Advertisement - Click to support our sponsors.

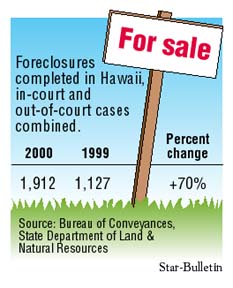

Home foreclosures Completed foreclosures in the state catapulted nearly 70 percent in 2000 from the previous year, a final, stinging reminder of Hawaii's economic hardship in the past decade.

leap 70 percent

Foreclosures, which can take

up to a year to close, lag

behind other economic

indicators, experts sayBy Tim Ruel

Star-BulletinA total of 1,912 foreclosures were completed in Hawaii last year, up from 1,127 in 1999, according to newly released figures from the state Bureau of Conveyances. The data, compiled monthly from the bureau's documents, count the combined number of in-court and out-of court foreclosures.

The increase and its negative implications appear to contradict other economic indicators for Hawaii, which mostly show improvement over the past few years. But foreclosures, which can take several months to a year to close, are a lagging -- though accurate -- marker of past economic activity, experts say.By most accounts, the jump was primarily fed by the Western side of Oahu, where home prices haven't rebounded like on East Oahu and the neighbor islands. Many families face mortgage payments that represent more than their property is worth. But if they sell in a down market, they'll lose income.

Instead, experts say, residents are increasingly turning to out-of-court foreclosure, which provides an easier way of turning in the keys to lenders.

Foreclosure attorney Kirk Caldwell said he saw more foreclosure cases close last year than opened, in line with the bureau's figures.

Real estate broker Coldwell Banker Pacific Properties said it closed on 384 foreclosures in 2000, up nearly 50 percent from 257 closings in 1999.

Much of the jump comes from the new popularity of so-called nonjudicial, or out-of-court foreclosures, said Lynne Kaneshiro, president of Island Title Corp., one of several local title insurance companies that began issuing insurance on nonjudicial foreclosure properties in the past couple of years.

Foreclosures that occur out of court essentially strip lenders of their legal ability to collect when sale of a home does not repay a loan. Lenders nationwide have increasingly started to accept this process, leaving consumers with a simple, cheaper alternative to going to court.

But the simplicity does not explain the jump in foreclosures by itself, attorney Mervyn Lee said.

West Oahu recovery lags

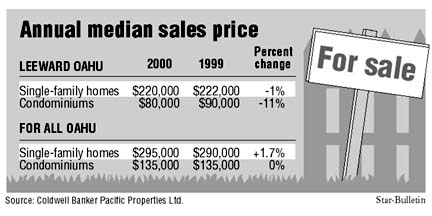

Many of the foreclosures came from West Oahu, where home prices have failed to recover since slumping earlier this decade, he said. The median price of single-family homes sold in Leeward Oahu in 2000 fell 1 percent to $220,000 from $222,000 in 1999, according to Coldwell Banker. At the same time, the median price for condominiums fell 11 percent.

"Somebody has to pay for that, and it's the sellers," said real estate agent Stephany Sofos.In contrast, the median price for homes on all of Oahu rose 1.7 percent to $295,000 from $290,000, while condo prices remained unchanged at $125,000, according to Coldwell Banker. The median is the level halfway between the highest and lowest sales price.

Resale home prices began falling in 1991, when Japan's economic bubble burst. Oahu home and condo prices began turning around as early as 1997, but the failure of West Oahu to catch on is no surprise to most observers.

"It's still a very tough market for the resale business," said Kaneshiro of Island Title Corp. "It's just certain areas that are doing better."

Leeward sales 35% of total

Leeward sales account for 35.7 percent of total Oahu sales in 2000.The main reason for West Oahu's slump is the high number of homes for sale, said John Connelly, broker-in-charge of Coldwell Banker's Kahala office and chairman of the Honolulu Board of Realtors. Developers Schuler Homes Inc., Gentry Homes Ltd. and Castle & Cooke Hawaii have been building several thousand new units in the area since the late 1980s, and plans for more stretch well into the future.

Real estate agent Sofos said only so many first-time buyers exist to buy all new homes being built in West Oahu. "I think we have a problem," she said.

Gentry, for one, recently finished 5,000 new homes in its Ewa development, and has plans for 4,000 more. Still, development is down 30 to 40 percent from what it was during the boom years, said Gentry President Norm Dyer.

He's confident the new units will sell, cutting both inventory and prices.

The market for first-time buyers, he said, is a predictable one, mainly composed of 20- and 30-somethings looking to move away from their parents. He noted that Gentry's rental properties in Ewa and Waipio have already started to see increases.

Improvement works way west

Harry Saunders, senior vice president of Oahu operations for Castle & Cooke Hawaii, said the high inventory and low prices are merely the result of an economic recovery that has been slow to spread across Oahu."(Improvement) always starts in East Oahu and works its way west," he said.

Castle & Cooke spent $100 million to build 430 new homes in Kunia and Mililani last year, and plans to finish 230 single-family homes in Waipahu by this fall.

If current demand for the units holds, they will sell quickly and prices will increase, possibly starting this year, Saunders said.

By most accounts, West Oahu prices, and the resulting number of completed foreclosures, should improve this year. Initial in-court foreclosure filings were down 26.6 percent to 2,153 cases in 2000 from 2,934 in 1999, although the number is still up 10 percent from 1,957 in 1995.

Initial filings are greater than actual closed foreclosures because some cases are settled before completion.

Nobody knows what the recent effect of the slowdown of the mainland economy will do to Hawaii's real estate situation, but one observer is concerned.

"The big thing about Hawaii is we're very fragile," said Sofos. "There are parts of our economy that have gotten better. But the majority does not have a lot of cash, because we've been lean and mean for so many years."