Upturn for Until four months ago, Pacific Century Financial Corp.'s stock had been about as credit worthy as a bad loan.

Bankoh stock

The shares have soared since

By Dave Segal

O'Neill took over but some

analysts remain unconvinced

Star-Bulletin

The shares of Bank of Hawaii's parent had fallen to a near-10-year low of $11.25 and Chairman and Chief Executive Officer Lawrence Johnson was under pressure to improve the company's earnings. To make matters worse, neighborhood rival First Hawaiian Bank, owned by BancWest Corp., had seen its stock shoot up by virtue of its mainland investments.

But since former Bank of America executive Michael O'Neill took over as chairman and CEO on Nov. 3, he has refocused the company and pledged to buy $10 million worth of Pacific Century shares on the open market.

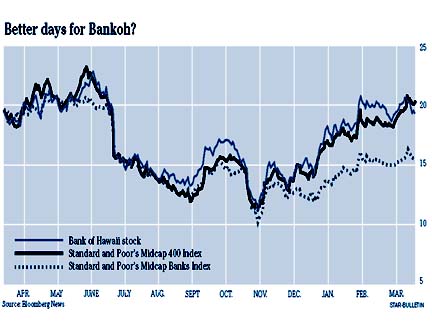

Pacific Century's shares, which fell 5.4 percent in 2000 (compared with BancWest's 34 percent increase), have gained 9.5 percent so far this year and 42.8 percent since O'Neill took charge. The shares closed yesterday at $19.37, a sharp rise from its price of $13.56 on the first trading day after O'Neill's appointment.

O'Neill has lived up to his vow, purchasing about 741,007 shares at a cost of about $11.3 million. The price of the purchases ranged from $14.25 to $20.16 a share. As of Wednesday, his shares were valued at more than $14.2 million, giving him a profit of nearly $3 million.

Analysts hold off

Still, analysts have been reluctant to jump on the Pacific Century bandwagon. Of the nine analysts covering the company, only one has a "buy" rating on the stock, while seven have "hold" ratings. The remaining analyst, Dave Trone of Prudential Securities in New York, initiated coverage Monday with a "sell" rating. Trone rates nine of the 15 companies he covers as "sell."

"The general reason why I choose to single out a group of companies as underperformers is that I believe they have downside earnings risk," said Trone, who has "strong buy" ratings on the remaining six. "Credit issues don't get cleaned up in one shot. I've seen this movie before. I know the ending."O'Neill, however, says the company's script is still being written.

"The story hasn't been told,' O'Neill said. "The story gets told on April 23 (when Pacific Century releases its earnings) and then over the course of the next couple weeks we'll see what they think of the story.

"They're now effectively making some estimate on what we may or may not do in the absence of clarity and they're not going to stick their necks out. If you measure how we've done against other financial stocks in the S&P 500, we've massively outperformed those companies."

The Standard & Poor's Midcap Banks Index, of which Pacific Century is a member, has fallen 6.1 percent this year, but is up 7.3 percent since O'Neill joined Pacific Century.

"The way I measure progress, as I've said repeatedly, is how our shareholders have done," O'Neill said. "The week before I joined Pacific Century the stock was at 11 something. And the stock now has been hovering around 20 for some time. I would say I feel very good about the progress but I'm certainly not by any means satisfied. We have a lot of work to do. My biggest priority in the next year is customer service. We need to improve in that area and we need to focus on it."

Since O'Neill gained control, Pacific Century has been streamlining its operations to improve profits. The company's moves included signing an agreement to sell its credit-card portfolio to a division of American Express Co., selling nine branches in Arizona to Zions Bancorporation and selling its interest in banks in Tonga and Samoa to Australia's Westpac Banking Corp.

The moves have won him favor from Jim Bradshaw, an analyst with D.A. Davidson Co. in Lake Oswego, Ore., whose "outperform" rating is the only so-called "buy" rating on the company.

"I think the read on why we like the stock is that we think the new management team will finish the job that the old management started in retrenching the company to a core base of operations," Bradshaw said. "Two of the areas dragging down performance were Asia and the syndicated lending group (shared loans with other institutions). The other three pieces are performing nicely -- Hawaii, California and the South Pacific."

Wait and see

Bank of Hawaii's earnings dropped 13.3 percent in the fourth quarter of last year, making $32.6 million compared with $37.6 million in the corresponding 1999 period. Part of the earnings decline can be attributed to the company taking steps to clear away bad loans and to improve the quality of its assets."On April 23, you'll understand what our game plan is for focusing on asset quality," O'Neill said. "We've brought in some people to deal with that. In the fourth quarter of last year, nonperforming loans declined by 17 percent."

Trone, though, wants to see more evidence of a turnaround before upgrading his rating.

"Change is always a positive in situations like Pacific Century," Trone said. "O'Neill will not have the sentimental connection with the company and the region that Johnson did so maybe he'll be more aggressive with the situation."

As the U.S. economy slows, though, financial stocks like Pacific Century should improve as interest rates fall and the cost of borrowing and refinancing becomes cheaper.

That bodes well for Pacific Century shareholders.

"O'Neill accounts for a big chunk of (Pacific Century's stock improvement) but we're also seeing rate cuts that are benefiting the financial stocks now, and he's benefiting from the timing of that," Bradshaw said.

"We've known O'Neill from his days back at Bank of America and obviously we're impressed with the financial discipline he brought to the old Bank of America. I'm sure he'll adopt many of those principles and we also think the economy will turn around."