Advertisement - Click to support our sponsors.

State bankruptcy filings fell

15.1 percent in the first six months

of this year, and foreclosure suits

showed a drop of 25.8 percentState tax collections up 4.2 percent for the year

By Tim Ruel

Star-BulletinBankruptcies and foreclosures statewide toppled during the first six months of this year from the same period last year, leading economists to positive but differing conclusions for the economy.

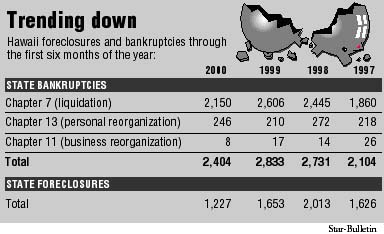

Total bankruptcy filings in Hawaii fell 15.1 percent to 2,404 from 2,833 in 1999, according to the U.S. Bankruptcy Court. Filings in 2000 average about 16 a day so far.

Bankruptcies soared through much of the last decade as Hawaii's economy stalled. But recent economic indicators have pointed to a fledgling recovery. Last year was the first since 1990 that Hawaii did not post a record for total bankruptcy filings.

Still, the 2,404 filings so far this year represent a 19 percent increase from the total bankruptcies filed in all of 1995.

For the first half of this year, Chapter 7 liquidation filings, the most commonly used protection from creditors, dropped 17.5 percent, to 2,150 from 2,606 in the same period last year.

More dramatically, foreclosure suits filed in state courts declined by 25.8 percent, to 1,227 from 1,653 last year.

In both cases, that's a big difference from the middle of 1998, when bankruptcies soared 29.8 percent for the first six months, and foreclosures jumped 23.8 percent from the year earlier period.

"We should be modestly optimistic and yet be ready for sudden changes," said Henry Wong, chief economist at City Bank.

He described the numbers as encouraging because they reflect restructuring of businesses and an increase in entrepreneurism. But he warned about changes because the state still depends on forces outside its grasp, such as foreign economies and mainland big-box retailers.

Paul Brewbaker, Bank of Hawaii's chief economist, was even more optimistic and said Hawaii's economy has finished recovering from the slowdown of the early 1990s.Bankruptcy and foreclosure filings lag actual economic activity by several years, while more current indicators -- unemployment, home prices -- show the economy in an upswing, Brewbaker said. He expects bankruptcies and foreclosures to continue falling.

Bankruptcy attorney Barbara Lee Melvin was more cautious, saying Hawaii has become more competitive but is not out of the woods. "Everywhere I look, I see small businesses folding. That doesn't speak to me of a healthy economy."

Part of the drop-off in foreclosures simply comes from banks allowing their loan customers to avoid costly suits through alternatives to foreclosure, a sure sign of a rough economy, Melvin said.

For example, in the past couple of years, Bank of Hawaii has started entering deed-in-lieu-of-foreclosure agreements, allowing clients to avoid foreclosure by surrendering their titles.The bank also has started offering short sales, letting customers lower the price of their home to get it sold.

Bankoh began offering these alternatives and others because of tough times in the earlier 1990s, Vice Chairman Alton Kuioka said. Economic activity still has a greater impact on foreclosure filings than the alternative arrangements, he said.

Regardless, most analysts did agree on one point: Hawaii still trails far behind the mainland, which has catapulted out of recession in the early '90s into an unprecedented boom.

"We've got a long ways to go," Brewbaker said.

"There's no question. We're the last state to see solid and sustained improvement."

State tax collections up

Star-Bulletin staff

4.2 percent for the yearState tax collections were up 4.2 percent for the fiscal year that ended in June, or $120.8 million more than was collected last fiscal year. The increase comes even though general excise collections decreased last month, according to the tax department.

General excise tax collections -- the state's largest source of revenue -- declined 5.3 percent in June, but were still up 6.5 percent for the fiscal year.

Ray Kamikawa, state tax director, said the tax collection increase was more than what had been predicted by the state Council on Revenues, which had put the increase at 3 percent.

Total tax revenues brought into the state treasury last month were $272 million, which was a slight increase of just less than 1 percent.

Gov. Ben Cayetano has previously said that the extra $120 million was not enough to give all state employees an across-the-board pay raise, but that it could be used selectively for specific employee groups or expanded state programs.

Cayetano has said he wants to increase the number of computers available to school children and also expand state social services next year.