A Tale of One's going to France. The other's going local.

Two Banks

Coming home, going abroad

Rick Daysog

Star-bulletin

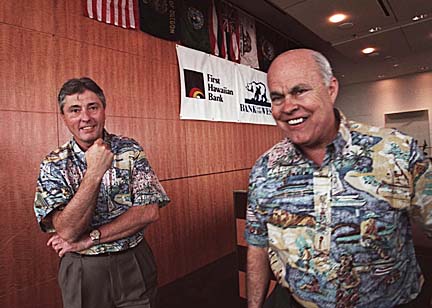

The tale of Hawaii's two banks is of vastly diverging destinies: First Hawaiian Bank, enjoying record earnings and unprecedented mainland growth, is aiming to double its size once acquired by French banking giant BNP Paribas SA.

Bank of Hawaii, hampered by bad loans in Asia and troubles in the mainland syndicated loan market, is retrenching to Hawaii. It plans to sell off most of Asia-Pacific holdings and its 19-branch California subsidiary, eliminating about 1,000 jobs.

The new paths taken by the state's two dominant financial institutions change their century-old rivalry, with one emerging as a super-regional lender while the other sheds its grandiose Pacific Rim expansion to become more of a community bank.

While both recent moves were cheered by investors who bid up the banks' stock prices recently, the new directions also put a spotlight on both institutions' decade-long strategies to diversify outside Hawaii.Why one plan succeeded where the other failed is partly the result of global economic trends beyond anyone's control. But it is also the product of the day-to-day decision-making that goes into running a major regional bank.

"For years, the two banks have been neck and neck," said analyst Richard Dole, chief executive officer of Dole Capital LLC. "Now one is expanding and the other is shrinking."

East vs. West

In many ways, the changes at the two big banks are a direct result of the 1990s Hawaii recession. Faced with the prospect of limited or no growth at home, both banks looked to new markets.

First Hawaiian went to the West Coast and methodically built its franchise by buying bank branches required to be divested as part of large-scale bank mergers.

Bank of Hawaii and parent Pacific Century Financial Corp., which launched its Asia-Pacific diversification more than 40 years ago, stepped up its lending and acquisitions in the region during the 1990s, hoping to take advantage of the Asian economic miracle. The bank also expanded into syndicated lending on the mainland.

Filings with the Securities and Exchange Commission show that Pacific Century's foreign loans rose from $593.5 million in 1993, or about 8.2 percent of the bank's overall loan portfolio, to $1.8 billion, or 18.5 percent of the bank's loan portfolio, in 1998. Last year, Pacific Century's outstanding foreign loans totaled $1.3 billion, or about 13.4 percent of all outstanding loans.

The company's nonperforming assets and loans 90 days past due more than doubled, to $201.8 million in 2000 from $78.8 million in 1993.

While Bank of Hawaii's strategy appeared sound in theory, the timing was terrible. Its big push in the Pacific Rim came in the latter half of the past decade, just as the 1997 Asian financial crisis began destroying financial markets throughout the region."It was out of the frying pan and into the fire," said David Winton, a New York-based banking analyst at Keefe Bruyette & Woods Inc. "There may have been some mistakes and many of those mistakes may have been corrected but the damage is done."

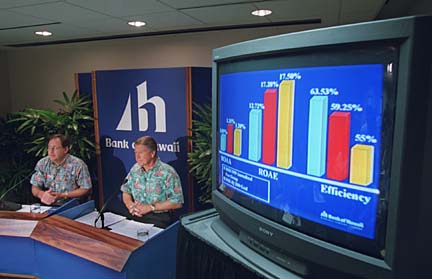

Michael O'Neill, who took over as Pacific Century's chairman and chief executive officer in November, said the decision to increase lending in Asia should be seen in the context of a sluggish mainland economy and double-digit growth in the Pacific Rim.

However, he said, the net effect of the move was to add risk. O'Neill recently noted that Bank of Hawaii has only a 1 percent share of the Asia market, which is dominated by the largest financial institutions in the world.

"Our ability to manage this far-flung network has been tested and we concluded that the complexity and the cost of managing this business, together with the volatility inherent in it, made it impossible to justify," O'Neill said in a recent teleconference with Wall Street analysts. "Diversification has to be done artfully. You don't diversify by taking more risk than you have."

Branches and mergers

When Walter Dods, chairman and chief executive officer of First Hawaiian Bank and parent BancWest Corp., considered expanding into the Asia-Pacific region five years ago, he found the market already dominated by major players he couldn't compete with.

The South Pacific market -- with the exception of Guam and Saipan where First Hawaiian operates branches -- was not attractive either, Dods said.

