Advertisement - Click to support our sponsors.

Amfac to quit Amfac/JMB Hawaii LLC, the second-largest private landowner on Kauai, today said it plans to end all agricultural operations on the island starting later this year, closing two sugar mills, laying off all 400 workers and selling more than 17,000 acres of land.

farming on Kauai

The company says it will

close two sugar mills, lay off

400 employees and sell a

17,000-acre parcelBy Tim Ruel

Star-Bulletin"We regret having to take this action, but with losses mounting and no end in sight, we really had no choice," Amfac President Gary Grottke said today. Amfac's plantations have been operating since the 19th century.

Employee terminations, expected to begin Nov. 17, will come in phases, spokesman Jim Boersema said. Amfac has not decided exactly when its last harvest will take place on the Garden Island, and the two mills in Lihue and Kekaha will be the last part of the operation to close.The 400 lost jobs represents 1.5 percent of Kauai's work force of 26,600 as of July. The island had an unemployment rate of 6.5 percent in July.

The announcement follows the planned closing of the Paia sugar mill on Maui, announced Wednesday by owner Alexander & Baldwin Inc., which will lay off 77 workers before the end of the month.

In addition to getting out of sugar, Amfac has also said that at least three parties are vying to buy the bulk of Amfac's agricultural and conservation land on Kauai, which the company listed for sale Sept. 5.

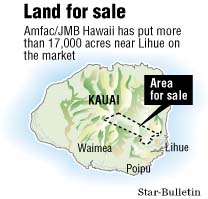

Amfac is asking $26 million for 17,779.7 acres, or about $1,462 an acre, agent Bob German said yesterday. The portion stretches from Lihue on the east side of the island up to Mount Kawaikini, Kauai's largest mountain. That's the bulk of Amfac's agricultural land, said German, president of Aloha Island Properties.

Grottke said the company needs cash and is refocusing on its developments on Maui, where it owns about 12,000 acres.

"Basically the company's strategy is to sell some of its large land holdings to raise cash to support its ongoing golf, agricultural and land development operations," Grottke said.

Grottke said the company likely would agree with the new owner to lease back some land.

"Taking control of such a large land holding is not an easy task," Grottke said.

The former Big 5 sugar company also has listed a separate 464-acre piece of oceanfront land in Hanamaulu, just north of the main parcel in Lihue. The asking price is $3.9 million.

"We have a critical need for cash at this juncture," Grottke said.

The company has posted multimillion-dollar year-end losses for 1999, 1998 and 1997, according to filings with the Securities & Exchange Commission. In the second quarter of this year, revenues fell 58 percent to $11 million from $26.3 million a year-earlier, and the company posted a net loss of $7.5 million, down from a gain of $6.5 million in second-quarter 1999.

Amfac is in financial trouble for several reasons:

It recently suffered a $4.2 million legal judgment against its former Oahu Sugar Co., which shut down in 1995.

Sugar prices have fallen 20 percent, or five cents a pound, in the past year.

And the state Employees' Retirement System is foreclosing on Amfac's two golf courses in Kaanapali, Maui, after Amfac defaulted on $77.4 million in loans and interest earlier this year.

Grottke said the company simply did not have the money to make payments, and stopped making payments to get ERS' attention.

Selling the Kauai land and closing the sugar operations will help bring the company out of its financial trouble, Grottke said.

German said six interested buyers have requested brochures for the land, and three of those could be within a week or two of signing a letter of intent. "I can say that there has been a lot of interest."

One company expressing interest was Continental Pacific LLC, a Troy, Ala.-based timber company whose principals made a failed attempt to buy C. Brewer & Co.'s parent Buyco Inc. in June.

The Alabama company sued C. Brewer last month, accusing Brewer of breaching contract obligations and hiding millions of dollars in payments to Brewer executives if the deal closed.

Brewer has called the charges reckless, baseless and without merit.

Continental has not made a decision on the Kauai property, but probably will not make an offer, said Jeremiah Henderson, part-owner of Continental Pacific, recently formed by the mergers of Strother Timberlands and Henderson Timberlands. The company owns 6,000 acres on the Big Island.

After selling the Kauai lands, Amfac's reduced holdings on the Garden Isle would include 500 acres of residential and commercial property in Lihue. In January, Amfac sold 1,400 acres of farm land mauka of Kapaa to entertainer and Honolulu native Bette Midler for $4.5 million.

Kauai's largest private landowner is the Robinson Family Partners, the last sugar plantation owner on Kauai with about 51,000 acres. A&B closed its McBryde Sugar Co. on Kauai in 1996.

Following the closure of the Paia sugar mill on Maui, Puunene Mill will be the only other sugar mill operating on Maui. Amfac also closed its Pioneer Mill on Maui last year.

Amfac is in discussions with local officials to transition its diversified agriculture -- seed corn, alfalfa, mangoes, papaya, gauva -- to other local farmers, Boersema said.

Grottke said Amfac has been refocusing its efforts in Hawaii to Maui, where a community group is making a master plan for a community on 3,500 acres of Amfac land.

