[ BUYING HAWAII ]

|

Hawaii has always been a good place to buy souvenirs. Market holds mixed bag

for companies that

buy isle firmsBy Dave Segal

dsegal@starbulletin.comBut whether there's value in purchasing Hawaii companies is another matter.

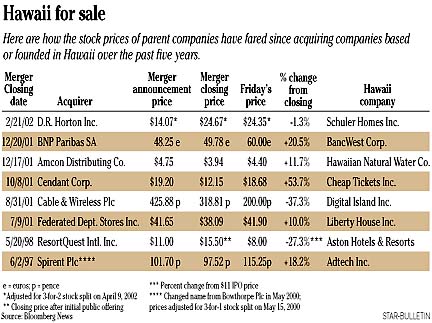

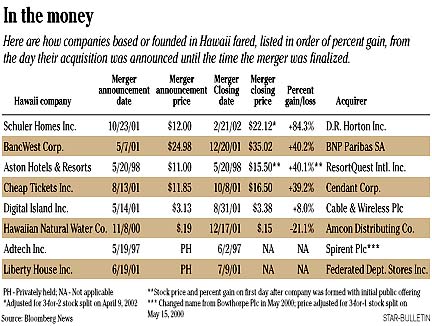

In the past five years, a handful of companies either based or founded in the state have been acquired by outsiders. While most Hawaii companies' stock prices rose after the deals were announced, the majority of the parent companies have yet to see their own prices appreciate.

Even though the ink is barely dry on the final paperwork, D.R. Horton Inc.'s purchase of Honolulu-based Schuler Homes Inc. just two months ago has proven to be one of those mergers beneficial to shareholders on both sides.

D.R. Horton's stock, despite being down 1.3 percent since the deal closed Feb. 21, is up 73.1 percent since announcing the merger Oct. 23.

Meanwhile, Schuler Homes' shares jumped 27.1 percent to $15.25 from $12 on the day of the announcement and eventually reached $22.12, a gain of 84.3 percent, before it stopped trading.

"Horton is an excellent company," Jim Schuler, the president, chief executive and co-chairman of Schuler Homes, said shortly before the deal was finalized. "I know the management, I like the people and I like the philosophy. It's an ideal transaction. And the price given to shareholders is a great return. When you can make that kind of money for shareholders, you really have to take advantage of the opportunity."

Overall, acquirers' stocks have turned in a mixed performance following the purchase of Hawaii companies. Since the day the deals closed, the stocks of BNP Paribas SA (acquired First Hawaiian Bank parent BancWest in 2001), Federated Department Stores Inc. (Liberty House Inc., 2001), Cendant Corp. (Cheap Tickets Inc., 2001), Amcon Distributing Co. (Hawaiian Natural Water Co., 2001) and Spirent Plc (Adtech Inc., 1997) have risen while Cable & Wireless Plc (Digital Island Inc., 2001), ResortQuest International Inc. (Aston Hotels & Resorts, 1998) and D.R. Horton have declined.Of course, a lot of factors can come into play. First and probably foremost, is the economy. Secondly, Hawaii companies can represent either big or small pieces in the overall makeup of the acquiring company. Thirdly, subsequent acquisitions by the parent company can affect the stock price.

For shareholders of companies being acquired, the greatest value usually comes on the day that the deal is first announced. That's because acquiring companies normally pay a premium for the right to acquire a company.

On the other hand, the purchasing companies often see the value of their own stock initially drop because the acquisition may dilute their earnings or because of investors' concerns about integrating the two companies. Acquisitions that add to earnings may result in the stocks of both companies rising right away.

D.R. Horton

In the Schuler Homes-D.R. Horton merger, the acquirer's stock enjoyed a big run-up as it rode the momentum of a booming housing market. Horton fell 71 cents to $20.39 on the day the deal was announced but eventually rose to $37, a gain of 81.5 percent by the time the deal was final. The stock now trades at a split-adjusted $24.35 -- after a 3-for-2 stock split on April 10 -- from $24.67 when the deal closed. On a nonsplit basis, the stock would be trading today at $36.53.Analyst Jim Wilson, who covers D.R. Horton for San Francisco-based brokerage Jolson Merchant Partners, said D.R. Horton was fortuitous in the timing of its deal.

"First and foremost, the closing price it was done at was accretive to earnings," Wilson said. "I also believe the timing ended up being opportune for Horton because Schuler, which was Hawaii-based, had 75 percent of its bottom line coming from California, and California (housing) in the last three months has really taken off because home prices dropped. Home prices, in the last 18 months in California, are now priced to the point where there are a lot of buyers again. From Horton's standpoint, they may have gotten lucky because they closed on Schuler when prices were taking off."

But not every marriage is successful. Just look at the 50 percent divorce rate for couples. And trying to blend together companies can be just as challenging.

Take, for example, ResortQuest International Inc., which was formed in Memphis, Tenn., and went public on May 20, 1998 in order to acquire Aston Hotels & Resorts in Hawaii and a dozen other vacation-related businesses.

ResortQuest

The company, which sold 5.8 million shares at $11 each to raise $63.8 million, rocketed nearly 41 percent on its first day to close at $15.50. The stock, which this year has soared 68.1 percent, today trades at $8, exactly $3 below its offering price five years ago.

