers greater choice, he said.

As the economy continues to grow and lower- to middle-income families become more financially secure, Cassiday predicts that West Oahu developers will likely step up the pace of construction to meet the growing need.