Cyanotech seeks ITS SHARES TRADE for about half the cost of a cup of cappuccino.

healthy profits

The Kona biotech firm hopes

that new uses for its nutritional

products will deliver big returnsBy Dave Segal

Star-BulletinBut while Cyanotech Corp.'s stock price might be watered down at $1.06, the company itself has plenty of nutritional value.

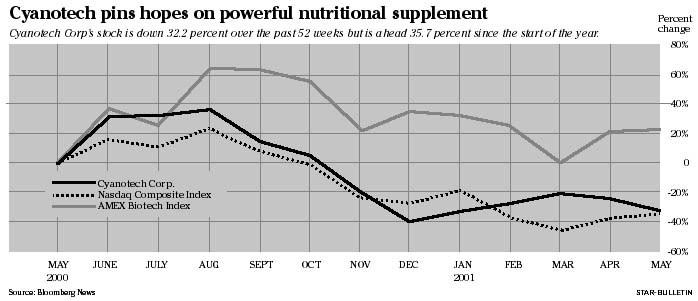

The Big Island biotechnology firm, which develops and commercializes natural products from microalgae, hasn't had a profit in the past 15 quarters. But its stock has soared 35.7 percent this year as enthusiasm builds for its nutritional supplement BioAstin.

The company has filed patent applications covering four health benefits for its powerful antioxidant, a nutrient that is being tested for its effect on alleviating carpal tunnel syndrome, reducing sunburn from ultraviolet rays, relieving muscle soreness from strenuous exercise, and ameliorating cold sores and canker sores.

If ongoing clinical trials involving BioAstin produce positive results and the company has scientific support to make claims about the added benefits of the antioxidant, then Ronald P. Scott, executive vice president and chief financial officer, says Cyanotech expects to be profitable in the current fiscal year. In fact, directors and officers of the company in March purchased 56,000 shares on the open market.

"It's kind of an interesting business," Scott said. "Back in 1997, we had a profit of $4.2 million on sales of $11.4 million. Our largest customer at that time was a multilevel marketing company in China, and when the Chinese government banned multilevel marketing, it essentially put them out of business and we lost about 40 percent of our sales."Once we get revenues up past break even, we've got a lot of fixed costs and we get very profitable. We expect to be profitable in the current fiscal year that just started. That's because our revenues before (when Cyanotech had the China contract) were growing in excess of 60 percent and our net income was growing in excess of 130 percent. We think we can get back in the near term to those kind of growth rates and that growth is going to come from BioAstin."

In the 2001 fiscal year that ended March 31, Cyanotech lost $1.07 million, or 7 cents per share, compared with $4.49 million, or 34 cents a share, in the year-earlier period. Full-year sales increased 8.7 percent to $8.04 million compared with $7.40 million in the previous 12 months.

While BioAstin offers the best hope for the future, the main product driving the company's revenues -- then and now -- is Spirulina. Unlike BioAstin, Spirulina is not a single compound but a whole food. Spirulina is a microscopic algal vegetable, which offers amino acids, B vitamins and beta carotene, as well as being high in protein and rich in plant nutrients.

"The National Cancer Institute recommends people eat five to six servings a day of fruit and vegetables," Scott said. "Most people don't, but they get most of the nutrients they need in a daily dose of Spirulina."

Cyanotech, which began selling Spirulina to China in 1994, also had a healthy stock price at the time as well. Shares of the company hit an all-time high of $13.88 on Nov. 27, 1995.

"We started selling to them in 1994 and when we really stopped selling to them in significant volume in 1997, we were on about a $4 million a year rate (in sales). There were a lot of other programs going on in the company to support additional growth, and when that (China deal) didn't happen, it took awhile to regroup and restrategize."

Today, Cyanotech's stock hovers around $1 on the Nasdaq Stock Market. Nasdaq rules require a company to maintain a price of at least $1 or face a warning and possible delisting if the price falls below that level for more than 30 consecutive business days. If a company gets a deficiency notice, it has 90 calendar days to regain compliance.

