Tesoro’s focus shifts Tesoro Petroleum Corp., once primarily known as an exploration and production company, has been stepping on the gas to reinvent itself.

to refining, marketing

The fuel company moves

its emphasis from explorationBy Dave Segal

dsegal@starbulletin.comFour refinery acquisitions in three years, including two deals that finalized last month, are a clear indication that Tesoro is on the fast track in remaking itself as a refiner and marketer of petroleum products.

Nowhere has that been as evident as in Hawaii, where the company, which entered the market in 1998, now has 36 Tesoro stations dotting the state and, in most cases, supplies more than half of the islands' energy needs.

"I think we've grown our retail presence in the market after changing from the BHP brand to the Tesoro brand," Tesoro Hawaii President Faye Kurren said. "We've been very well received here. All of our stations have a new logo and the 2Go convenience store brand has seen very good acceptance."

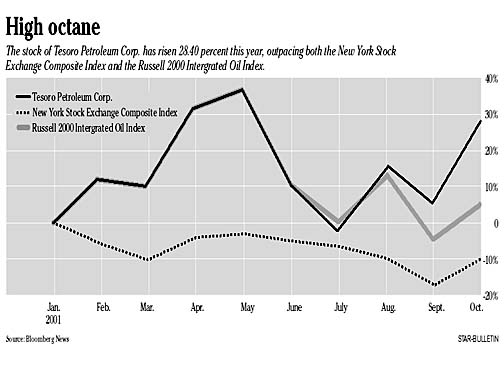

Tesoro's stock price also has been on the move, rising 14.67 percent so far this year and 28.48 percent over the past 52 weeks. The company, which reports its third-quarter earnings at the end of this week, closed Friday at $13.33.

Those are the types of results that San Antonio-based Tesoro was hoping for in the early 1990s when it was trying to decide the best direction for the company's future. At the time, it was using its lone refinery in Alaska to fund its exploration and production business. Now, Tesoro operates five refineries, including one in Washington state that it picked up three months after the Hawaii acquisition, as well as refineries in Salt Lake City and Mandan, N.D., that the company finished deals on last month."We felt as we started to focus on a strategic plan for the company, the best way to create shareholder value was not as a small exploration and production company, but as a small, yet with the ability to grow, refining and marketing company," Tesoro Chief Financial Officer Greg Wright said. "In 1998, we started examining all the refining and marketing operations in the western United States and it hit upon us that BHP owned assets -- a refinery in Hawaii and retail -- and we approached them. It was the only refining and marketing operation in their whole portfolio. What we liked about Hawaii was that it was very similar to the Alaska operation. They were one of only two primary refineries there and there were probably under 10 retail (gas) brands in the state. It was truly a niche market and we felt we operated in a niche market (in Alaska) in an environmentally sensitive area very well and understood what it took to do so."

Tesoro entered the Hawaii market on May 29, 1998, when it purchased one of the state's two refineries and 32 Gas Express retail gas stations from Broken Hill Proprietary Co. subsidiary BHP Hawaii Inc. for $243.5 million in cash plus a promissory note of $50 million. The refinery, which is capable of processing 95,000 barrels of crude oil per day, is located at the Campbell Industrial Park in Kapolei and competes with the 54,000-barrel-a-day refinery operated by Chevron at the same location.Tesoro says its Hawaii refinery produces about 95 percent of the state's ship fuel, more than 60 percent of the jet fuel used by commercial and military aircraft, more than 60 percent of the diesel fuel, about 50 percent of the fuel oil used to generate electricity and about 30 percent of the gas consumed locally.

In addition, Tesoro's original 32 namesake gas stations in the state have grown to 36, with 25 on Oahu, seven on the Big Island and four on Maui. All but three are company owned.

Tesoro, which has a companywide crude capacity of 390,000 barrels per day, doesn't break out earnings for its individual refineries so there's no way of telling how much the Hawaii refinery contributed to the company's record net earnings of $73.3 million in 2000.

But Kurren, whose subsidiary employs about 700 locally, said the company now is more "efficient" than it was under BHP.

In addition, Tesoro also rid itself last year of its portion of a $2 billion antitrust lawsuit the state filed in late 1998 alleging that seven oil companies in Hawaii conspired to keep gas prices artificially high in Hawaii. In January 2000, a federal judge approved a $15 million settlement between the state, Tesoro and BHP Hawaii. The trial for the remaining five companies, including Chevron, is scheduled for next year.

Despite the pending lawsuit, Honolulu's gas prices continue to rank among the highest in the nation. In fact, last week's Lundberg survey of nearly 8,000 gas stations nationwide showed that Honolulu's $1.87 average price for all grades of gas, including taxes, was the most expensive in the United States and easily towered above the national average of $1.34.

