Advertisement - Click to support our sponsors.

Isle banks

lagging on

CD rates

On average, big banks

By Rob Perez

pay the nation's lowest rates

on certificates of deposit

Star-BulletinHonolulu's major banks on average pay the country's lowest interest rates on certificates of deposit and have greatly lagged their mainland counterparts in raising those rates over the past year, industry data show.

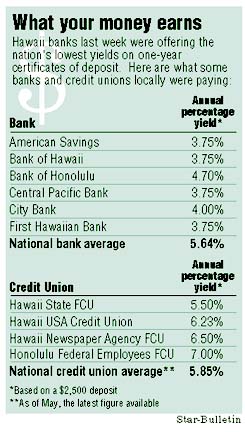

In mid-July local banks were paying an average annual yield of 3.75 percent on one-year certificates, easily the lowest average of nearly 130 markets nationwide, according to a survey by bankrate.com, a Florida company that tracks the industry. The national average in mid-July was 5.64 percent.

After Honolulu, the lowest average was found in Wilmington, Del., where banks paid 4.23 percent, according to the survey.

For other CDs, such as those covering six months or five years, the Honolulu averages also were the lowest in the country, bankrate.com says."You see the same stark differences across the board," said Greg McBride, a financial analyst for the Florida company.

What's more, local CD rates barely climbed over the past year even as national rates rose dramatically, hitting their highest levels since 1995, the data shows.

Most of the major Hawaii banks were reluctant to explain the difference between local and national CD rates but they generally cited different market conditions.

The low CD returns at local banks are in stark contrast to what isle consumers can get from Oahu credit unions or banks on the Internet. Annual yields approaching or topping 6 percent are not uncommon for one-year CDs at isle credit unions. Mainland banks that accept deposits from Hawaii residents offer rates as high as 7.3 percent on the Web, bankrate.com says.

"My advice to consumers: Don't settle for what the biggest banks in town are paying," McBride said.

The CD survey, based on rates at Honolulu's four largest banks, comes after a Star-Bulletin report last year noting that those institutions charged by far the highest interest rates in the country for bank auto loans. Honolulu still is the most expensive market for new- and used-car bank loans, according to bankrate.com.

The two surveys underscore a consumer truism that is especially relevant in Hawaii: Customers can pay dearly if they don't shop around.

Analysts cite a variety of reasons why bank CD yields locally are far below what is typically paid on the mainland and why Honolulu banks raise those payouts at a far slower pace.

With just a few banks dominating the Hawaii market, "there hasn't been great competition," McBride said.

Officials at Bank of Hawaii, the state's largest and one of the four institutions surveyed by bankrate.com, refused to comment on their benchmark CD rates.

Two other surveyed banks, First Hawaiian and American Savings, also refused to allow a Star-Bulletin reporter to question executives about rates. But they did submit written statements defending their rate-setting practices and noting that their promotional rates were high or on par with mainland offerings.

Questioning why First Hawaiian's regular rates are lower than those on the mainland is "like asking, 'Why does it cost 50 cents for today's Star-Bulletin and just 25 cents for the San Francisco Chronicle or Examiner?' " First Hawaiian said in its statement. "Every bank has its own competitive strategy. We emphasize our promotional rates, the highest we offer."

Banks typically run promotional specials that are good for limited times and apply only to limited products. Surveys, however, usually focus on regular rates, not promotional ones, to provide valid apples-to-apples comparisons.

In its statement, American Savings said the Hawaii and mainland financial markets are "as different as most of the other economic sectors in our state, so no direct comparison can be accurately made."

Central Pacific Bank was the only one of the four institutions that permitted an executive to answer questions directly about rates.

Wayne Kirihara, Central Pacific's senior vice president for retail banking, said banks generally are more aggressive with rates when loan demand is high. Strong demand for loans means the banks must attract deposits to fund the loans, and paying higher interest rates is one way to lure deposits, Kirihara said.

For the past five years, however, loan demand in Hawaii has been relatively flat, he said, and that helps explain why rates are lower than on the mainland, where the economy has been booming. "Everything is driven by the economy," Kirihara said.

Yet even in the late 1980s, when Hawaii's economy was thriving and double-digit loan growth was common, Honolulu banks still offered CD rates well below mainland levels.

In July 1988, for instance, local banks paid an average annual yield of 6.69 percent on six-month CDs, while the national average was 8.18 percent, according to a Star-Bulletin bank survey and federal statistics.

While local banks are unwilling or unable to pay CD rates on par with the mainland for many benchmark products, the same cannot be said about local credit unions. Hawaii credit unions paid an average of 5.1 percent on one-year certificates at the end of last year, the most recent data available, according to the Credit Union National Association. The national average at the time was 5.2 percent.

The dramatic spike in bank CD rates nationally has been driven largely by the anti-inflationary policies of the Federal Reserve, which since June 1999 has bumped interest rates six times.

Since July 1999, the national average for a one-year bank CD has jumped 122 basis points, or 1.22 percentage points, to 5.64 percent, according to bankrate.com. During the same period, the Honolulu average has risen only 27 basis points, the bankrate.com data show.

Yet the major banks locally have raised their prime lending rates about 125 basis points in that same period -- raises that came almost immediately after the Fed bumped its rates.

Asked why the changes in local CD rates have lagged the mainland by so much, Central Pacific's Kirihara said, "I don't have an answer to that one."

First Hawaiian said it has raised promotional rates even faster than its prime rate. In June 1999, for instance, the bank offered a seven-month CD with a 4.7 percent yield. In June 2000, it had an eight-month CD at 6.5 percent, an increase of 180 basis points.

First Hawaiian, however, was silent on why its benchmark rates for nonpromotional CDs have not risen by similar amounts. It said focusing on so-called published book rates -- the regular, non-promotional rates -- does not tell the whole story since most people take advantage of the specials.

Linda Sherry, spokeswoman for Consumer Action in San Francisco, criticized banks for making such big differences between promotional and regular rates, steering customers toward the promotional products and giving poor deals to the others.

"It's really very bad customer service in one sense," Sherry said. "The banks think consumers are mindless idiots who kind of want to be dragged around."

The big difference between local and mainland rates can be seen even within the same company. First Hawaiian's affiliate bank, California-based Bank of the West, last week was offering yields well above First Hawaiian's. For a one-year CD with a minimum $2,500 deposit, for instance, a Northern California branch of Bank of the West was paying 5.9 percent. First Hawaiian was offering 3.75 percent.

In its statement, First Hawaiian said the two subsidiaries of parent BancWest Corp. are run as separate banks and that rates can be priced differently because of different market conditions.

Bankrate.com's McBride, however, notes that even in high-cost markets like New York and San Francisco, banks offer rates comparable to mainland averages. So costs should not preclude Hawaii institutions from doing the same, he said.

Special: What Price Paradise?