Hawaii can be an alluring place to retire. It has the weather, the beaches and the beauty to provide a comfortable lifestyle. Unfortunately, though, it also has a cost of living that ranks among the highest in the nation.

ILLUSTRATION BY DAVID SWANN / DSWANN@STARBULLETIN.COM

Experts say addressing income,

Savvy creates security

housing and health care issues

must be done early and often

Where to turnBy Dave Segal

dsegal@starbulletin.comThat may be the price of paradise, but it's a cost that some retirees have a hard time meeting.

Cindi John, an investment representative for the Edward Jones brokerage on South King Street in Honolulu, said there is no easy way to determine how much it costs to retire in Hawaii. But she said the general rule of thumb for anybody's retirement is 70 percent of one's current working income.

"When you retire, your expenses theoretically will go down because you take away all the work-related expenses like clothes, a car, tools or whatever it is you were doing," John said. "And your taxes will hopefully be lower.

"What does it take to live in Hawaii? Well, that's a function of your expenses. The higher your expenses, the more you're going to need. Many of my senior clients are very frugal, so they can stay in Hawaii even on a fixed income."

|

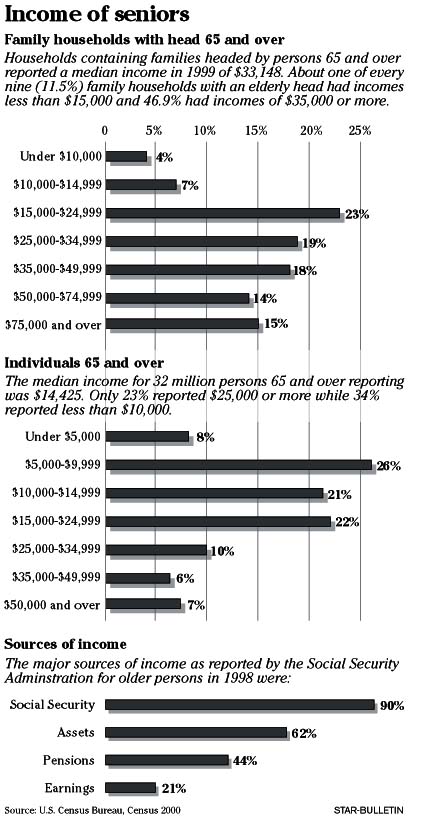

Reaching the point where a senior can survive on a fixed income is not something that happens overnight, though. Joe DeMattos, associate state director for AARP in Hawaii, said he cannot stress enough how important it is for people to plan early for their retirement."When it comes to retirement in general, the first thing we tell our members is that they should revisit the fact that Social Security was never intended to be a retirement plan unto itself," DeMattos said. "The second thing we tell our members is to plan early and often for their retirement.

"In our recent past, retirement was viewed as a destination when we got to 62, 63, 64 or 65. It was something you planned for, looking at it as a three-legged stool. That three-legged stool was security, pensions and savings. We already know that people are working well into their 60s, and the idea of retirement being a destination at 65 no longer holds true. The three-legged stool also no longer holds true. What we're looking at now is a four-legged stool, and that four-legged stool is security, pensions, 401(k) or savings, and health care.

"The 401(k) has gotten in there because workers have increasingly become more involved in their retirement planning by establishing self-directed investments through mutual funds, savings or electing to invest in 401(k)s. And health care has become part of that four-legged stool because we can no longer make assumptions that as we reach 60, 70 and 80 that either our basic medical needs or our long-term needs will be met by someone else. So long-term health-care needs have become part of the equation for people in planning for their retirement."

In Hawaii, that four-legged stool takes on even more importance because the state's 65-and-over population has been growing at a faster rate than the rest of the nation. The 2000 census showed the number of Hawaii residents aged 65 to 74 had grown 8.4 percent to 85,262 from 78,653 in 1990, those aged 75 to 84 had jumped 60.7 percent to 57,775 from 35,955 and those 85 and over had spiraled 68.9 percent to 17,564 from 10,397. Among seniors, only the 60-to-64 category showed a decline as the state's population for those residents fell 4.8 percent to 46,400 from 48,728.

Nationwide, the 60-to-64 age group increased 1.8 percent, the 65-to-74 group rose 1.6 percent, the 75-to-84 group gained 22.9 percent and those 85 and over increased 37.6 percent.

John seeks diversification for her clients, while balancing income-generating investments with growth vehicles.

"One of the concerns about people who are retired is inflation," she said. "You may be in retirement 20, 30, 40 years, and you need some of your money in the stock market. It's a risk not to be in the market because of inflation, but you also need some of your money in fixed income like CDs, bonds, bond mutual funds or fixed annuities -- those types of investments -- because they're safe and generating income. But the risk of having those investments is, they don't grow. ... I try to urge balance with as many people as I can even if they've only invested in CDs most of their lives."

