|

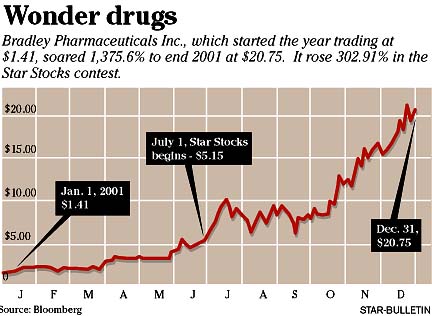

Bradley Pharmaceuticals Inc., which started the year as little more than a penny stock, has been flying beneath the radar screen of Wall Street's analysts. Stock watching hobby

pays off for insurance

agent Gordon AuBy Dave Segal

dsegal@starbulletin.comBut there was something about the drug marketer that caught the eye of Honolulu's Gordon Au.

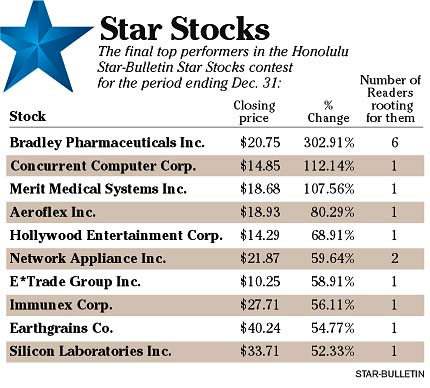

The 65-year-old independent property and casualty insurance agent with Pyramid Insurance Centre Ltd., seeing what he called "a turnaround situation," rode Bradley Pharmaceuticals' coattails to a 302.91 percent gain over the final six months of the year to capture the $500 winning prize in the six-month Star-Bulletin Star Stocks contest that ended yesterday.

"It was a great investment for the price of a 34-cent postage stamp," Au said.

His name was selected in a random drawing among five other winning entrants. The other contestants who picked Bradley were Roland Corpuz of Waianae, Takashi Kamisato of Waipahu, James Kaneshiro of Honolulu, Alan Tashiro of Honolulu and Meg Lee of Mililani.What probably was most amazing about Bradley Pharmaceuticals' selection by Au and the five others is that only one analyst covers the company. If the stock wasn't known before, though, it certainly is now after finishing the year with a gain of 1,375.6 percent. The stock closed yesterday at $20.75 after starting the year at $1.41. It was trading at $5.15 when the contest began.

Au, who calls stock picking a hobby, said he often goes to bed around midnight watching financial news network CNBC and then turns it on again in the morning before heading off for work. He also has subscriptions to financial magazines Money, Entrepreneur and Inc.

"The main thing is doing your homework and reading the papers," said Au, who declined to say whether he owned Bradley Pharmaceuticals in his own portfolio.

|

"From time to time, the newspaper prints the names of companies making new highs, and if you scan the 2,000 to 3,000 issues in the papers that have upward pyramids, there must be a reason why these stocks are making new highs," Au said. "Bradley had a deficit in earnings last year ... but this year revenues were up 57 percent, they showed a profit of $2 million and their capitalization was low at about 9 million."Au, who believes in a concentrated portfolio, said he think investors should stick with only a handful of stocks.

"Would you rather have 12 stocks doing 10, 12 percent a year or three stocks doing 25 or 50 percent? If the average person out there has under $100,000, they probably shouldn't be in more than four or five stocks."

Bradley, which in November raised its 2001 earnings estimates for the third time this year, markets dermatology brands under its Doak Dermatologics subsidiary and gastroenterology, nutritional and respiratory brands under its Kenwood Therapeutics division. All of Bradley's product lines are manufactured and supplied by independent contractors who are under the company's quality control standards and are marketed primarily to wholesalers. The wholesalers, in turn, distribute the products to retail outlets and health care institutions throughout the United States.

Concurrent Computer Corp., which provides computer systems for the video-on-demand market, finished second with a gain a 112.14 percent. It was selected by Darryl Fennie of Honolulu.

Merit Medical Systems Inc., which manufactures and markets disposable products used in cardiology and radiology procedures, was third with a gain of 107.56 percent. It was picked by Honolulu's Frank Yap.

The Star Stocks contest, which received 321 entries, also asked three financial experts for their picks as well as making two random choices by throwing a red pen at a list of stocks.

Guy Steele of the Edward Jones brokerage selected Citigroup, which slipped 4.47 percent. Clint Bidwell, president of Bidwell & Associates, chose Sempis Energy, which fell 10.20 percent. Dwight Melton, a National Association of Investors Corp. director and president of the Patience and Discipline Investment club, selected Concord EFS, which plunged 36.97 percent.

Of the two random picks, Clarent stopped trading in September due to accounting irregularities and Duke Realty lost 2.09 percent.