Cyanotech was beneath the $1 level for 67 days in 1999, hitting a low of 53 cents on six separate occasions that year, before finally topping the $1 mark again on Dec. 20, 1999. The stock began this year at 78 cents.

"(Delisting) is always a concern but at this point we're in compliance with all Nasdaq rules," Scott said. "We were faced with the possibility of being delisted, but with the price over $1 now that threat has been put aside."

Cyanotech also spent 21/2 years embroiled in intellectual property litigation over proprietary microalgae cultivation techniques with Kona neighbor Aquasearch Inc. A settlement in the case finally was reached in March, with Cyanotech agreeing to pay Aquasearch undisclosed royalties.

"I'm glad it's over," Scott said. "We spent a lot of time on that -- more than we wanted to."

Meanwhile, restrategizing has meant finding more uses for BioAstin, a product containing natural astaxanthin -- an antioxidant produced by microalgae -- that has been shown to have benefits surpassing many leading vitamins and beta carotene. It is one of the four products that the company develops from more than 30,000 species of microalgae.

"We just completed one evaluation study of BioAstin in terms of its effects in reducing sunburn and it was a positive outcome," Scott said. "It only lasted about a month and we got the results back very quickly and now we want to follow with a larger study. What we're looking at doing is developing specifically formulated products that might actually improve the performance.

"We also have a clinical trial ongoing to assess BioAstin's effect in alleviating carpal tunnel syndrome and hope to have some preliminary results available in June. We have another study that we started in April to assess whether BioAstin is effective in reducing muscle soreness after strenuous exercise and we hope to have some preliminary results in June.

"If the results are successful, then we're able to make label claims under the DSHEA (Dietary Supplement Health Education Act). Under those rules, if you have credible scientific support for your claims, you can make label claims even though they haven't been approved or reviewed by the FDA (Food and Drug Administration)."

Besides BioAstin and Spirulina, Cyanotech's other products are NatuRose, which is used in the aquaculture industry to impart a natural pinkish hue to farm-raised fish and shrimp, and phycobiliproteins, which are highly fluorescent pigments purified from microalgae that are used in immunological diagnostic tests.

NatuRose gives fish-farmers the ability to grow salmon and other fish using the natural pinkish substance rather than using synthetic pigmentation that could create health concerns for people who eat fish.

Phycobiliproteins, due to their highly fluorescent characteristics, are used in laboratories as markers in cancer research.

"Spirulina accounts for about 75 percent of our sales," Scott said. "But where the real growth of the company is going to come is from sales of BioAstin and to a lesser extent NatuRose. Both BioAstin and NatuRose account now for 20 percent of sales while phycobiliproteins is about 5 percent."

Taglich Brothers Inc.'s Gary Weber, the only Wall Street analyst to cover the company, rates Cyanotech a "speculative buy" with a 15-month price target of $4.20. Taglich Brothers, a broker-dealer founded in 1992 and based in New York, focuses exclusively on companies with less than $250 million in total worth.

"Basically, when you have a small early stage biotech company it's not going to be a 'strong buy' because most of its revenues and earnings are in the future," Weber said. "We see in Cyanotech some products that have excellent potential, especially with holistic and nutritional products and the antioxidant craze.

"Its nutritional product BioAstin is an antioxidant. And that's where the market is headed in nutritional supplements. It's also where the medicine field is finding excellent health benefits."

Cyanotech, which opened its production facility on the Big Island in 1985, moved its corporate headquarters from Seattle to Kona in 1990. Scott says the Big Island is the perfect location for the company.

"Microalgae needs sunlight, water and warm average temperatures," Scott said. "And where we are here, Keahole Point has more sunlight of any coastal location in the U.S. We have abundant freshwater and seawater resources and our average daytime temperatures are from 80 to 90 degrees all year. That's just perfect for growing a wide range of 30,000 species of microalgae."