John, who was a lawyer before becoming a financial adviser, said there are five fears common to just about every senior. She lists them as inflation, outliving one's money, unexpected events, health care and taxes."Health is a big issue for seniors," she said. "Long-term care is big in Hawaii. Who's going to take care of them when they're old?

"When we're born, our immune system is very low. As we get older, our immune system gets so that we don't have to worry about bugs at all. That's usually around our mid- to late 30s. Then your immune system starts going back down, and the bugs win. That's when you die."

Of course, the adage about the two certainties in life being death and taxes takes on even more immediacy for seniors.

"Seniors hate to pay taxes," John said. "So they're coming to me for tax-free bonds or deferred annuities to get away with having to pay taxes. When you're employed, you have the taxes withheld so you don't see it. But when you retire, you don't have withholding. You have to write that check every quarter, and they hate that."

For many seniors, their housing situation often takes a hefty bite out of their monthly income.

"You plan ahead for your economic life; you need to plan ahead for housing," said Betty Lou Larson, program director of the housing assistance program at Catholic Charities Elderly Services.

"Seniors often pay 50 percent of their income for rent. Many seniors pay 60, 70, 80, even 90 percent. I had one client who paid literally all her income on rent. I have one client now who's doing that and has friends that help with food.

"Housing is the one thing that you don't really have much control over. You can eat less, be a better shopper and look for bargains and economize on food. You may have something where medical costs are contained. But the housing is what's available out in the marketplace."

And even then, Larson said, seniors should be prepared to wait for a place that fits their personal taste or financial needs.

Owning their house outright, of course, alleviates a big burden. Even so, the time may come when seniors no longer want to or are able to care for their house. Some of their rental options may include moving into Department of Housing & Urban Development Section 8 low-cost housing, affordable housing or a retirement community.

HUD's federal subsidy housing allows low-income people ($22,600 for singles, up to $25,850 for couples) to pay just 30 percent of their income on rent with the government paying the rest.

The waiting list in Honolulu, according to Larson, is about two years.

Affordable housing, which Larson said can have a wait of up to nine months, generally runs about $500 to $600 a month for a one-bedroom or a studio and has income limits of approximately $22,000 to $36,000.

Retirement communities, which have higher costs, run from $1,500 to $3,000 a month and up. Besides the housing unit, they offer services such as meals, house cleaning, transportation to doctors or events, recreation and social activities. Some even offer assisted living care for an additional amount.

"People retiring now (but still working) are in a Catch-22 because their income may be too high, and they may not qualify for a (housing) project," Larson said.

"But when they retire, their income drops drastically. The difficulty is, you have to be eligible (for housing programs) when you apply. Sometimes in retirement you have to have savings for six months to a year before you can move into affordable housing, because your income may be too high when you're working."

Some of the organizations that provide assistance for seniors. The Web sites also include links to other services. Looking for advice

AARP

Information centersOahu: 1199 Dillingham Blvd., Monday through Thursday, 9 a.m. to 2 p.m.; Friday, 9 a.m. to noon. Telephone: 843-1906;

Kauai: 4212-A Rice St., Lihue, Monday through Friday, 10 a.m. to 4 p.m. Telephone: 246-4500.

Big Island: Royal Kona Resort, Monday through Saturday, 9 a.m. to noon. Telephone: 334-1212

Web site: www.aarp.org

SENIOR HOTLINE

Phone referrals, information, counseling, etc.Telephone: 523-4545

Web site: www.elderlyaffairs.com

CATHOLIC CHARITIES ELDERLY SERVICES

Financial advice, housing, transportation services, etc.Telephone: 595-0077

Address: 2745 Pali Hwy.

Web site: www.catholiccharitieshawaii.org

HAWAII EXECUTIVE OFFICE ON AGING

Long-term care, health insurance, other informationTelephone: Oahu: 586-0100; Kauai: 800-274-3141; Maui: 800-984-2400; Big Island: 800-974-4000; Molokai, Lanai: 800-408-4644.

Web site: www2.state.hi.us/eoa

|

They've been married less than three years but have known each other for more than half a century. Kahala couple’s

financial savvy creates

security in retirementBy Dave Segal

dsegal@starbulletin.comIt's a story about love rediscovered after a war pulled them apart.

An initial meeting at a USO dance was followed by separation during World War II. At a chance meeting seven years later on a Waikiki beach, both were already married, she a newlywed of just two weeks. But in 10 days they will celebrate their three-year wedding anniversary -- some 57 years after their first introduction.