By 2020, a part of the plot could see the development of residential homes and time-share resorts, Grottke said, adding that most of the land will remain open and green.

The company says it will close two sugar mills, lay off 400 employees and sell a 17,000-acre parcel

By Tim Ruel

Star-Bulletin

Amfac/JMB Hawaii LLC, the second-largest private landowner on Kauai, today said it plans to end all agricultural operations on the island starting later this year, closing two sugar mills, laying off all 400 workers and selling more than 17,000 acres of land.

"We regret having to take this action, but with losses mounting and no end in sight, we really had no choice," Amfac President Gary Grottke said today. Amfac's plantations have been operating since the 19th century.

Employee terminations, expected to begin Nov. 17, will come in phases, spokesman Jim Boersema said. Amfac has not decided exactly when its last harvest will take place on the Garden Island, and the two mills in Lihue and Kekaha will be the last part of the operation to close.

The 400 lost jobs represents 1.5 percent of Kauai's work force of 26,600 as of July. The island had an unemployment rate of 6.5 percent in July.

The announcement follows the planned closing of the Paia sugar mill on Maui, announced Wednesday by owner Alexander & Baldwin Inc., which will lay off 77 workers before the end of the month.

In addition to getting out of sugar, Amfac has also said that at least three parties are vying to buy the bulk of Amfac's agricultural and conservation land on Kauai, which the company listed for sale Sept. 5.

Amfac is asking $26 million for 17,779.7 acres, or about $1,462 an acre, agent Bob German said yesterday. The portion stretches from Lihue on the east side of the island up to Mount Kawaikini, Kauai's largest mountain. That's the bulk of Amfac's agricultural land, said German, president of Aloha Island Properties.

Grottke said the company needs cash and is refocusing on its developments on Maui, where it owns about 12,000 acres.

"Basically the company's strategy is to sell some of its large land holdings to raise cash to support its ongoing golf, agricultural and land development operations," Grottke said.

Grottke said the company likely would agree with the new owner to lease back some land.

"Taking control of such a large land holding is not an easy task," Grottke said.

The former Big 5 sugar company also has listed a separate 464-acre piece of oceanfront land in Hanamaulu, just north of the main parcel in Lihue. The asking price is $3.9 million.

"We have a critical need for cash at this juncture," Grottke said.

The company has posted multimillion-dollar year-end losses for 1999, 1998 and 1997, according to filings with the Securities & Exchange Commission. In the second quarter of this year, revenues fell 58 percent to $11 million from $26.3 million a year-earlier, and the company posted a net loss of $7.5 million, down from a gain of $6.5 million in second-quarter 1999.

Amfac is in financial trouble for several reasons:

It recently suffered a $4.2 million legal judgment against its former Oahu Sugar Co., which shut down in 1995.

Sugar prices have fallen 20 percent, or five cents a pound, in the past year.

And the state Employees' Retirement System is foreclosing on Amfac's two golf courses in Kaanapali, Maui, after Amfac defaulted on $77.4 million in loans and interest earlier this year.

Grottke said the company simply did not have the money to make payments, and stopped making payments to get ERS' attention.

Selling the Kauai land and closing the sugar operations will help bring the company out of its financial trouble, Grottke said.

German said six interested buyers have requested brochures for the land, and three of those could be within a week or two of signing a letter of intent. "I can say that there has been a lot of interest."

One company expressing interest was Continental Pacific LLC, a Troy, Ala.-based timber company whose principals made a failed attempt to buy C. Brewer & Co.'s parent Buyco Inc. in June.

The Alabama company sued C. Brewer last month, accusing Brewer of breaching contract obligations and hiding millions of dollars in payments to Brewer executives if the deal closed.

Brewer has called the charges reckless, baseless and without merit.

Continental has not made a decision on the Kauai property, but probably will not make an offer, said Jeremiah Henderson, part-owner of Continental Pacific, recently formed by the mergers of Strother Timberlands and Henderson Timberlands. The company owns 6,000 acres on the Big Island.

After selling the Kauai lands, Amfac's reduced holdings on the Garden Isle would include 500 acres of residential and commercial property in Lihue. In January, Amfac sold 1,400 acres of farm land mauka of Kapaa to entertainer and Honolulu native Bette Midler for $4.5 million.

Kauai's largest private landowner is the Robinson Family Partners, the last sugar plantation owner on Kauai with about 51,000 acres. A&B closed its McBryde Sugar Co. on Kauai in 1996.

Following the closure of the Paia sugar mill on Maui, Puunene Mill will be the only other sugar mill operating on Maui. Amfac also closed its Pioneer Mill on Maui last year.

Amfac is in discussions with local officials to transition its diversified agriculture -- seed corn, alfalfa, mangoes, papaya, gauva -- to other local farmers, Boersema said.

Grottke said Amfac has been refocusing its efforts in Hawaii to Maui, where a community group is making a master plan for a community on 3,500 acres of Amfac land.

By 2020, a part of the plot could see the development of residential homes and time-share resorts, Grottke said, adding that most of the land will remain open and green.