Advertisement - Click to support our sponsors.

Hawaii stocks Hawaii's stocks got rocked in both directions by this year's hurricane on Wall Street, but an improving local economy helped ease motion sickness, analysts said.

mixed in 2000

Eight advanced while

12 other firms fellBy Tim Ruel

Star-Bulletin"The feeling is that Hawaii's economy is improving, and real estate holdings are improving as well," said Michael Kowal, account executive for the brokerage First Honolulu Securities Inc.

In recent years, Hawaii's stocks have fallen in the shadow of booming mainland stocks, as the state trudged through nearly a decade of economic hardship.

But intense speculation on technology issues -- which drove some mainland dot-com stocks up more than 1,000 percent last year -- ran out in March. "Last year, you could have a good idea and your stock would take off," Kowal said.

"I guess the pendulum swings both ways. People got back to reality."

As a result, stocks in companies with operations or headquarters in Hawaii were mixed this year, with more traditional, land-based and energy companies seeing gains, likely an effect of money flowing out of dot-com businesses. Meanwhile, local biotechnology and other higher-risk issues took their medicine.

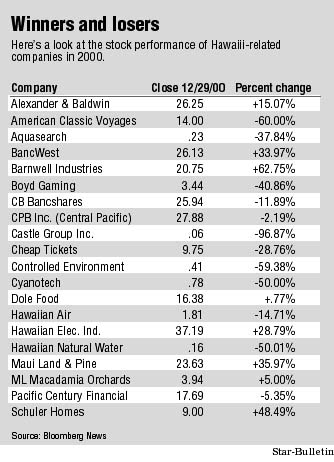

At today's close of the last trading day of the year, 12 of Hawaii's public companies were down for 2000, while eight were higher.

Alexander & Baldwin Inc. rose 15.1 percent, with earnings up 32.1 percent in the first nine months of the year. The former Big 5 sugar operator is on a continuing shopping spree for local real estate, with recent purchases including the five-story downtown Judd Building and the 18-story Pacific Guardian Tower on Kapiolani Boulevard.

With increased local holdings, A&B has been poised to benefit from Hawaii's recovery, said Richard Dole of Dole Capital LLC, a private-equity investment firm.

The story may change next year, however.

One of A&B's main subsidiaries, Matson Navigation Co., faces new competition in shipping to Hawaii, Dole said. Also, with the economies of the mainland and Japan both in doubt, Hawaii could be hit next year, along with A&B."The economic turnaround could come to an end very quickly," Dole said. "Hawaii is so dependent on California and Japan."

Another land-based company, Maui Land & Pineapple Co., faired well this year, up 36 percent, despite a 15 percent drop-off in the earnings in the first nine months of the year.

Interest in land on the Valley Isle was sparked last year by America Online Inc. Chairman Steve Case, who acquired a 41.2 percent stake in Maui Land for $39.2 million, Kowal said.

Another company that has recently acquired land in Hawaii, Schuler Homes Inc., has done well this year, up 38.5 percent as its earnings rose 74 percent for the first nine months. Schuler has recently announced plans to buy land and develop homes in Hawaii Kai, Kalama Valley and on Maui and Kauai.

A more unusual development on the market this year, analysts said, is the boom in the utilities sector, with the stock of Hawaiian Electric Industries Inc. up 29 percent.

With technology stocks down and energy prices soaring, speculators have gone after the once-neglected utilities market, Dole said. The main reason is that profits are up -- Hawaiian Electric recorded a 7.7 percent gain in the first nine months of the year.

Like the tech explosion, however, the utility boom may be short-lived, Dole said.

Meanwhile, Hawaii's biotech companies -- Aquasearch Inc., Cyanotech Corp., Controlled Environment Aquaculture Technology Inc. -- have all dipped by double-digit percentages this year. "I just think that's money coming out of the stock market," Kowal said.

Dole compared the technology fallout to Japan's bubble economy of the 1980s. He also noted that Cyanotech and Aquasearch, which haven't turned profits, have been further hurt by an ongoing legal war over intellectual property.

Another Honolulu-based company with a technology angle, Cheap Tickets Inc., dropped 28.8 percent, despite steady profits. Being a travel agency, the company is simply in a highly competitive industry with razor-thin margins, Dole said.

The one surprise this year was Hawaii's banks, all of which are down this year, with the exception of BancWest Corp, which went up 34 percent, following strong performance in its West Coast operations.

Pacific Century Financial Corp. is capping off a tumultuous year, in which bad loan write-offs made the company's stock hit an nearly 10-year low. Chief Executive Larry Johnson stepped down, and was replaced by industry veteran Michael O'Neill. The company's stock has since recovered, but still fell 5.35 percent for the year.

"As we speak, it's going through a review of its operations. I have no idea where it could end up," Dole said of Pacific Century, which is the parent of Bank of Hawaii.

Dole noted that the bank's new management may try to clean house by writing off more bad loans, which could lead to further drops in earnings, and possible the stock price.

Kowal said he expects Hawaii's banks to do better next year, particularly with the Fed poised to cut rates after raising them in the past year to stave off inflation. Previous rate cuts helped the Nasdaq achieve last year's surge, although heavy speculation played a key role.