For seniors Randall and Charlotte Pratt, life is comfortable now. Their three-bedroom, 212-bath, upper-floor Kahala condominium is adorned with a revolving Christmas tree and offers views of Moanalua Bay and Koko Head.

Even more important, they are financially secure, and their children from previous marriages get along remarkably well.

"We're very happily married," Randall said, prompting his wife, sitting next to him on the couch, to give him a nudge.

Retirement does not always end this way -- especially in Hawaii, where the cost of living or the lack of savings can force seniors to scrimp to make ends meet.

"There are so many people I feel so very sorry for because they're struggling," Charlotte said. "Real estate is so expensive here."

Randall, 80, and Charlotte, who he describes as "a few years younger," did not become financially secure by getting lucky. Randall, who worked on Oahu for 30 years as an agency manager for Sun Life Assurance Co. of Canada and 10 years for Standard Insurance Co. of Portland, Ore., faithfully put away money in his companies' 401(k) plans.

Charlotte, who worked for a while in real estate and interior design, helped her late husband fix up houses and then resell them.

And both sought out assistance from financial advisers.

In Randall's case, he cashed out the employee contribution portion of his 401(k), left the employer match untouched and invested the distribution in the stock market.

"I thought I could do a better job investing than the company did, and I did very well," he said. "I'm a risk-taker, and so a lot of my investments were in aggressive stocks, some were conservative and some were in mutual funds. Now I've turned over most of my investments to (Bank of Hawaii's) Hawaiian (Tax-Free) Trust. They're handling it now. They're a lot more conservative than I am."

Charlotte, meanwhile, consulted a financial adviser prior to her late husband's death.

"I took what I had to a wonderful man, Jonathan McRoberts at Dean Witter (now renamed Morgan Stanley)," Charlotte said. "Thank God, before my late husband died, we had turned our things over to him because he knows how I feel. I also had a fabulous girlfriend that unfortunately died some months ago. Every day, she would come over and tutor me."

Charlotte admitted her financial knowledge was lacking when her husband passed away nine years ago.

"I was scared," she said, "so I just tightened my belt. But I managed to get by."

Nowadays, Charlotte is feeling more comfortable with money matters.

"I know a little bit more, enough to get by," she said. "But I know where to go if I'm in trouble or if I have doubts."

She also thinks her financial temperament and that of her husband create a good mix.

"I'm very glad I'm ultraconservative because we blend together that way," she said.

Randall, who has a master's degree in economics, a degree in certified financial planning and a chartered life underwriter designation, used to teach economics at the University of Hawaii.

"I know how to handle finances not because I was born into it, but because I learned it," he said. "It just didn't happen.

"I left home when I was 13 years old, worked for a lady for 50 cents a day for four years and saved enough money to help put my brother through college. I've struggled all my life but always with an end in mind."

Randall grew up on a farm in a small Nebraska town named Rising City, which had a population of 300.

"It's now 305," Charlotte quipped.

"It's really rising," Randall retorted.

He rode a horse three miles to school and attended the College of Agriculture at the University of Nebraska in Lincoln. He served for 3 12 years in field artillery in the Army as a first lieutenant on Okinawa, Japan, and later was given a simulated rank as colonel while serving for a year as a civilian.

Upon returning to Hawaii, Randall was elected Rotary president at clubs in both Hilo and Honolulu while working for the life insurance companies, raised hives of bees as a hobby and sold the honey, and built a house in Kailua for $50,000, which he later sold for $500,000.

"You can't do that today," he said. "Real estate prices aren't going up like they were in those days."

Charlotte, a fourth-generation Oahu resident, bought and sold real estate.

"All I knew is that what little money I had I would invest in real estate, fix up the place and sell it," she said. "I loved to do it. It was fun. But there's not much profit in that anymore."

Charlotte feels strongly that children need to be taught at an early age about money.

"I think it starts when the child is young and learning about finances," she said. "But they are spoiled today in my opinion. They're given so much that they've lost creative ability as young kids (from an earlier generation) have learned. (Those kids) saved for something and appreciated what they purchased more deeply. That's been my philosophy."

Life has not always been a smooth ride for the Pratts. Both have had hardships to overcome during their lives as each has lost a spouse and a child. But the Pratts are looking ahead these days, not backward.

Perhaps that is why Randall and Charlotte keep busy with church activities and maintain a busy schedule.

"Very often after people retire from an active life, their life is short-lived," Charlotte said. "They should be keeping their mind occupied.

"Older people always should be sure they have a group of younger people actively in their lives -- not just children -- because we've gotten to the age where it seems at least once or twice a month, I recognize someone who's died."