"What do we have to offer in Asia that would be more competitive than that offered by all of the large banks like Citicorp, Fuji Bank, Deutsche Bank? The answer that came back to me was Zippo. Nothing," Dods said. "I didn't see the kinds of yields that I thought would make it profitable to run from a long distance."

Instead, First Hawaiian concentrated on the West Coast, which endured considerable consolidation in the past few years.

In 1995, the company picked up 30 branches in Oregon, Washington and Idaho as a result of the $1.6 billion merger between U.S. Bancorp and West One Bank.

U.S Bancorp and West One were required to sell the branches to address antitrust concerns raised by the merger. Dods said First Hawaiian's $38 million purchase wasn't the high bid, but the sellers -- who Dods knew personally from his role on the board of the American Bankers Association -- accepted his offer partly because First Hawaiian wasn't a major competitor in the Pacific Northwest.

In 1998, First Hawaiian merged with BNP Paribas' California-based BancWest Corp. in a $905.7 million deal that allowed local managers to retain control and provided additional capital for expansion.

The new company, known as BancWest Corp., in 1999 acquired SierraWest Bancorp., which operates 20 branches in Northern California. The following year it entered into an agreement to purchase 23 branches in New Mexico and Nevada from Wells Fargo & Co. and First Security Corp. Wells Fargo and First Security were required to divest themselves of the branches as a result of their merger.

Tale of the tape:

Here's how Hawaii's two biggest financial institutions measure up against each other.

BANCWEST CORP.

Chief Executive Officer: Walter Dods

Founded: 1858 (First Hawaiian)

Employees: 5,300 (About 2,200 in Hawaii)

Branches: 252 (56 in Hawaii)

Assets: $19.4 billion

2000 net income: $216 million ($1.73 per diluted share)

Main subsidiaries: First Hawaiian Bank, Bank of the West.

Markets: Hawaii, California, Oregon, Washington, Idaho, New Mexico, Nevada, Guam and Saipan

PACIFIC CENTURY FINANCIAL CORP.

Founded: 1897

Employees: 4,166 (about 3,000 in Hawaii)

Branches: 163 (76 in Hawaii)

Assets: $14.4 billion

2000 net income: $113.7 million ($1.42 per diluted share)

Main subsidiaries: Bank of Hawaii, Pacific Century Bank

Markets: Hawaii, California, Arizona, New York, Asia (offices in 6 countries), South Pacific (branches in 6 locations) and the Western Pacific.

"BancWest expanded differently on the mainland and they didn't lend in the problematic sectors like Pacific Century," said analyst Ken Ritz, a director with Fitch Ratings in New York.

Looking forward, Dods said that BNP's pending takeover of BancWest will allow the company to continue its ambitious growth plans. With the French bank now footing the bills for mergers and acquisitions, the goal is double the bank's size, making it the nation's 25th largest bank, according to Dods.

The new financial backing will allow BancWest to look to acquirer larger banks with assets of $1 billion to $5 billion.

For the Bank of Hawaii, the plan is not to get bigger, just better.

The company has a business relationship with six of every 10 households in Hawaii, either in the form of consumer loan, checking account or brokerage account.

But more than half of those households subscribe to just one service. And the bank receives only one in 10 of all local consumer expenditures on financial services.

O'Neill believes those numbers represent tremendous opportunities to cross-sell company products, such as home insurance or brokerage services to people who have a mortgage or trust account with the company.

To do so, he's willing to step up investment for training, personnel and branch services to make that work. In addition to major upgrades of their branch systems, O'Neill said the bank is in the process of adding about 140 new positions to branch staff.The bank will also invest in additional training for its customer representatives so that they can better understand the wide range of financial products the bank offers.

Residential lending and small business lending are other growth targets. For years, the Bank of Hawaii was a leader in the mortgage lending business. However, its growth is hampered by the costs of keeping the loans on its books.

In the future, the bank hopes to avoid the costs and reduce risk by selling off its new home loans on the mainland while retaining servicing responsibilities.

As for the small business sector, O'Neill said he hopes to expand the bank's already healthy 31 percent market share in the small business lending environment. With recent cutbacks by General Electric Capital Corp. and other small business lenders, O'Neill believes that there are opportunities in this sector.

To be sure, the company needs to work hard to win back its local customers. Last year's controversial New Era redesign not only slashed more than 1,000 jobs from the company's payroll, it alienated many consumers who were not accustomed to the changes at the bank.

"Unfortunately, that all-consuming process had an unintended consequence: We lost touch with our customers," O'Neill said.

"However, we have stored up much good will over the years that they have not left us. We will not take them for granted. We are rededicating ourselves to keep our customers in the front of our minds."