|

Getting away With tax season fast approaching, Hawaii residents are gathering the information to complete their state and federal tax returns.

with it (not)

Creative deducting can earn

Tax myths

you a visit from the tax manBy Lyn Danninger

ldanninger@starbulletin.comFor many, determining what kind of deductions are allowable is a big part of the process. After all, it can oftentimes make the difference between receiving a refund and having to turn over more money to Uncle Sam.

Yet a surprising number of people make those decisions based either on hearsay or their own unique interpretation of the tax code. With the tax code constantly changing, deductions are one place where many tax troubles begin.

Just how honest Hawaii residents are when it comes to claiming deductions and paying the correct amount of tax is hard to determine. It also depends on who you talk to.

|

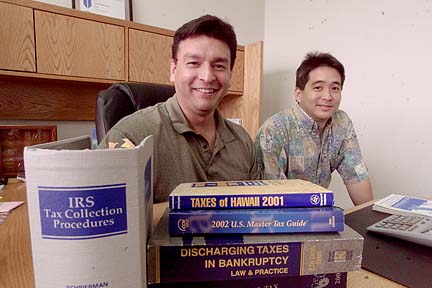

"Definitely there's cheating out there," said David Ramirez, a tax consultant and former IRS agent who owns a company called IRS Tax Relief Services.But Ramirez said he believes the vast majority of people don't consciously set out to cheat.

"They're trying to pay the lowest amount possible," he said. "That's called tax planning, which is perfectly legal under the tax code."

Steven Hiranaka, criminal tax investigator with the state Taxation Department, has worked on a number of high-profile tax evasion cases.

"There's probably millions (of dollars) not being addressed but just how much no one knows," he said. "I think perhaps 10 percent or a little more are the people who are not complying."

It's usually the high-profile tax evasion criminal cases rather than civil cases that get all the attention, said Marie Okamura, director of the state Department of Taxation.

The vast majority of tax cases are civil cases that are settled privately with the department, she said.

"We do have full civil cases as well as criminal. The civil cases bring in more money but we just can't publicize what we do there," she said.

Until 1995, the state did very little from the tax enforcement perspective, Hiranaka said.

Then the legislature passed a bill creating a special criminal tax investigation division and Hiranaka was hired.

In the past six and a half years, the division has had 77 convictions, levied fines of $743,000 and assessed taxes amounting to $9.7 million, he said.

Tax consultant Ramirez said when people run afoul of the tax system, most of the problems he sees fall into about four basic categories.

The first area is allowable deductions.

"Some people just make up fraudulent deductions and that doesn't show up unless someone questions it," Ramirez said.

Then there are other people, probably the vast majority, who genuinely believe they are allowed to take a particular deduction.

"When people do their own returns they may have been putting the same things on the return for years thinking they were deductible because they are related to work," he said.

Ramirez recalls the case of a man who came to see him who had been deducting the cost of suits, shoes and other clothing he wore to work, which is not allowable.

"Uniforms are different," Ramirez said. "The definition is something not suitable (like a uniform) for everyday wear."

Then there are the people who consult Ramirez after they encounter tax problems, saying that despite having signed their return, they weren't aware of what it contained.

"Many people don't scrutinize their returns, especially when they are due a refund," he said. "Generally when people get money back they don't care what's on the return. They just ask, 'where do I sign?'"

A third category Ramirez has seen for a number of years in Hawaii is what he calls the "constitutional argument."

|

"These are the sovereign nation cases where people believe or have been told they don't have to pay taxes because Hawaii is not part of the U.S.," he said. "There have been numerous cases probably dating back to the 1940s. All of them have failed."One recent high-profile tax fraud case using this myth involved the owner of RB Tax Service, Richard Basuel.

Hiranaka worked on that case.

Basuel pleaded "no contest" to filing false returns and overstating his clients' itemized deductions. Tax officials said Basuel claimed the foreign earned-income credit for his clients, stating they were eligible because Hawaii is a foreign country and not a part of the United States.

He was sentenced to six months in jail and fined $30,000.

Basuel's son, Richard Jr., also pleaded guilty to filing false returns for others. He received five years probation and a fine.

Unlike the federal government, the state has no sentencing guidelines for tax evasion cases, Hiranaka said.

"Judges here are given wide discretion; some are firm, some are less firm. There's no consistency," he said.

One tax fallacy that has become popular among some business owners is to set up a trust to avoid paying self-employment tax.

"They have been told if they start a trust, any income that gets funneled into the trust can be distributed as something other than wages," Ramirez said.

But for Hiranaka, the state's general excise tax and employee withholding tax are the two most consistent tax problem areas.

Most of his cases involve non-payment of general excise tax.

"There are a considerable number of people who are not filing GET but there's no way to tell how many," he said.

Part of the problem is that when people get behind in paying the general excise tax it can be difficult to make up what is owed, he said.

Knowing they are already behind, people become reluctant to start paying again.

"Once people stop filing, it's hard to catch up so pretty soon 10 years can go by," he said.

But, in spite of some compliance problems in specific areas that the state Taxation Department has been working to improve, Hiranaka is positive about the vast majority of people.

"The U.S. still has the highest tax compliance rate of all industrial nations," he said.

>> Business expenses Tax myths

Not everything related to work can be written off. Business suits, for example, are not eligible for deduction since they also can be used as everyday wear. Specific required uniforms, however, may be allowable.>> I didn't know

Many taxpayers, particularly if they're getting a refund, will sign anything their accountant puts in front of them. It's important to know what you're affixing your name to.>> Constitutional argument

Hawaii is a part of the United States, and as such, residents are required to pay income tax. Arguments that the islands are a sovereign nation and immune from the requirements have never held water with courts. Yours won't either.>> Trust me

A dodge gaining in popularity is for the self-employed to run earnings through a trust, which distributes proceeds to them. This ploy to avoid the self-employment tax has not held up.