Cendant

Meanwhile, Cendant has been on quite a roller-coaster ride since announcing its deal for discount travel retailer Cheap Tickets on Aug. 13 -- less than a month before the Sept. 11 terrorist attacks -- and closing the transaction Oct. 8. The New York-based provider of business and consumer services fell from $19.20 on the day the deal was announced to as low as $11.03 during the post-Sept. 11 selloff. Its stock, though, has risen 53.7 percent from $12.15 on the day the merger closed to Friday's price of $18.68 -- less than a point shy of its price when the deal initially was announced.Despite the rebound, analyst Jake Fuller of New York-based Thomas Weisel Partners said it would be a stretch to attribute Cendant's rise to the Cheap Tickets acquisition, since Cendant has a market capitalization of nearly $18.3 billion.

"That (Cheap Tickets acquisition) wasn't the big driver in the improvement in stock price," Fuller said. "The big driver for Cendant was across the travel and travel-related industries and the pace of recovery that has widely exceeded market expectations. The acquisition of Cendant was a relatively small event for a company the size of Cendant.

"It's a mild positive for the company, which we have yet to see strategically fully play out. It will be an integral part of Cendant's online effort, but they've yet to launch their online portal (which is expected midyear), so it's hard to judge strategically how Cendant will be impacted by the Cheap Tickets deal."

Cheap Tickets, for its part, jumped 37.8 percent to $16.33 from $11.85 on the day of the announcement and eventually reached $16.50 -- a total gain of 39.2 percent -- on its final day of trading.

Federated

Federated, which bought Hawaii retailer Liberty House in July and converted all the stores to Macy's in November, has seen its stock rise 10 percent since that time as the retail industry has remained strong amid continued consumer spending. Federated's stock, trading at $38.09 when the deal was finalized, closed Friday at $41.90 -- essentially flat with the $41.65 it was trading at when the deal was announced June 19.Analyst Jeffrey Stein of Cleveland-based McDonald Investments Inc. said it's unclear how the purchase of Liberty House has contributed to Federated's earnings.

"They don't break it out (separately from their overall operations)," Stein said.

He said, though, one can assume that Federated must have concluded that purchasing Liberty House was in the giant retailer's best interests.

"Department stores are consolidating," he said, "and they and May Department Stores are basically going to be the consolidators in the department store space. So whenever anyone is up for sale, Federated is probably one of the two logical buyers. Whether it's them or May depends if it geographically fits their distribution synergies. Liberty House fits with Federated's Macy's West division and obviously they felt that the ($200 million) price was right."

BNP Paribas

BNP Paribas, the French banking giant that now fully owns First Hawaiian Bank parent BancWest Corp., fell to 48.05 euros from 48.25 euros on the day it announced it was buying the 55 percent of BancWest that it didn't already own.The shares eventually rose 3.2 percent to 49.78 euros on the day the deal was final. Since then, BNP Paribas has gained 20.5 percent to 60 euros.

As of Friday, one euro equaled about 89 cents.

BancWest, which jumped 37.3 percent to $34.31 from $24.98 when the deal was announced May 7, eventually climbed to $35.02 -- a total gain of 40.2 percent -- before the deal was consummated Dec. 19. BancWest was formed May 28, 1998, when First Hawaiian Bank merged with Bank of the West, a unit of BNP Paribas.

Brock Vandervliet, a banking analyst for New York-based Lehman Brothers, said BNP Paribas' acquisition of BancWest represents just one piece of a global operation.

"Banking is a reflective industry," Vandervliet said. "In other words, it's influenced and reflected by the economy around it. I think you can make a case for a huge organization like BNP having exposure to Hawaii because you've got a very strong market share with basically half the Hawaiian market.

"And the cyclicality of the Hawaiian markets and its linkage to tourism isn't necessarily a big factor because you've got a much larger parent looking for market share and not particularly concerned with entering a slower growth market, which Hawaii is. I think that's a possible outcome for (Bank of Hawaii parent) Pacific Century (Financial Corp.) eventually -- to become part of a much larger organization that's looking to build market share."

Among other mergers of the past five years, Amcon's stock has risen slightly while shares of Cable & Wireless and Spirent have declined.

Amcon

Amcon, which bought Hawaiian Natural Water Dec. 17, has risen 11.7 percent to $4.40 from its price of $3.94 when the deal closed.However, Amcon, which took 13 months to complete the transaction, is still trading below its price of $4.75 when the deal was first announced Nov. 8, 2000. Hawaiian Natural Water's stock fell 21.1 percent to 15 cents from 19 cents by the time the oft-delayed deal eventually closed.

Cable & Wireless

London-based Cable & Wireless, which bought formerly Hawaii-based Digital Island on Aug. 31, has seen its stock fall 37.3 percent since that time. Digital Island, a Web hosting and design company that moved to San Francisco after getting its start in Hawaii, traded at $3.13 but jumped 8.3 percent to $3.39 on the announcement of the deal. It was trading at $3.38 -- a total gain of 8.0 percent -- on its final day of trading. Cable & Wireless, trading at 318.81 pence when the deal closed, has since fallen to 200 pence.Cable & Wireless had traded at 425.88 pence when the deal was announced on May 14, 2001.

As of Friday, $1 equaled about 69 pence.

Spirent

Crawley, U.K.-based Bow-thorpe Plc, which changed its name to Spirent in May 2000, has risen 18.2 percent since closing its deal on June 2, 1997, for privately held Adtech Inc., a Honolulu-based maker of electronic test equipment. Spirent, a telecommunications equipment maker, traded at 101.70 pence when the deal was announced May 19, 1997, but fell 4.1 percent to 97.52 pence by the time the deal closed.It later rebounded to an all-time high of 688.36 pence on Oct. 3, 2000, before falling upon hard times because of a slowdown in the global electronics industry. It closed Friday at 115.25 pence.