Growing city debt Mayor Jeremy Harris is mortgaging the financial future of the city. Or, he's tapping every revenue source he can so taxpayers won't have to pay more in the coming year.

threatens budget

But some financial officials insist

that the city is in good shapeBy Gordon Y.K. Pang

gpang@starbulletin.comThose are the two sides of the debate as the City Council nears the end of the most contentious budget review since Harris became mayor in 1994.

At the heart of the issue is the growing cost of the city's debt service, the amount the city pays every year to borrow money by issuing general obligation bonds. Most of the debt finances large capital improvement projects like upgrades to Kalakaua Avenue in Waikiki and the Central Oahu Regional Park.

Said Council Budget Chairwoman Ann Kobayashi: "When you can't pay your operating costs without raiding a fund, when there's not enough money to balance the budget, and there's not enough money to pay back your debt service, then most of us would think about declaring bankruptcy."

Those kinds of comments enraged Harris administration officials, who trotted out bond underwriters and advisers to give assurances that the city's proposed $1.02 billion operating budget is balanced and sound and that the city's AA credit rating is not threatened.

Council members and other Harris critics point to the administration's own numbers to show that the city's yearly payments on its general obligation bonds could nearly double in two years. They note that Harris, who has announced he will resign to run for governor, won't be around to deal with the problem.

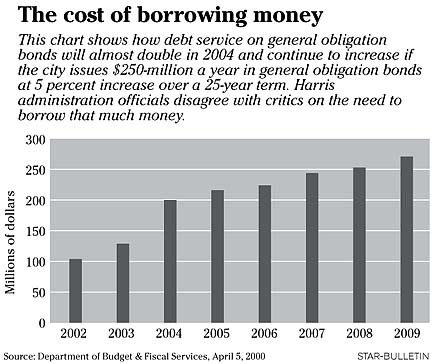

The city's general obligation bond debt payments are projected to rise to $129 million next year from $104 million this year. From there, it jumps to $200 million in 2004, then climbs to $271 million in 2009.

The numbers assume the city will issue an average of $250 million in new bonds at 5 percent interest over 25 years -- a figure Harris administration officials dispute.

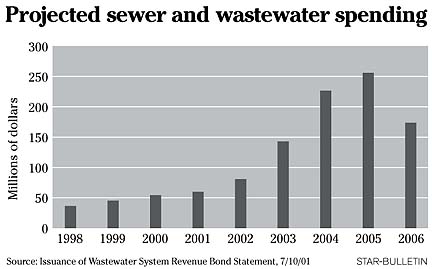

City Budget Director Caroll Takahashi said the city more realistically will issue only an average of $150 million in general obligation bonds annually.The city also issues sewer bonds to finance wastewater projects. The debt service on those bonds is paid through sewage fees.

Some $141.8 million is projected for sewer and wastewater spending next fiscal year. With spending projected to rise even more in coming years, some Council members suggest that sewer fees may need to go up.

Councilman John Henry Felix said the city's financial policies limit the amount of debt service to no more than 20 percent of the operating budget. The administration's numbers show the city could come close to that threshold within two years, Felix said.

The guideline was established "in order to preserve our bond rating, and we definitely don't want to put that in jeopardy because that would dramatically impact on the financial health and welfare of our city," Felix said.

Administration officials pointed to comments by its bond underwriters giving assurances that the city remains in excellent financial shape.

"The city has shown to the bond-rating agencies financial strength in the past, and I don't believe we, the bond rating agencies, have seen anything to change that opinion," said Frank Lauterbur, the California-based mutual securities group director for UBS PaineWebber.

PaineWebber recently helped the city sell $150 million in general obligation bonds.

A report issued last month by PaineWebber's municipal research department praised Honolulu for being able to retain its AA credit standing in the wake of tough budgetary times.

"Any suggestion of (the city's) potential bankruptcy or insolvency is wholly unfounded and without merit," the report said.

"In our capacity as primary investment bankers to the City and County, we can unequivocally state that Honolulu's current financial position remains strong and any local concerns regarding 'bankruptcy' or dire financial consequences as a result of current policies are unfounded," the local office of investment banker Smith Barney said in a statement.Both the PaineWebber and Smith Barney reports pointed to anticipated growth in revenues and its ability to weather rough financial conditions in the recent past.

Kobayashi scoffed at the expert opinions.

"They're interest is selling bonds; my interest is protecting the taxpayer," she said.

Another point of contention in next year's budget is the refinancing of $53 million in general obligation bonds.

Harris administration officials say interest rates are low and pushing back the debt payments will free up cash to balance next year's $1.02 billion operating budget.

A memorandum from Budget Director Takahashi to Council members stated that the restructuring will add $46.5 million in interest payments over the 25-year term of the new bond.

Lowell Kalapa, director of the Tax Foundation of Hawaii, equated the move to "borrowing $53 million on my MasterCard to pay $53 million on my MasterCard."

Kalapa said if the Council doesn't raise taxes this year, it likely will need to next year.

"The problem is when we refinance, we borrow money and we push it into the future," Councilman Gary Okino said. "That's what the refinancing was. It wasn't to save money or anything like that. All we did was push it into the future and, of course, all of this comes at a cost -- interest."

The $53 million from bond restructuring and the taking of $60 million from the sewer fund are only part of $164 million in revenues from "nontraditional resources" that is being used to balance next year's budget, Okino said. Most, if not all, of those resources won't be available when the Council works on the budget next year, he said.

The city will have a $235 million shortfall even before discussions begin on the 2004 operating budget, Okino said.

"The budget (for the coming year) is balanced, but the way they chose to do it jeopardizes our future," said Okino, who, like Kobayashi, is eligible to run for re-election this fall.

The administration's capital improvements program for 2003 called for $294 million in projects financed through general obligation bonds. That figure has since been pared down by the Council to $227.5 million.

Kobayashi has threatened to cut $19 million from the operating budget and at least $75 million from the capital budget, triggering administration officials to rally hundreds of people to attend meetings, write letters and call Council members to object to cuts threatening their projects.

But not all Council members believe there's a problem with the mayor's budget.

Councilman Steve Holmes, Kobayashi's predecessor as budget chairperson, said his colleagues are overstating the situation.

"We go through this every year, he said. "Every year they take money from different sources."

And for Council members to suggest that the administration's capital improvements package is too large is disingenuous, Holmes said, pointing out that the Council last year raised Harris' initial CIP budget to $579 million from $498 million.

"I think that the charges you are hearing are more politically motivated, Council members and their connections with outside interest groups," he said.

Holmes, whose leadership as budget chairman was criticized as being too cozy toward Harris, said political considerations resulted in Kobayashi replacing him only days after she was sworn in as a Council member earlier this year.

"I think the whole take on the reorganization of the Council was to be as disruptive to the mayor as they possibly could," Holmes said. "Why else would you give somebody who just walked in the door the most powerful committee on the City Council?"

Kobayashi, however, insinuated that it is Harris who has another agenda.

"I'm not worried about elections, and I'm not running for higher office," she said. "I'm just trying to show the true financial state of the city, and I'm very worried for our taxpayers."