The national weighted average price of gas, including taxes, at self-serve pumps was about $1.31 a gallon for regular unleaded, $1.41 for midgrade and $1.50 for premium. By comparison, the Tesoro gas station at King Street and Kalakaua Avenue that is listed in the weekly Star-Bulletin survey posted prices last week of $1.859 for regular unleaded, $1.959 for midgrade unleaded and $2.039 for premium unleaded.

All this comes despite rising inventories that have been reported by the American Petroleum Institute and crude oil prices for November delivery on the New York Mercantile Exchange that have been hovering around $22 a barrel.

"It's difficult to answer specific questions about pricing because of the ongoing lawsuit against the other companies in town," Kurren said. "In general, though, it's just priced to the relevant market. There are many products in our market that are more expensive here than elsewhere.

"The price of crude is just one of the factors that go into the determination of the price. The most persuasive factor is competition in the marketplace."

Jacques Rousseau, an analyst for Arlington, Va.-based Friedman, Billings and Ramsey, agreed that cheaper oil prices don't always translate into cheaper costs at the pump.

"For refining companies, their key indicator is the refining margin -- the difference of what they pay for crude oil which goes into the refinery and the value of what they sell that gas, heating oil, jet fuel or diesel oil," he said. "It's not a straight correlation between oil price and refining margin. When oil prices go down, it's obviously a positive for the companies as long as the price of their products don't go down more.

"But you always have to look at the price of the margin. (The companies) really don't have control over it because the market sets the price for gas and heating oil. So when the crude level price goes up, it's not necessarily good or bad. But if inventory levels start to build, that's not positive for refinery companies because demand for these products will have more supply to meet it. It's a supply-demand equation."

Tesoro Hawaii gets its crude oil supply for the state primarily from Alaska, Australia and Southeast Asia. Tankers carrying an average of 600,000 to 800,000 barrels of crude make four to six deliveries to Tesoro Hawaii each month. The deliveries are made to a mooring terminal, which is a floating buoy anchored in 100 feet of water about 1 1/2 miles offshore of Barbers Point. Three underwater pipelines are used to transfer crude oil deliveries to the refinery and to load products from the Hawaii refinery to ships and barges. In addition, four 2 1/2-mile pipelines extend from the refinery to Barbers Point Harbor to transfer refined products to ships or barges.

Meanwhile, the parent company's western U.S. expansion now encompasses more than 600 stations, including about 50 Wal-Mart sites that sell Tesoro's "Mirastar" brand under an exclusive agreement that the companies negotiated last year for 17 states. Tesoro expects to have an additional 60 to 70 Mirastar stations operating in both 2002 and 2003.

Tesoro, whose debt has grown to nearly $1.2 billion with the $677 million deal to acquire the Utah and North Dakota refineries and other related assets, may look for further acquisitions once it pays down some of its debt, Rousseau said.

"I think they would like to get a refinery in California and have synergy with the Hawaii operations to move products back and forth," he said.

Tesoro, which employs about 700 people in Hawaii, now has a combined crude capacity of 390,000 barrels per day.

Credit Suisse First Boston analyst John McNulty, who says his "hold" rating on the stock is related to the whole sector, is generally upbeat on the company.

"I think the (Utah and North Dakota) acquisition was a good one," McNulty said. "I think there were mixed reviews when the news came out. A lot of people looked at it and said Tesoro may have paid too much. But the measures they were using to look at it were pretty bad ones. In actuality, it was a good deal. It was not too expensive and the company's average returns should be better with those assets in their portfolio."

In fact, Tesoro, which warned in its second-quarter earnings report in August that it would miss analysts' third-quarter estimates, reversed itself late last month. The company issued a press release Sept. 27 saying that the refining and marketing operations of the Utah and North Dakota businesses would result in the company exceeding analysts' third-quarter estimates of 33 cents per share.

"I think when you add refining assets (such as the Utah and North Dakota operations), you end up reducing the risk profile for the company because if you have an explosion at a plant or a plant is down for a time, it has a bigger effect on earnings then if you have five or six plants and one goes down," said the New York-based McNulty. "The additional plants tend to take the volatility out of a company's earnings stream. All in all, the company is heading in the right direction."

Rousseau has a "buy" recommendation on the stock.

"I think the piece of the puzzle most people are missing is that they've made a lot of different acquisitions and improvements," Rousseau said. "They bought two refineries from BP. They also have a heavy oil project in an Anacortes refinery near Seattle."

The project, with $30 million to $50 million savings per year, should be a promising payout for a $100 million investment, he said.

"The third piece of the program is the Mirastar program with Wal-Mart. Those (Mirastar) earnings have not been fully realized in the share price," he said. "So when you add up all those pieces, they're going to significantly enhance their earnings and cash flow."