Advertisement - Click to support our sponsors.

Ex-Bishop trustees The five former trustees of the Kamehameha Schools have each paid the Internal Revenue Service several thousand dollars to settle the federal agency's claims that the former board members received excessive compensation.

pay IRS in settling

tax claims

The federal agency argued

that the trustees had received

excessive compensationBy Rick Daysog

Star-Bulletin

In statements released this morning, former trustees Henry Peters, Gerard Jervis, Richard "Dickie" Wong, Lokelani Lindsey and Oswald Stender said they have resolved their differences with the IRS, whose exhaustive, three-year audit of the Kamehameha Schools found that the ex-board members' $1 million-a-year salaries exceeded reasonable limits.

The former trustees did not disclose the amount that they had paid, but sources familiar with the IRS investigation said that the agency had recently assessed each trustee with an excise tax of about $40,000.

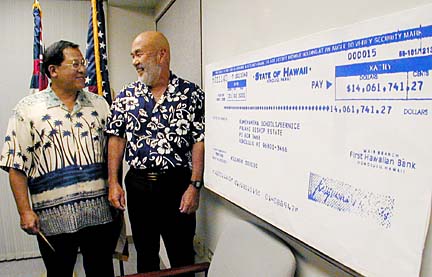

The deal with the IRS is part of the recently concluded, $20.1 million settlement between the attorney general's office and the former board.

In that agreement, the Kamehameha Schools will receive $14.1 million to cover alleged mismanagement by the former trustees.

In written statements, the former trustees said they settled with the IRS "to enable Kamehameha Schools to receive approximately $14 million under the settlement agreement approved by the Probate Court."

The IRS in 1999 threatened to revoke the trust tax-exempt status, saying the former board members took excessive compensation, mismanaged trust assets and neglected the estate's core educational mission.

The IRS audit has found that the former trustees, who resigned last year, should have been paid no more than $160,000 a year from 1990 to 1996.

Kamehameha Schools archive