Bishop Street BEAR MARKETS bring many investors to their knees.

finds comfort

in bonds

Although the Equity Fund

has taken its lumps, fixed income

has provided balance to

clients' portfoliosBy Dave Segal

dsegal@starbulletin.comBut Anthony Goo, chief investment officer of Bishop Street Capital Management, is still standing thanks to his company's philosophy of keeping a balance between stocks and bonds.

Not that this market has been easy to navigate.

Goo, who oversees the Bishop Street Equity Fund, Bishop Street Hawaii Municipal Bond Fund and Bishop Street High Grade Income Fund for the wholly owned subsidiary of First Hawaiian Bank, has seen those funds turn in mixed performances this year in relation to their peers.

Still, the fixed-income funds' positive returns have helped smooth out what has been another tumultuous year for most U.S. stock funds.

"Our basic belief when it comes to successful investments is to have a strategic asset allocation between stocks and bonds," said Goo, whose company has just under $3 billion in assets under management.

"We don't try to time the market. We have a long-term outlook for the client to achieve the client's objectives. I do think now would be a good time to increase our exposure to equities over bonds as the bond market is overextended in valuation relative to stocks.The Hawaii Municipal Bond Fund (Class A), which primarily buys investment grade (BBB or higher) Hawaii municipal securities, through Thursday had posted a total return of 5.66 percent this year and 9.95 percent over the past 52 weeks, according to Denver-based Lipper Analytical Services. Its net asset value, the price of the fund's shares, closed yesterday at $10.97.

The High Grade Income Fund (Class A), which purchases government, agency and corporate notes and bonds, through Thursday was up 5.82 percent since Jan. 1 and 9.11 percent over the past year. Its NAV closed yesterday at $9.99.

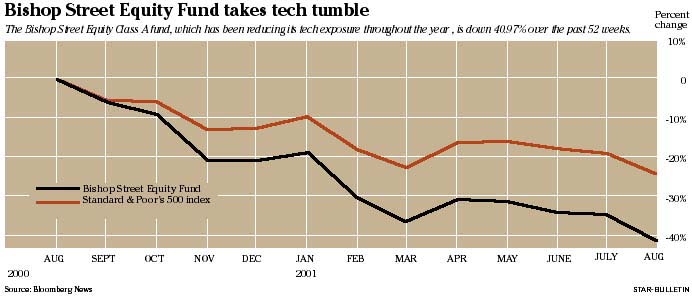

And the Equity Fund (Class A), which Goo describes as a large-cap blend fund with a growth bias, through Thursday had fallen 25.35 percent year-to-date with a 40.97 decline over the past 52 weeks. Its NAV closed yesterday at $10.12.

The Hawaii Municipal Bond Fund has been the shining star, so to speak, of the three funds, with its institutional shares earning a maximum five-star rating from Chicago-based research firm Morningstar.

Hawaii Municipal Bond's retail Class A fund (which is available to individuals) isn't rated by Morningstar since it is less than 3 years old, but the fund's holdings for both institutional and retail clients are the same. The institutional shares generate a slightly higher return than the retail shares because they have a lower expense ratio. The institutional and retail assets under management in the fund are $156.30 million.

"We have the latitude to invest up to 35 percent in non-Hawaii paper but we're about 93 percent invested in Hawaii right now basically because of valuation," Goo said.

"The value of Hawaii bonds are comparable and competitive and we felt we could benefit from the full exemption (earnings are exempt from both federal and state taxes). We have the other 7 percent invested in the Puerto Rico Commonweath, but that's fully (tax) exempt as well."

Only earnings generated by certain non-Hawaii paper in the fund would be taxable, but due to the fund's present holdings, all of the income it generates is free of taxes.

The Hawaii Municipal Bond Fund, according to Lipper, ranks first out of nine funds in its category with returns of 5.64 percent and 6.64 percent, respectively, for its institutional shares over the past 3- and 5-year periods. The retail class, which has a 4.25 percent front-loaded sales charge and was started on June 14, 1999, is ranked fourth out of 10 funds in its category since the start of the year and fifth over the past 52 weeks.

Its top three issues as of July 31 were Honolulu City & County General Obligation bonds, Hawaii State General Obligation bonds and Honolulu City & County Wastewater System Revenue bonds.

