Advertisement - Click to support our sponsors.

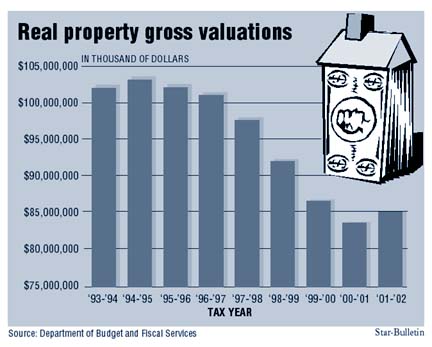

Property tax The value of all taxable properties on Oahu is up almost 2 percent this year -- the first increase since 1994-95.

valuations on Oahu

are up by 2 percent

The increase, the first since

1994-95, may mean higher taxes

for most island property ownersBy Gordon Y.K. Pang

Star-BulletinThe $85.1 billion valuation by the city Budget and Fiscal Services Department for fiscal 2000-01 represents a $1.9 billion increase from 1999-2000 values.

Whether that increase will mean higher taxes for most island property owners remains to be seen, Managing Director Ben Lee said yesterday.

Taxes owed by a property owner are based on multiplying the assessed value by the tax rate for a given classification of property.

With the increased valuations, that translates into a $3.5 million to $4 million increase in revenues from property taxes -- if the City Council keeps tax rates the same, Lee said.Mayor Jeremy Harris will be sending a balanced budget to the City Council the first week of March, which likely will set the tone for the discussion on rates.

The increase in values was driven strictly by the residential and apartment classifications, which went up 3.5 and 0.1 percent, respectively.

The valuation of all other property classes declined: commercial, 0.2 percent; industrial, 3.1 percent; agricultural, 11.3 percent; conservation, 7.3 percent; hotel/resort, 0.8 percent; and unimproved residential, 4.4 percent.

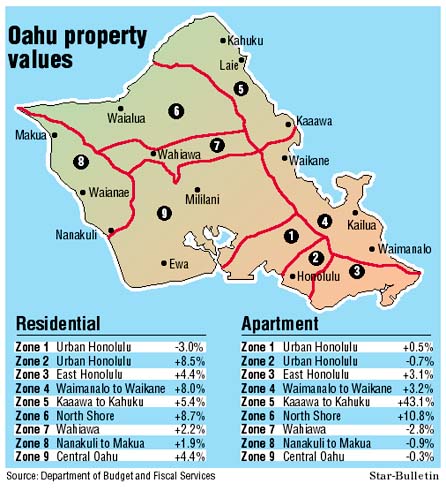

Single-family homeowners in the North Shore region saw an 8.7 increase in valuations, the highest among the nine zones classified by the Real Property Division.

The urban Honolulu region between Nuuanu and Kaimuki saw an 8.5 percent increase. The third-highest increases were in the area from Waimanalo to Waikane, which went up 8.0 percent.

Among other areas: Kaaawa to Kahuku was up 5.4 percent; East Honolulu and Central Oahu were up 4.4 percent; Wahiawa was up 2.2 percent; and Nanakuli to Makua was up 1.9 percent.

Only the area from Salt Lake to Nuuanu saw a decrease in single-family valuations, dropping 3.0 percent.

One Lanikai homeowner, who asked not to be identified, said he is contemplating an appeal after coming home on Monday to find a card stating that the assessed value of his property had gone up 39 percent."We've called half a dozen people in the neighborhood who had the same increase, and they are also upset," he said. "It seems pretty extreme for one year."

While Lee was ambivalent about how the valuations would affect homeowners' taxes, he thinks the numbers are good news for the real estate market.

"I believe the property values across the island have finally stabilized," he said. "The trend over the last five years has been on the decline, and we hope that it's bottomed out and on the increase over the next few years."

About 250,000 assessment notice cards were mailed to property owners Friday.

Appeals will be accepted through Jan. 16. Those who have not received assessment cards or have questions about their valuations may call 527-5520.