High Grade has 3 stars

The High Grade Income Fund, which has a three-star rating from Morningstar for its institutional shares, like the municipal fund was opened to retail clients on June 14, 1999. The High Grade Income Fund retail shares rank near the bottom among its peer funds, placing 159th of 183 funds year-to-date and 172nd out of 175 over the past 52 weeks. The institutional and retail assets under management in the fund are $125.60 million. The front-loaded sales charge for the retail shares is 4.75 percent.Goo, whose top three holdings were U.S. Treasury bonds (7.25 percent yield), U.S. Treasury notes (6 percent yield) and Federal National Mortgage Association bonds (7.25 percent) as of July 31, said there's a shift under way in his portfolio as he looks to reduce his exposure to Treasuries in light of the Federal Reserve's seven interest-rate cuts this year.

Reducing Treasuries

"We just feel that while they served their purpose during the slowdown, in anticipation of a stronger economy next year we think that corporate debt will outperform Treasuries," Goo said."Our bond strategy is to reduce our exposure to Treasuries because they are currently overvalued relative to corporate notes and bonds and to increase our exposure to corporate bonds.

"The average length of maturity (for the fund of 61/2 years) is slightly shorter than the Lehman Government Credit Index (which has 9.54 years average maturity and is the index to which the High Grade Income Fund compares its performance). The reason for shortening our maturities is in anticipation of higher yields in 2002, which has an adverse impact on bond values."

The Bishop Street portfolio that has felt the brunt of the economic slowdown has been the Equity Fund, which has been overweighted in technology this year and has suffered accordingly with the tech meltdown.

The Equity Fund, which has a two-star rating from Morningstar for its institutional shares, has been a middle-of-the-pack performer in relation to its peer groups.

Lipper ranks the 5.75 percent, front-loaded retail class 510th out of 869 year-to-date and 394th out of 807 over the past 52 weeks. The institutional and retail assets under management in the fund are $262.80 million.

The Equity Fund's top 10 holdings are Citigroup Inc., a diversified financial services holding company; General Electric Co., a diversified manufacturer; Microsoft Corp., a software maker; Tyco International Ltd., a diversified manufacturing and services company; Bank of New York Co., a financial services company; American Express Co., a financial services company; Pfizer Inc., a pharmaceutical company; Intel Corp., a chipmaker; Wal-Mart Stores Inc., a retail discounter; and AES Corp., an electricity generation company.

Cutting back on tech

"What we've been doing is reducing our exposure to technology, but not to the core names like Microsoft, Intel and AOL," Goo said."We've sold telecommunication equipment companies like Nortel and software companies that had high valuations like Siebel. We've reduced our exposure and reduced our volatility as well."

Goo said at the beginning of the year that the Equity Fund was about 6 percent overweighted in technology compared to the sector's 35 percent representation in the Standard & Poor's 500 index, which is the benchmark by which the Equity Fund measures its performance.

S&P 500 outperforms

S&P 500, which has outperformed the Equity Fund, is down 14.1 percent year-to-date and 25.5 percent over the past 52 weeks,As tech stocks sold off, the sector's representation in the S&P dropped to 23 percent while the Equity Fund's tech holdings dropped to 20 percent of its total portfolio.

Now, Goo said, the Equity Fund is only about 1 percent overweighted in tech, with the sector representing about 19 percent of his portfolio compared to the S&P 500's 18 percent weighting in technology.

"We still think there's poor sentiment in the market against technology right now," Goo said.

"There's quite a bit of inventory overhang that's going to have an impact on corporate profits for the next couple of quarters that will prevent a quick recovery there.

"Where we're building our sector position is in basic materials. And we have a fairly decent position in energy stocks, primarily oil and gas exploration and production companies like Anadarko Petroleum.

Likes basic materials

"We also like Dow Chemical because it's somewhat of a late-cycle type, and as the economy comes back, commodity prices will start to pick up again. People will start to use more industrial gas and chemicals and we're building up our basic materials sector."The time to buy them is in the tail end of an economic downturn. If you're anticipating an economic boom next year or the following year, then companies like chemicals and metals will begin to perform better."